Peer-to-peer insurance leverages collective risk-sharing among individuals to reduce costs and increase transparency, contrasting sharply with digital insurance that uses advanced algorithms and data analytics to offer personalized policies and streamlined claims processing. Both models revolutionize traditional insurance by enhancing user engagement and efficiency through technology and community-driven approaches. Discover how these innovative insurance solutions can redefine your coverage experience.

Why it is important

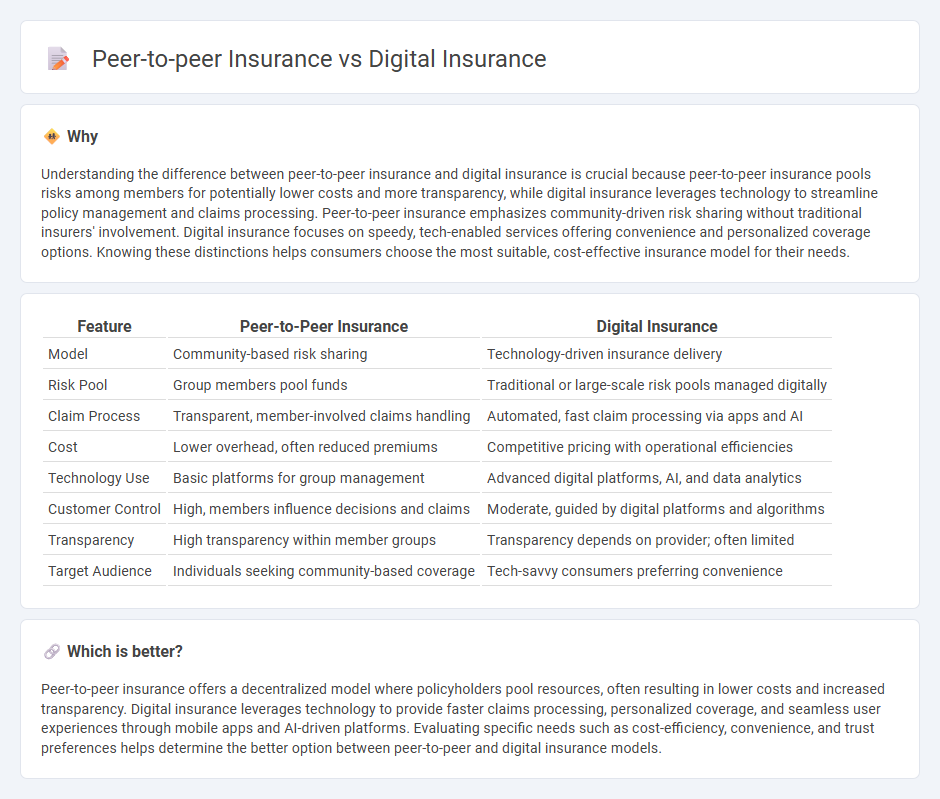

Understanding the difference between peer-to-peer insurance and digital insurance is crucial because peer-to-peer insurance pools risks among members for potentially lower costs and more transparency, while digital insurance leverages technology to streamline policy management and claims processing. Peer-to-peer insurance emphasizes community-driven risk sharing without traditional insurers' involvement. Digital insurance focuses on speedy, tech-enabled services offering convenience and personalized coverage options. Knowing these distinctions helps consumers choose the most suitable, cost-effective insurance model for their needs.

Comparison Table

| Feature | Peer-to-Peer Insurance | Digital Insurance |

|---|---|---|

| Model | Community-based risk sharing | Technology-driven insurance delivery |

| Risk Pool | Group members pool funds | Traditional or large-scale risk pools managed digitally |

| Claim Process | Transparent, member-involved claims handling | Automated, fast claim processing via apps and AI |

| Cost | Lower overhead, often reduced premiums | Competitive pricing with operational efficiencies |

| Technology Use | Basic platforms for group management | Advanced digital platforms, AI, and data analytics |

| Customer Control | High, members influence decisions and claims | Moderate, guided by digital platforms and algorithms |

| Transparency | High transparency within member groups | Transparency depends on provider; often limited |

| Target Audience | Individuals seeking community-based coverage | Tech-savvy consumers preferring convenience |

Which is better?

Peer-to-peer insurance offers a decentralized model where policyholders pool resources, often resulting in lower costs and increased transparency. Digital insurance leverages technology to provide faster claims processing, personalized coverage, and seamless user experiences through mobile apps and AI-driven platforms. Evaluating specific needs such as cost-efficiency, convenience, and trust preferences helps determine the better option between peer-to-peer and digital insurance models.

Connection

Peer-to-peer insurance leverages digital platforms to connect individuals directly, enabling risk pooling without traditional intermediaries, which enhances transparency and reduces costs. Digital insurance uses advanced technologies such as AI, blockchain, and big data analytics to streamline underwriting, claims processing, and customer engagement. The integration of digital tools in peer-to-peer insurance empowers decentralized risk sharing, efficient policy management, and real-time data exchanges, forming a symbiotic relationship that transforms the insurance industry.

Key Terms

Platform Technology

Platform technology in digital insurance leverages advanced AI algorithms, big data analytics, and cloud computing to automate underwriting and claims processing, enhancing efficiency and customer experience. Peer-to-peer insurance platforms utilize blockchain technology and smart contracts to facilitate transparent risk-sharing and decentralized claim settlements, reducing fraud and operational costs. Explore deeper insights on how these platform technologies are revolutionizing the insurance landscape.

Risk Pooling

Digital insurance leverages advanced data analytics and AI to optimize risk pooling by accurately assessing individual risk profiles and dynamically adjusting premiums. Peer-to-peer insurance emphasizes collective risk sharing among a defined group, reducing administrative costs and fostering trust by aligning incentives within the pool. Explore the evolving mechanisms of risk pooling in both models to understand their impact on affordability and customer engagement.

Underwriting Model

Digital insurance leverages advanced algorithms and big data analytics to streamline the underwriting model, enabling faster risk assessment and personalized policy pricing. Peer-to-peer insurance adopts a community-based underwriting approach, where risk is pooled among members, reducing administrative costs and fostering transparency. Explore how these innovative underwriting models reshape the insurance landscape by diving deeper into their mechanisms and benefits.

Source and External Links

What is Digital Insurance? - Tibco - Digital insurance refers to technology-driven insurance companies that use a customer-first approach, omni-channel presence, and connected software platforms to improve policy sales, risk evaluation, and claims handling, offering speed, agility, and enhanced customer experiences.

A Guide to Digital Insurance - Hitachi Solutions - Digital insurance encompasses any insurer leveraging a technology-first business model to manage policies with features like AI, online portals, and fast, personalized interactions to meet modern consumer expectations and deliver speed to market.

Digital insurance in 2018 - McKinsey - Digital insurance transforms customer claims journeys through integrated AI, automation, analytics, and digital ecosystems enabling real-time claims assessment, fraud detection, automated settlements, and value-added services for improved customer experience.

dowidth.com

dowidth.com