Weather index insurance offers farmers a payout based on predetermined weather parameters such as rainfall or temperature, reducing the need for physical loss assessments. Traditional crop insurance relies on field-level damage evaluations, often leading to delays and disputes over claim settlements. Explore the differences between these insurance models to determine the best protection for agricultural investments.

Why it is important

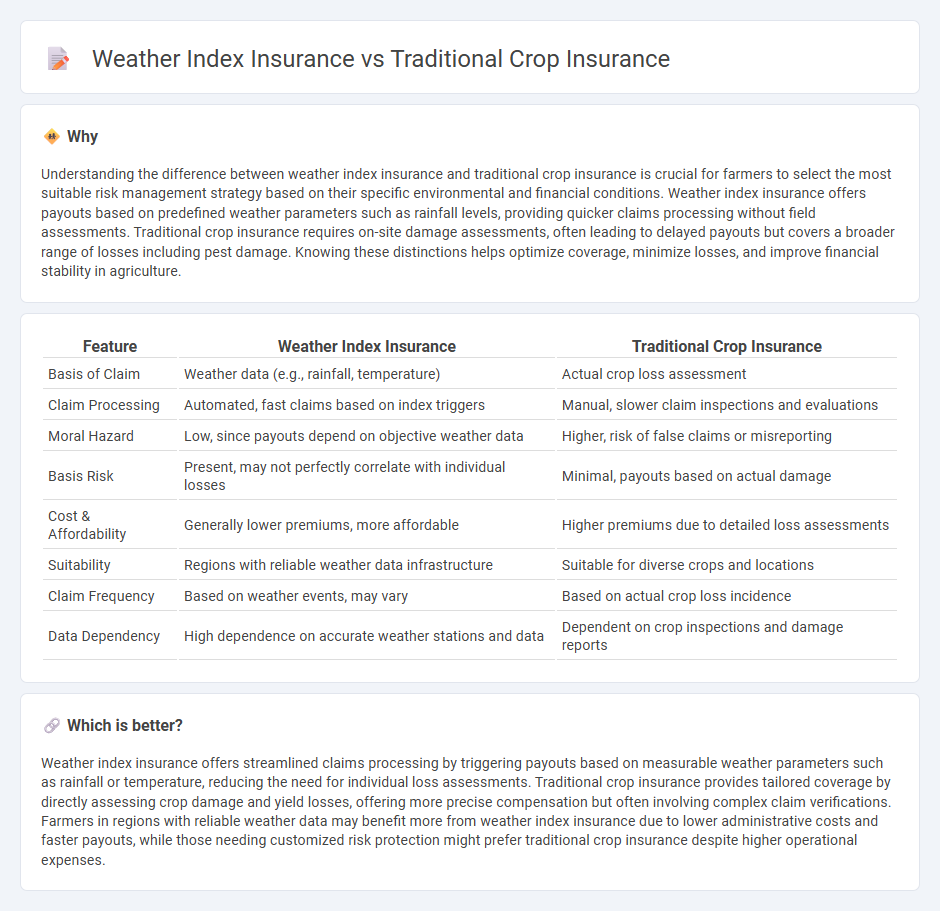

Understanding the difference between weather index insurance and traditional crop insurance is crucial for farmers to select the most suitable risk management strategy based on their specific environmental and financial conditions. Weather index insurance offers payouts based on predefined weather parameters such as rainfall levels, providing quicker claims processing without field assessments. Traditional crop insurance requires on-site damage assessments, often leading to delayed payouts but covers a broader range of losses including pest damage. Knowing these distinctions helps optimize coverage, minimize losses, and improve financial stability in agriculture.

Comparison Table

| Feature | Weather Index Insurance | Traditional Crop Insurance |

|---|---|---|

| Basis of Claim | Weather data (e.g., rainfall, temperature) | Actual crop loss assessment |

| Claim Processing | Automated, fast claims based on index triggers | Manual, slower claim inspections and evaluations |

| Moral Hazard | Low, since payouts depend on objective weather data | Higher, risk of false claims or misreporting |

| Basis Risk | Present, may not perfectly correlate with individual losses | Minimal, payouts based on actual damage |

| Cost & Affordability | Generally lower premiums, more affordable | Higher premiums due to detailed loss assessments |

| Suitability | Regions with reliable weather data infrastructure | Suitable for diverse crops and locations |

| Claim Frequency | Based on weather events, may vary | Based on actual crop loss incidence |

| Data Dependency | High dependence on accurate weather stations and data | Dependent on crop inspections and damage reports |

Which is better?

Weather index insurance offers streamlined claims processing by triggering payouts based on measurable weather parameters such as rainfall or temperature, reducing the need for individual loss assessments. Traditional crop insurance provides tailored coverage by directly assessing crop damage and yield losses, offering more precise compensation but often involving complex claim verifications. Farmers in regions with reliable weather data may benefit more from weather index insurance due to lower administrative costs and faster payouts, while those needing customized risk protection might prefer traditional crop insurance despite higher operational expenses.

Connection

Weather index insurance and traditional crop insurance both serve to protect farmers against losses due to adverse weather conditions, but they differ in claim assessment methods. Weather index insurance uses predefined weather parameters, such as rainfall or temperature thresholds, as triggers for payouts, eliminating the need for individual loss verification. Traditional crop insurance requires detailed field inspections to assess actual crop damage, making weather index insurance a more efficient and cost-effective risk management tool in agricultural finance.

Key Terms

Indemnity

Traditional crop insurance provides indemnity based on actual losses determined by on-site crop assessments, ensuring compensation aligns with specific damage due to pests, diseases, or weather events. Weather index insurance offers indemnity payments triggered by objective weather parameters such as rainfall levels or temperature thresholds, reducing claims processing time and administrative costs. Explore how these indemnity mechanisms impact risk management and farmer resilience.

Index Trigger

Traditional crop insurance compensates farmers based on verified actual losses, requiring in-field assessments which can be time-consuming and costly. Weather index insurance triggers payouts automatically when specific weather parameters, such as rainfall or temperature thresholds, are breached, eliminating the need for loss verification. Explore how weather index insurance can transform risk management in agriculture.

Yield Assessment

Traditional crop insurance relies on individual yield assessments through farm visits and damage appraisals to determine compensation, often resulting in delayed payouts and higher administrative costs. Weather index insurance uses weather data such as rainfall or temperature indices to trigger payouts without the need for direct yield measurement, offering faster and more objective claim settlements. Explore the advantages of each method in yield risk management for informed agricultural decision-making.

Source and External Links

Farm & Commodity Policy - Title XI: Crop Insurance Program Provisions - Traditional crop insurance under the Federal program offers subsidized policies for over 100 commodities, covering losses due to below-average yield or revenue, with policies sold through private companies and premiums partially paid by the government.

Background on: Crop Insurance - Two main types are available: multiple peril crop insurance (MPCI), which covers a wide range of natural disasters and is sold through a federal-private partnership, and crop-hail insurance, which is offered privately and covers specific risks like hail.

A Brief History of Crop Insurance - Initially focused on major crops like wheat, the program expanded over time to include more crops, with modern policies typically based on individual farm production history rather than area averages.

dowidth.com

dowidth.com