Cyber insurance protects businesses from financial losses due to data breaches, cyberattacks, and other digital threats, while fidelity insurance safeguards organizations against employee dishonesty, such as theft or fraud. Both types of insurance play crucial roles in risk management by addressing distinct vulnerabilities in today's business environments. Explore how each policy can fortify your company's security and financial stability.

Why it is important

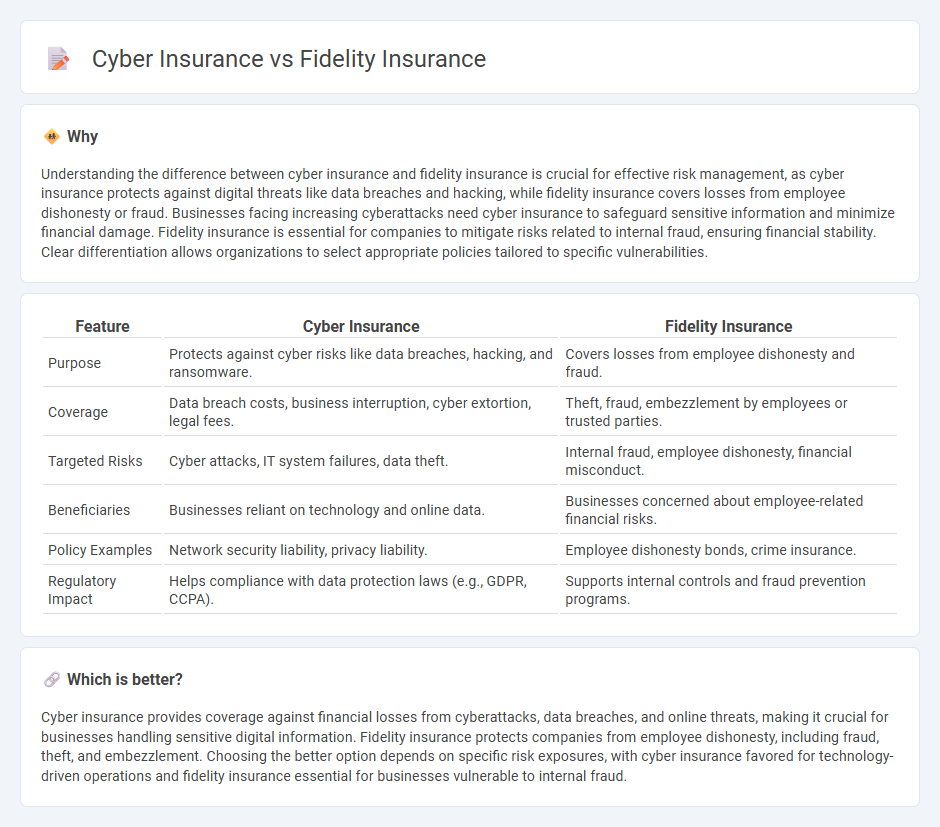

Understanding the difference between cyber insurance and fidelity insurance is crucial for effective risk management, as cyber insurance protects against digital threats like data breaches and hacking, while fidelity insurance covers losses from employee dishonesty or fraud. Businesses facing increasing cyberattacks need cyber insurance to safeguard sensitive information and minimize financial damage. Fidelity insurance is essential for companies to mitigate risks related to internal fraud, ensuring financial stability. Clear differentiation allows organizations to select appropriate policies tailored to specific vulnerabilities.

Comparison Table

| Feature | Cyber Insurance | Fidelity Insurance |

|---|---|---|

| Purpose | Protects against cyber risks like data breaches, hacking, and ransomware. | Covers losses from employee dishonesty and fraud. |

| Coverage | Data breach costs, business interruption, cyber extortion, legal fees. | Theft, fraud, embezzlement by employees or trusted parties. |

| Targeted Risks | Cyber attacks, IT system failures, data theft. | Internal fraud, employee dishonesty, financial misconduct. |

| Beneficiaries | Businesses reliant on technology and online data. | Businesses concerned about employee-related financial risks. |

| Policy Examples | Network security liability, privacy liability. | Employee dishonesty bonds, crime insurance. |

| Regulatory Impact | Helps compliance with data protection laws (e.g., GDPR, CCPA). | Supports internal controls and fraud prevention programs. |

Which is better?

Cyber insurance provides coverage against financial losses from cyberattacks, data breaches, and online threats, making it crucial for businesses handling sensitive digital information. Fidelity insurance protects companies from employee dishonesty, including fraud, theft, and embezzlement. Choosing the better option depends on specific risk exposures, with cyber insurance favored for technology-driven operations and fidelity insurance essential for businesses vulnerable to internal fraud.

Connection

Cyber insurance and fidelity insurance are connected through their focus on protecting businesses from financial losses due to fraudulent and malicious activities. Cyber insurance covers risks related to data breaches, cyberattacks, and digital threats, while fidelity insurance safeguards against employee dishonesty and internal fraud. Both policies are essential components of a comprehensive risk management strategy, mitigating different aspects of operational vulnerabilities.

Key Terms

Employee Dishonesty (Fidelity)

Fidelity insurance primarily covers losses resulting from employee dishonesty, including theft, fraud, or embezzlement, protecting businesses from internal risks. Cyber insurance, on the other hand, addresses external threats like data breaches, ransomware, and cyberattacks, but does not typically cover fraudulent acts by employees. To understand the specific protections each policy offers and determine the best fit for your organization's risk management, explore more details on fidelity and cyber insurance coverage.

Data Breach (Cyber)

Fidelity insurance primarily covers losses from employee dishonesty, such as theft or fraud, but does not extend protection against cyber-related data breaches or unauthorized access to sensitive information. Cyber insurance specifically addresses risks associated with data breaches, including costs for notification, legal fees, and remediation efforts following the compromise of confidential data. Explore how cyber insurance policies can safeguard your business from the financial impact of data breaches and evolving cyber threats.

Financial Loss

Fidelity insurance primarily protects businesses from financial losses due to employee dishonesty, including theft, fraud, and embezzlement, whereas cyber insurance covers financial losses resulting from cyberattacks, data breaches, and ransomware incidents. While fidelity insurance safeguards assets against internal threats, cyber insurance addresses external digital risks affecting information security and business continuity. Explore more to understand which insurance best suits your organization's risk management strategy.

Source and External Links

Fidelity Life: Affordable Life Insurance for everyday Americans - Fidelity Life offers easy, fast, and affordable term life insurance, often without requiring a medical exam, designed for everyday Americans.

Term life insurance | Financial resources & coverage options | Fidelity - Fidelity provides flexible and affordable term life insurance with policies ranging from $250,000 to $10 million, including tax-free payout to beneficiaries, ideal for financial security of loved ones.

Deferred Fixed Annuity | The Fidelity Insurance Network - Fidelity Insurance Network offers deferred fixed annuities which provide guaranteed returns and tax deferral benefits, helping with retirement savings and financial planning.

dowidth.com

dowidth.com