Buy now insurance offers immediate coverage tailored to individual needs through private companies, often providing flexible plans and faster claim processing. Government-provided insurance ensures fundamental protection and wider access, typically funded by public resources and designed to cover essential risks for all citizens. Explore the key differences and benefits to determine which insurance option suits your requirements best.

Why it is important

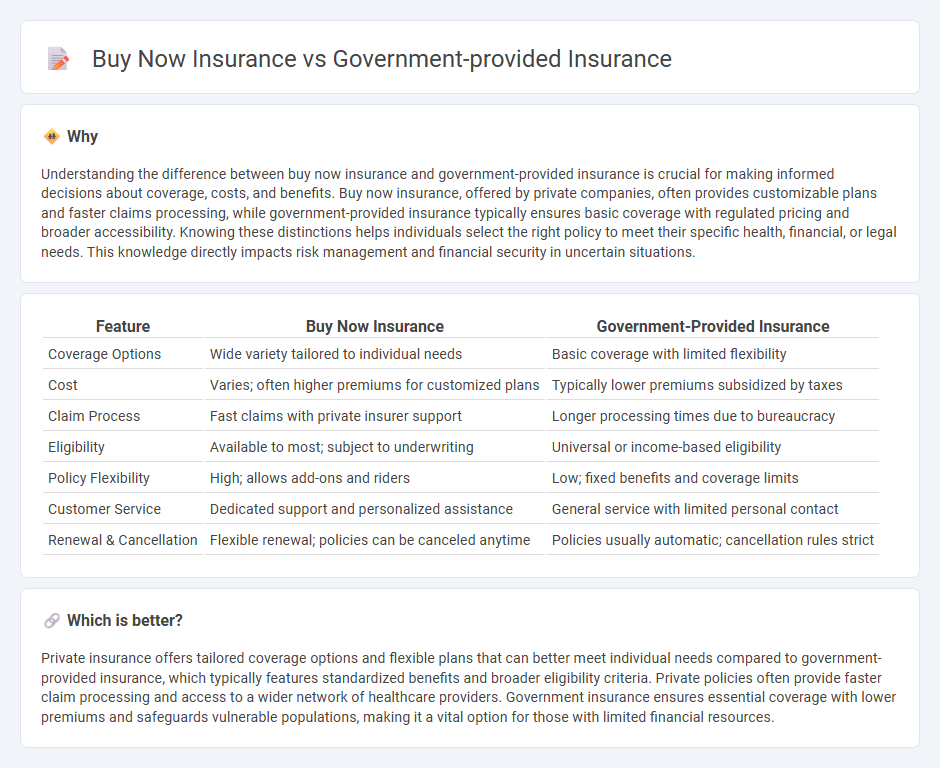

Understanding the difference between buy now insurance and government-provided insurance is crucial for making informed decisions about coverage, costs, and benefits. Buy now insurance, offered by private companies, often provides customizable plans and faster claims processing, while government-provided insurance typically ensures basic coverage with regulated pricing and broader accessibility. Knowing these distinctions helps individuals select the right policy to meet their specific health, financial, or legal needs. This knowledge directly impacts risk management and financial security in uncertain situations.

Comparison Table

| Feature | Buy Now Insurance | Government-Provided Insurance |

|---|---|---|

| Coverage Options | Wide variety tailored to individual needs | Basic coverage with limited flexibility |

| Cost | Varies; often higher premiums for customized plans | Typically lower premiums subsidized by taxes |

| Claim Process | Fast claims with private insurer support | Longer processing times due to bureaucracy |

| Eligibility | Available to most; subject to underwriting | Universal or income-based eligibility |

| Policy Flexibility | High; allows add-ons and riders | Low; fixed benefits and coverage limits |

| Customer Service | Dedicated support and personalized assistance | General service with limited personal contact |

| Renewal & Cancellation | Flexible renewal; policies can be canceled anytime | Policies usually automatic; cancellation rules strict |

Which is better?

Private insurance offers tailored coverage options and flexible plans that can better meet individual needs compared to government-provided insurance, which typically features standardized benefits and broader eligibility criteria. Private policies often provide faster claim processing and access to a wider network of healthcare providers. Government insurance ensures essential coverage with lower premiums and safeguards vulnerable populations, making it a vital option for those with limited financial resources.

Connection

Buy now insurance offers immediate coverage options that complement government-provided insurance by filling gaps in protection and reducing out-of-pocket expenses. Government-provided insurance, such as Medicare or Medicaid, establishes a baseline of healthcare access, while buy now insurance plans often cover services and benefits excluded from public programs. Combining both insurance types helps individuals achieve comprehensive risk management and financial security.

Key Terms

Underwriting

Government-provided insurance underwriting typically emphasizes standardized risk assessments based on broad population data, resulting in uniform eligibility criteria and premiums that often reflect socio-economic objectives rather than individual risk profiles. Buy now insurance employs dynamic underwriting processes utilizing real-time data analytics, personalized risk evaluations, and advanced algorithms to tailor coverage options and pricing to individual circumstances. Explore how these distinct underwriting approaches impact policyholder benefits and pricing structures.

Subsidy

Government-provided insurance often includes substantial subsidies that lower premiums and out-of-pocket costs for eligible individuals, making healthcare more affordable. In contrast, buy-now insurance plans typically lack direct subsidies, which can result in higher monthly payments but may offer more flexibility and immediate coverage options. Explore how subsidy structures impact your insurance choice for optimal financial and health benefits.

Premium

Government-provided insurance typically offers lower premiums due to subsidization and risk pooling at a national or regional level, making it more affordable for a broad population. Buy now insurance premiums are often higher as they reflect individual risk assessments, administrative costs, and immediate coverage needs without subsidies. Discover how premium structures impact your coverage options and costs by exploring detailed comparisons.

Source and External Links

Health Insurance | USAGov - Provides information on health insurance programs such as Medicaid, Medicare, the ACA Health Insurance Marketplace, and COBRA.

Medicaid.gov: The Official U.S. Government Site for Medicaid and CHIP - Offers resources and information regarding Medicaid and the Children's Health Insurance Program (CHIP).

Welcome to Medicare - The official U.S. government site for Medicare, a health insurance program for people age 65 or older and younger people with disabilities.

dowidth.com

dowidth.com