Workers' compensation carveout specifically addresses workplace injuries by covering medical expenses and lost wages directly related to work incidents, while disability insurance provides broader income protection for employees unable to work due to any illness or injury, whether job-related or not. Understanding the distinctions in coverage scope, claim processes, and benefits is critical for employers aiming to manage risks and ensure comprehensive employee protection. Explore detailed comparisons to optimize your insurance strategy effectively.

Why it is important

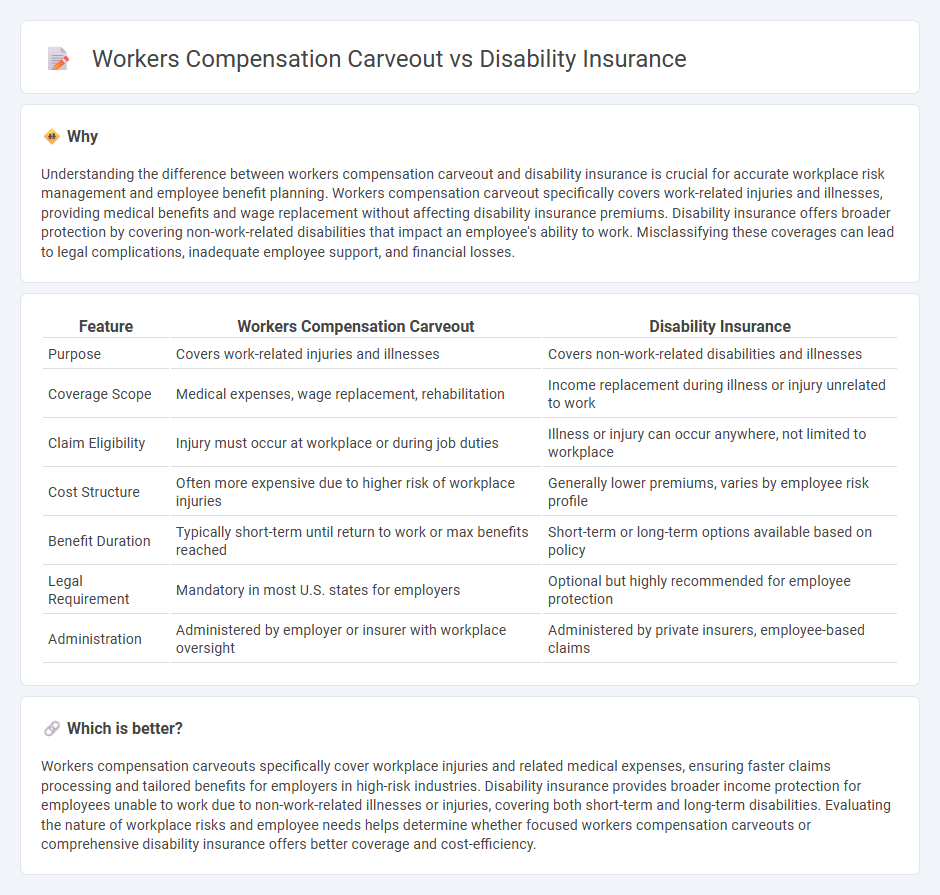

Understanding the difference between workers compensation carveout and disability insurance is crucial for accurate workplace risk management and employee benefit planning. Workers compensation carveout specifically covers work-related injuries and illnesses, providing medical benefits and wage replacement without affecting disability insurance premiums. Disability insurance offers broader protection by covering non-work-related disabilities that impact an employee's ability to work. Misclassifying these coverages can lead to legal complications, inadequate employee support, and financial losses.

Comparison Table

| Feature | Workers Compensation Carveout | Disability Insurance |

|---|---|---|

| Purpose | Covers work-related injuries and illnesses | Covers non-work-related disabilities and illnesses |

| Coverage Scope | Medical expenses, wage replacement, rehabilitation | Income replacement during illness or injury unrelated to work |

| Claim Eligibility | Injury must occur at workplace or during job duties | Illness or injury can occur anywhere, not limited to workplace |

| Cost Structure | Often more expensive due to higher risk of workplace injuries | Generally lower premiums, varies by employee risk profile |

| Benefit Duration | Typically short-term until return to work or max benefits reached | Short-term or long-term options available based on policy |

| Legal Requirement | Mandatory in most U.S. states for employers | Optional but highly recommended for employee protection |

| Administration | Administered by employer or insurer with workplace oversight | Administered by private insurers, employee-based claims |

Which is better?

Workers compensation carveouts specifically cover workplace injuries and related medical expenses, ensuring faster claims processing and tailored benefits for employers in high-risk industries. Disability insurance provides broader income protection for employees unable to work due to non-work-related illnesses or injuries, covering both short-term and long-term disabilities. Evaluating the nature of workplace risks and employee needs helps determine whether focused workers compensation carveouts or comprehensive disability insurance offers better coverage and cost-efficiency.

Connection

Workers' compensation carveouts and disability insurance are linked through their shared goal of protecting employees from income loss due to workplace injuries or illnesses. Carveouts allow employers to separate specific claims or liabilities from the standard workers' compensation policy, often to manage costs or tailor coverage, while disability insurance provides wage replacement benefits for non-work-related disabilities. Understanding their interplay helps employers design comprehensive benefits strategies that ensure financial security and regulatory compliance.

Key Terms

Benefit Eligibility

Disability insurance covers employees who cannot work due to non-work-related illnesses or injuries, ensuring income protection during recovery, whereas workers' compensation exclusively addresses work-related injuries or illnesses with medical benefits and wage replacement. Eligibility criteria for disability insurance typically require medical certification and may include waiting periods, while workers' compensation eligibility depends on the injury's connection to job duties and does not require a waiting period. Explore detailed benefit eligibility distinctions to optimize your organization's risk management strategy.

Coverage Scope

Disability insurance covers lost income due to non-work-related injuries or illnesses, while workers' compensation carveouts specifically address job-related injuries and occupational diseases. Disability policies often provide broader coverage including short-term and long-term options, whereas workers' compensation carveouts narrow the employer's exposure by excluding certain injuries from traditional workers' comp claims. Explore the differences further to optimize your risk management strategy.

Dispute Resolution

Disability insurance and workers compensation carveouts differ significantly in their dispute resolution processes, with disability insurance often involving third-party claim administrators and formal appeals, while workers compensation carveouts typically rely on employer-managed or insurer-specific procedures tailored to workplace injuries. The complexity of dispute resolution in each influences claim outcomes and legal strategies, making a clear understanding of policy terms essential for effective risk management. Explore detailed insights on dispute resolution mechanisms to optimize coverage and claims handling strategies.

Source and External Links

Disability insurance - Wikipedia - Disability insurance protects earned income against work barriers caused by disabilities from injury, illness, or psychological disorders, and includes paid sick leave, short-term, and long-term disability benefits.

Disability Insurance - State Farm - Disability insurance provides money to help cover expenses such as mortgage, rent, and loans if you cannot work due to disability, with options for short-term and long-term coverage.

Affordable Disability Insurance Plans for Individuals and Businesses - Guardian disability insurance replaces income if illness or injury prevent working, offering affordable long-term plans and group coverage options for individuals and businesses.

dowidth.com

dowidth.com