Pay per mile insurance charges policyholders based on the exact number of miles driven, offering cost savings for low-mileage drivers by aligning premiums with actual usage. On-demand insurance provides flexible, short-term coverage activated only when needed, ideal for occasional drivers seeking immediate protection without long-term commitments. Explore the advantages and suitability of each option to determine the best fit for your driving habits.

Why it is important

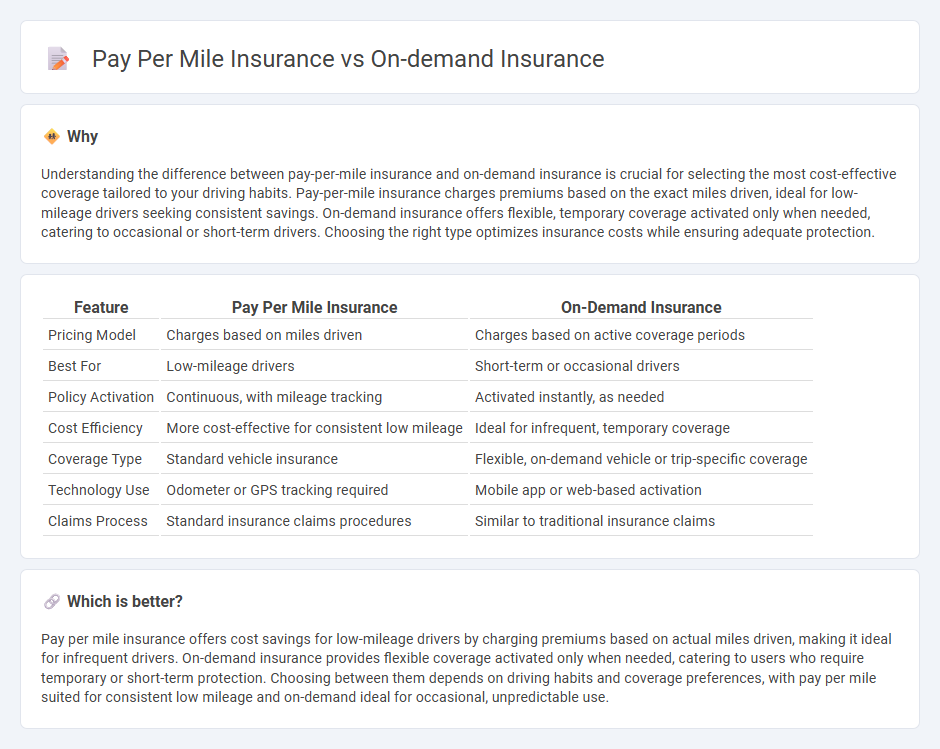

Understanding the difference between pay-per-mile insurance and on-demand insurance is crucial for selecting the most cost-effective coverage tailored to your driving habits. Pay-per-mile insurance charges premiums based on the exact miles driven, ideal for low-mileage drivers seeking consistent savings. On-demand insurance offers flexible, temporary coverage activated only when needed, catering to occasional or short-term drivers. Choosing the right type optimizes insurance costs while ensuring adequate protection.

Comparison Table

| Feature | Pay Per Mile Insurance | On-Demand Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on active coverage periods |

| Best For | Low-mileage drivers | Short-term or occasional drivers |

| Policy Activation | Continuous, with mileage tracking | Activated instantly, as needed |

| Cost Efficiency | More cost-effective for consistent low mileage | Ideal for infrequent, temporary coverage |

| Coverage Type | Standard vehicle insurance | Flexible, on-demand vehicle or trip-specific coverage |

| Technology Use | Odometer or GPS tracking required | Mobile app or web-based activation |

| Claims Process | Standard insurance claims procedures | Similar to traditional insurance claims |

Which is better?

Pay per mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual miles driven, making it ideal for infrequent drivers. On-demand insurance provides flexible coverage activated only when needed, catering to users who require temporary or short-term protection. Choosing between them depends on driving habits and coverage preferences, with pay per mile suited for consistent low mileage and on-demand ideal for occasional, unpredictable use.

Connection

Pay-per-mile insurance and on-demand insurance are both usage-based insurance models that tailor premiums according to actual driving behavior, providing cost efficiency and flexibility. Pay-per-mile insurance charges customers based on the number of miles driven, while on-demand insurance allows users to activate coverage only when needed, such as during specific trips. Both models leverage telematics and mobile technology to deliver personalized pricing and enhance user control over insurance costs.

Key Terms

Coverage Activation

On-demand insurance activates coverage instantly when needed, providing flexibility for sporadic use, whereas pay per mile insurance automatically activates based on recorded mileage, ensuring cost efficiency for low-mileage drivers. On-demand policies are ideal for occasional drivers seeking immediate protection without continuous premiums, while pay per mile plans reward consistent but limited driving habits with lower base rates plus per-mile charges. Discover detailed comparisons to choose the best fit for your driving lifestyle and financial goals.

Usage Measurement

On-demand insurance calculates premiums based on real-time usage data, offering flexibility for short-term coverage, whereas pay per mile insurance charges a fixed rate plus a variable cost determined by the actual miles driven, enhancing cost efficiency for low-mileage drivers. Usage measurement in on-demand policies relies heavily on app-based activation and deactivation, while pay per mile insurance employs telematics devices or smartphone tracking to record mileage accurately. Explore more to understand which model aligns best with your driving habits and insurance needs.

Premium Calculation

On-demand insurance premiums are calculated based on the duration of coverage, typically charging a fixed rate per hour or day, providing flexibility for intermittent use. Pay per mile insurance determines premiums by tracking and charging for actual miles driven, offering cost efficiency for low-mileage drivers. Explore detailed comparisons to understand which premium calculation model best suits your driving habits.

Source and External Links

The ins and outs of on-demand insurance: a growing trend in coverage flexibility - On-demand insurance allows consumers to purchase and manage coverage only when needed, typically via digital platforms, offering flexibility for assets not constantly in use, such as travel insurance or rental car coverage.

What Is On-Demand Insurance? - Experian - On-demand insurance lets policyholders activate or deactivate coverage instantly and pay only for the period the policy is active, often managed through a smartphone or other device, providing a buffer against accidents or loss during specific times of need.

Will On-Demand insurance become mainstream - KPMG International - On-demand insurance represents a small share of the global market but offers per-use rates higher than annual policies, presenting both opportunities for customer savings and challenges for insurers due to potential fraud and capital reserving needs.

dowidth.com

dowidth.com