Digital nomad insurance provides comprehensive coverage tailored to remote workers living abroad long-term, including health, equipment, and liability protection. Travel insurance focuses primarily on short-term trips, covering trip cancellations, lost luggage, and emergency medical expenses. Discover how to choose the best insurance plan that fits your lifestyle and travel needs.

Why it is important

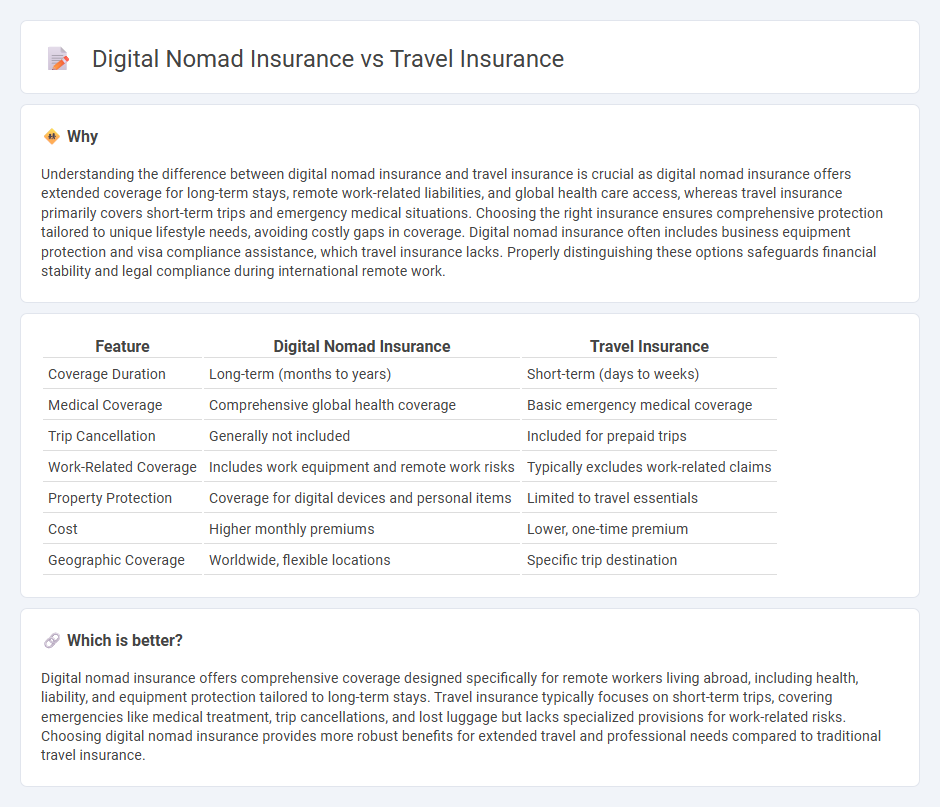

Understanding the difference between digital nomad insurance and travel insurance is crucial as digital nomad insurance offers extended coverage for long-term stays, remote work-related liabilities, and global health care access, whereas travel insurance primarily covers short-term trips and emergency medical situations. Choosing the right insurance ensures comprehensive protection tailored to unique lifestyle needs, avoiding costly gaps in coverage. Digital nomad insurance often includes business equipment protection and visa compliance assistance, which travel insurance lacks. Properly distinguishing these options safeguards financial stability and legal compliance during international remote work.

Comparison Table

| Feature | Digital Nomad Insurance | Travel Insurance |

|---|---|---|

| Coverage Duration | Long-term (months to years) | Short-term (days to weeks) |

| Medical Coverage | Comprehensive global health coverage | Basic emergency medical coverage |

| Trip Cancellation | Generally not included | Included for prepaid trips |

| Work-Related Coverage | Includes work equipment and remote work risks | Typically excludes work-related claims |

| Property Protection | Coverage for digital devices and personal items | Limited to travel essentials |

| Cost | Higher monthly premiums | Lower, one-time premium |

| Geographic Coverage | Worldwide, flexible locations | Specific trip destination |

Which is better?

Digital nomad insurance offers comprehensive coverage designed specifically for remote workers living abroad, including health, liability, and equipment protection tailored to long-term stays. Travel insurance typically focuses on short-term trips, covering emergencies like medical treatment, trip cancellations, and lost luggage but lacks specialized provisions for work-related risks. Choosing digital nomad insurance provides more robust benefits for extended travel and professional needs compared to traditional travel insurance.

Connection

Digital nomad insurance and travel insurance both provide coverage for individuals relocating temporarily or traveling internationally, addressing health, trip cancellations, and emergency evacuations. Digital nomad insurance extends traditional travel insurance by including policies tailored to long-term remote work needs, such as equipment protection and liability coverage. The convergence of these insurance types ensures comprehensive protection for mobile lifestyles, blending travel benefits with work-specific safeguards.

Key Terms

Coverage Duration

Travel insurance typically offers coverage for short-term trips, ranging from a few days to several months, ideal for vacationers or business travelers. Digital nomad insurance provides extended coverage tailored for long-term remote workers, often spanning months or even years to accommodate ongoing travel lifestyles. Explore detailed comparisons to choose the best insurance plan for your travel and work needs.

Geographic Scope

Travel insurance typically covers short-term trips within specific countries or regions, providing protection against medical emergencies, trip cancellations, and lost belongings during limited travel periods. Digital nomad insurance extends coverage globally, addressing the unique needs of location-independent workers by offering broader medical, liability, and work-related risk protection across multiple countries. Explore the key differences in geographic scope to choose the best insurance for your travel or remote work lifestyle.

Medical Benefits

Travel insurance typically offers short-term medical coverage for emergencies, accidents, and urgent care while abroad, but may exclude pre-existing conditions and long-term treatments. Digital nomad insurance provides comprehensive medical benefits tailored for extended stays, including access to routine healthcare, telemedicine, and chronic condition management. Explore the key differences in medical coverage to choose the best plan for your lifestyle.

Source and External Links

Travel Insurance - Travel insurance helps protect against losses from unexpected events during travel, offering benefits like trip cancellation, medical expenses, and baggage coverage to safeguard your trip investment.

Squaremouth - Squaremouth lets you compare and buy travel insurance from over 20 providers, helping you find affordable coverage for medical emergencies, trip cancellations, and more, especially important for international trips where standard health plans may not apply.

InsureMyTrip - InsureMyTrip allows you to compare thousands of travel insurance plans and read reviews, helping you choose comprehensive coverage tailored to your specific trip needs and concerns.

dowidth.com

dowidth.com