Pet insurance and auto insurance both serve to mitigate financial risks but cover distinctly different needs; pet insurance protects against veterinary bills for illnesses and injuries, while auto insurance safeguards against vehicle-related damages and liability. Choosing the right policy depends on factors such as coverage limits, premiums, and specific risks tied to pets or vehicles. Explore how tailored insurance solutions can provide peace of mind for your unique lifestyle needs.

Why it is important

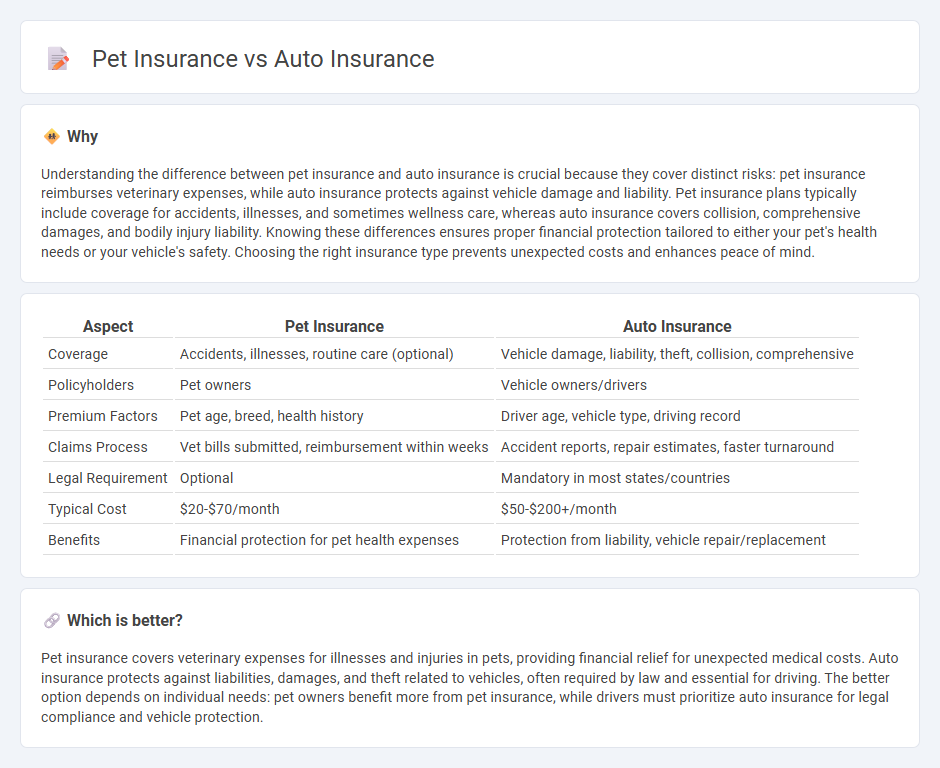

Understanding the difference between pet insurance and auto insurance is crucial because they cover distinct risks: pet insurance reimburses veterinary expenses, while auto insurance protects against vehicle damage and liability. Pet insurance plans typically include coverage for accidents, illnesses, and sometimes wellness care, whereas auto insurance covers collision, comprehensive damages, and bodily injury liability. Knowing these differences ensures proper financial protection tailored to either your pet's health needs or your vehicle's safety. Choosing the right insurance type prevents unexpected costs and enhances peace of mind.

Comparison Table

| Aspect | Pet Insurance | Auto Insurance |

|---|---|---|

| Coverage | Accidents, illnesses, routine care (optional) | Vehicle damage, liability, theft, collision, comprehensive |

| Policyholders | Pet owners | Vehicle owners/drivers |

| Premium Factors | Pet age, breed, health history | Driver age, vehicle type, driving record |

| Claims Process | Vet bills submitted, reimbursement within weeks | Accident reports, repair estimates, faster turnaround |

| Legal Requirement | Optional | Mandatory in most states/countries |

| Typical Cost | $20-$70/month | $50-$200+/month |

| Benefits | Financial protection for pet health expenses | Protection from liability, vehicle repair/replacement |

Which is better?

Pet insurance covers veterinary expenses for illnesses and injuries in pets, providing financial relief for unexpected medical costs. Auto insurance protects against liabilities, damages, and theft related to vehicles, often required by law and essential for driving. The better option depends on individual needs: pet owners benefit more from pet insurance, while drivers must prioritize auto insurance for legal compliance and vehicle protection.

Connection

Pet insurance and auto insurance share similarities in risk management by providing financial protection against unexpected events, such as accidents or damages. Both types of insurance rely on policyholder profiles, claim histories, and actuarial data to determine premiums and coverage limits. Integration of mobile apps and telematics technology enhances customer experience and streamlines claims processing for both insurance sectors.

Key Terms

Auto insurance:

Auto insurance provides financial protection against vehicle damage, theft, and liability claims, covering repair costs and medical expenses resulting from accidents. Comprehensive policies include collision coverage, liability insurance, and personal injury protection to ensure full safeguarding on the road. Explore detailed auto insurance options and compare plans to find the best coverage for your needs.

Liability coverage

Auto insurance liability coverage protects policyholders against legal responsibility for bodily injury and property damage caused to others in car accidents, ensuring financial protection against claims and lawsuits. Pet insurance typically does not include liability coverage, as it primarily covers veterinary expenses for illnesses or injuries, with some specialized policies offering limited liability for pet-related damages. Explore the distinctions between auto and pet insurance liability protections to make informed choices tailored to your needs.

Collision coverage

Collision coverage in auto insurance protects drivers from financial loss due to vehicle damage in accidents, covering repairs or replacement costs. Pet insurance, conversely, does not include collision coverage but focuses on veterinary expenses for illnesses or injuries in pets. Explore detailed comparisons and the benefits of each insurance type to make an informed choice.

Source and External Links

Car Insurance - Get A Free Auto Insurance Quote Online - Farmers Insurance offers customizable auto insurance with key coverage options including comprehensive, collision, and liability coverage to protect against theft, damage, and injury liability.

Direct Auto: Auto Insurance - Get a Free Quote Today - Direct Auto provides affordable car insurance plans with various coverages such as liability, collision, comprehensive, uninsured motorist, and personal injury protection, plus discounts and flexible payment options.

Cheap car insurance | Affordable auto insurance - Liberty Mutual emphasizes affordable car insurance that maintains quality coverage, warns of risks with very cheap insurance, and offers multiple discounts for safe, multi-car, and online purchases.

dowidth.com

dowidth.com