Earthquake microinsurance provides targeted financial protection against seismic risks, helping vulnerable populations recover quickly from property damage and loss, while health microinsurance focuses on covering medical expenses for low-income individuals facing illness or injury. Both schemes offer affordable premiums and tailored coverage to address specific community needs, enhancing resilience through accessible risk management solutions. Discover how these specialized microinsurance products safeguard livelihoods and improve financial security.

Why it is important

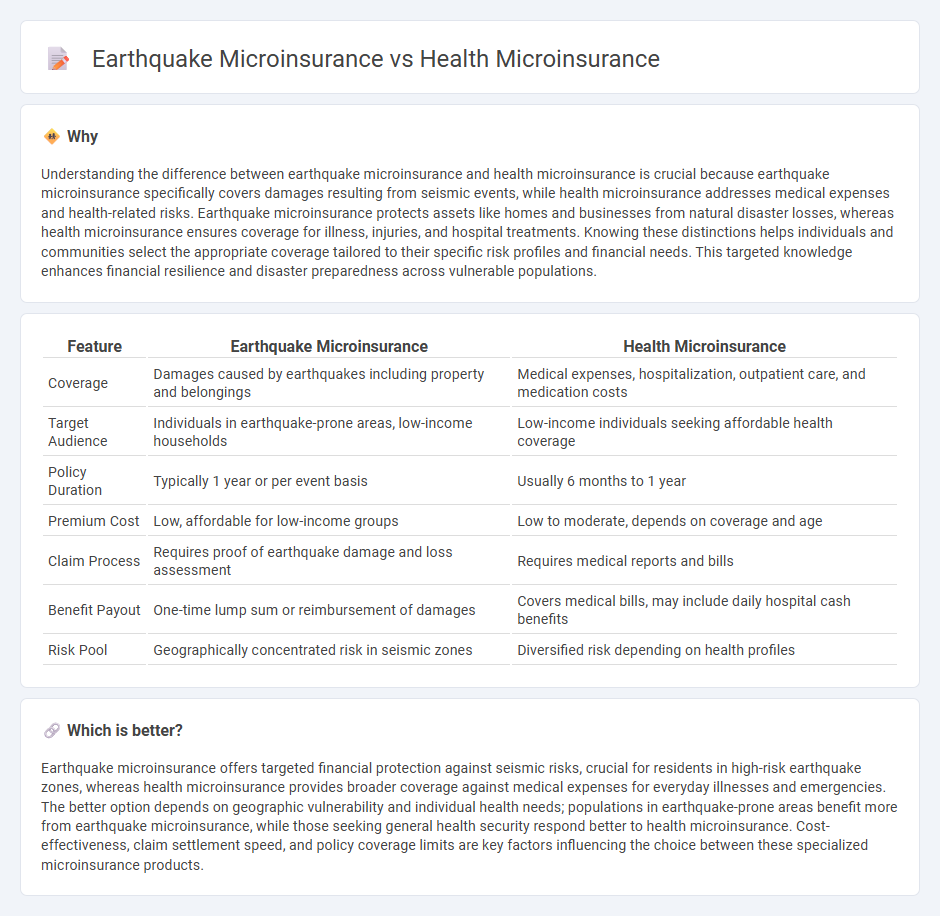

Understanding the difference between earthquake microinsurance and health microinsurance is crucial because earthquake microinsurance specifically covers damages resulting from seismic events, while health microinsurance addresses medical expenses and health-related risks. Earthquake microinsurance protects assets like homes and businesses from natural disaster losses, whereas health microinsurance ensures coverage for illness, injuries, and hospital treatments. Knowing these distinctions helps individuals and communities select the appropriate coverage tailored to their specific risk profiles and financial needs. This targeted knowledge enhances financial resilience and disaster preparedness across vulnerable populations.

Comparison Table

| Feature | Earthquake Microinsurance | Health Microinsurance |

|---|---|---|

| Coverage | Damages caused by earthquakes including property and belongings | Medical expenses, hospitalization, outpatient care, and medication costs |

| Target Audience | Individuals in earthquake-prone areas, low-income households | Low-income individuals seeking affordable health coverage |

| Policy Duration | Typically 1 year or per event basis | Usually 6 months to 1 year |

| Premium Cost | Low, affordable for low-income groups | Low to moderate, depends on coverage and age |

| Claim Process | Requires proof of earthquake damage and loss assessment | Requires medical reports and bills |

| Benefit Payout | One-time lump sum or reimbursement of damages | Covers medical bills, may include daily hospital cash benefits |

| Risk Pool | Geographically concentrated risk in seismic zones | Diversified risk depending on health profiles |

Which is better?

Earthquake microinsurance offers targeted financial protection against seismic risks, crucial for residents in high-risk earthquake zones, whereas health microinsurance provides broader coverage against medical expenses for everyday illnesses and emergencies. The better option depends on geographic vulnerability and individual health needs; populations in earthquake-prone areas benefit more from earthquake microinsurance, while those seeking general health security respond better to health microinsurance. Cost-effectiveness, claim settlement speed, and policy coverage limits are key factors influencing the choice between these specialized microinsurance products.

Connection

Earthquake microinsurance and health microinsurance are connected through their shared goal of providing financial protection to vulnerable populations against specific risks that threaten their well-being. Both forms of microinsurance help mitigate the economic impact of disasters by covering medical expenses and recovery costs arising from earthquakes and related injuries. By targeting low-income individuals, these insurance products enhance resilience and promote access to essential health services after seismic events.

Key Terms

**Health Microinsurance:**

Health microinsurance offers affordable coverage targeting low-income populations to manage medical expenses, including hospitalization, outpatient care, and medication costs. It improves access to essential health services and reduces the financial burden of illness, particularly in underserved communities. Explore how health microinsurance can safeguard your well-being and financial stability.

Premium

Health microinsurance premiums typically vary based on age, pre-existing conditions, and coverage limits, often ranging from $5 to $20 per month. Earthquake microinsurance premiums are influenced by geographic risk, property value, and building structure, with monthly costs generally between $10 and $30. Explore our detailed analysis to understand which microinsurance option best suits your needs.

Coverage Limit

Health microinsurance typically offers coverage limits tailored to medical expenses such as hospitalization, outpatient treatment, and medication costs, often ranging from $500 to $5,000 per policy period depending on the provider and region. Earthquake microinsurance coverage limits are generally set to address property damage, structural repairs, and temporary relocation expenses, with limits varying from $1,000 to over $20,000 based on risk assessments and local building values. Explore detailed comparisons and regional data to understand how coverage limits impact claim settlements and overall protection.

Source and External Links

The impact of the health microinsurance M-FUND - This article discusses how health microinsurance, like M-FUND, can increase healthcare utilization and provide financial protection for low-income populations.

Case study: Health insurance microinsurance scheme - This case study highlights a microinsurance scheme aimed at providing affordable healthcare through a comprehensive package covering various health services.

5 lessons for designing fit-for-purpose health microinsurance - This article outlines lessons for microinsurance providers in sub-Saharan Africa, focusing on creating value propositions that meet the needs of uninsured populations.

dowidth.com

dowidth.com