Pet health insurance provides coverage for veterinary expenses, including surgeries, medications, and routine check-ups, ensuring financial protection for pet owners. Marine insurance safeguards vessels, cargo, and liabilities from risks such as accidents, natural disasters, and piracy during maritime transport. Explore the distinct benefits and coverage details of both insurance types to make informed choices.

Why it is important

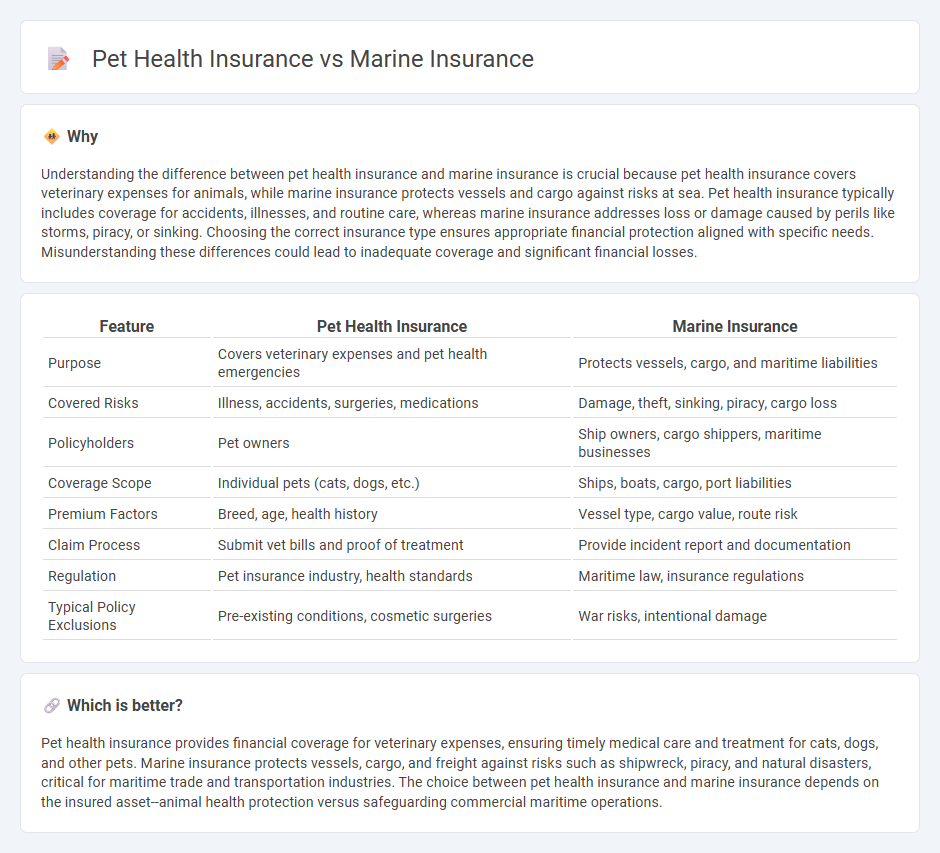

Understanding the difference between pet health insurance and marine insurance is crucial because pet health insurance covers veterinary expenses for animals, while marine insurance protects vessels and cargo against risks at sea. Pet health insurance typically includes coverage for accidents, illnesses, and routine care, whereas marine insurance addresses loss or damage caused by perils like storms, piracy, or sinking. Choosing the correct insurance type ensures appropriate financial protection aligned with specific needs. Misunderstanding these differences could lead to inadequate coverage and significant financial losses.

Comparison Table

| Feature | Pet Health Insurance | Marine Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses and pet health emergencies | Protects vessels, cargo, and maritime liabilities |

| Covered Risks | Illness, accidents, surgeries, medications | Damage, theft, sinking, piracy, cargo loss |

| Policyholders | Pet owners | Ship owners, cargo shippers, maritime businesses |

| Coverage Scope | Individual pets (cats, dogs, etc.) | Ships, boats, cargo, port liabilities |

| Premium Factors | Breed, age, health history | Vessel type, cargo value, route risk |

| Claim Process | Submit vet bills and proof of treatment | Provide incident report and documentation |

| Regulation | Pet insurance industry, health standards | Maritime law, insurance regulations |

| Typical Policy Exclusions | Pre-existing conditions, cosmetic surgeries | War risks, intentional damage |

Which is better?

Pet health insurance provides financial coverage for veterinary expenses, ensuring timely medical care and treatment for cats, dogs, and other pets. Marine insurance protects vessels, cargo, and freight against risks such as shipwreck, piracy, and natural disasters, critical for maritime trade and transportation industries. The choice between pet health insurance and marine insurance depends on the insured asset--animal health protection versus safeguarding commercial maritime operations.

Connection

Pet health insurance and marine insurance are connected through their shared focus on risk management and financial protection in specialized domains. Both types of insurance involve assessing unique liabilities--pet health insurance covers veterinary expenses and medical emergencies for animals, while marine insurance protects vessels, cargo, and shipping operations against perils at sea. The underwriting processes and policy structures in both fields emphasize tailored coverage to mitigate specific risks associated with their respective environments.

Key Terms

**Marine Insurance:**

Marine insurance provides specialized coverage for vessels, cargo, and maritime liabilities, protecting against risks like shipwreck, piracy, and cargo loss during transit. This insurance is crucial for shipping companies, import-export businesses, and vessel owners, ensuring financial protection against high-value maritime losses. Discover more about how marine insurance safeguards global trade and maritime assets.

Hull Coverage

Hull coverage in marine insurance specifically protects the physical structure of a vessel against risks such as sinking, collision, or fire, crucial for shipowners and operators. In contrast, pet health insurance focuses on covering veterinary expenses and medical treatments for animals, with no relation to physical asset protection. Explore detailed comparisons to understand how hull coverage functions differently from pet health insurance policies.

Cargo Insurance

Marine cargo insurance provides coverage against loss or damage to goods during sea transportation, ensuring financial protection from risks such as shipwreck, piracy, or weather-related incidents. Pet health insurance covers veterinary expenses and medical treatments for pets, which is unrelated to cargo or transport risks. Explore the specific benefits and policy details of marine cargo insurance to safeguard your shipments effectively.

Source and External Links

Inland & Ocean Marine Insurance - Markel - Markel offers customizable inland and ocean marine insurance policies that cover boats, yachts, marinas, vessel owners, and marine businesses, providing flexible coverage solutions backed by over 45 years of industry experience.

Ocean Marine Insurance Policy & Coverage - Ocean marine insurance protects goods and merchandise on shipping vessels in domestic and international transit, covering marine liabilities, commercial hull, and protection and indemnity risks in a unique industry exposed to varied risks including weather events.

What Is Marine Insurance? - Hylant - Marine insurance covers risks related to transporting goods over water and includes specialized coverages like docks, piers, wharves, and bumbershoot coverage, which provides excess liability protection for maritime business operations.

dowidth.com

dowidth.com