Climate risk insurance provides financial protection against losses caused by climate-related events, using traditional indemnity-based claims assessment to cover damages. Parametric reinsurance offers a faster payout method by triggering payments based on predefined parameters like rainfall levels or wind speeds, without the need for loss adjustments. Explore the differences and benefits of both approaches to better manage climate-related financial risks.

Why it is important

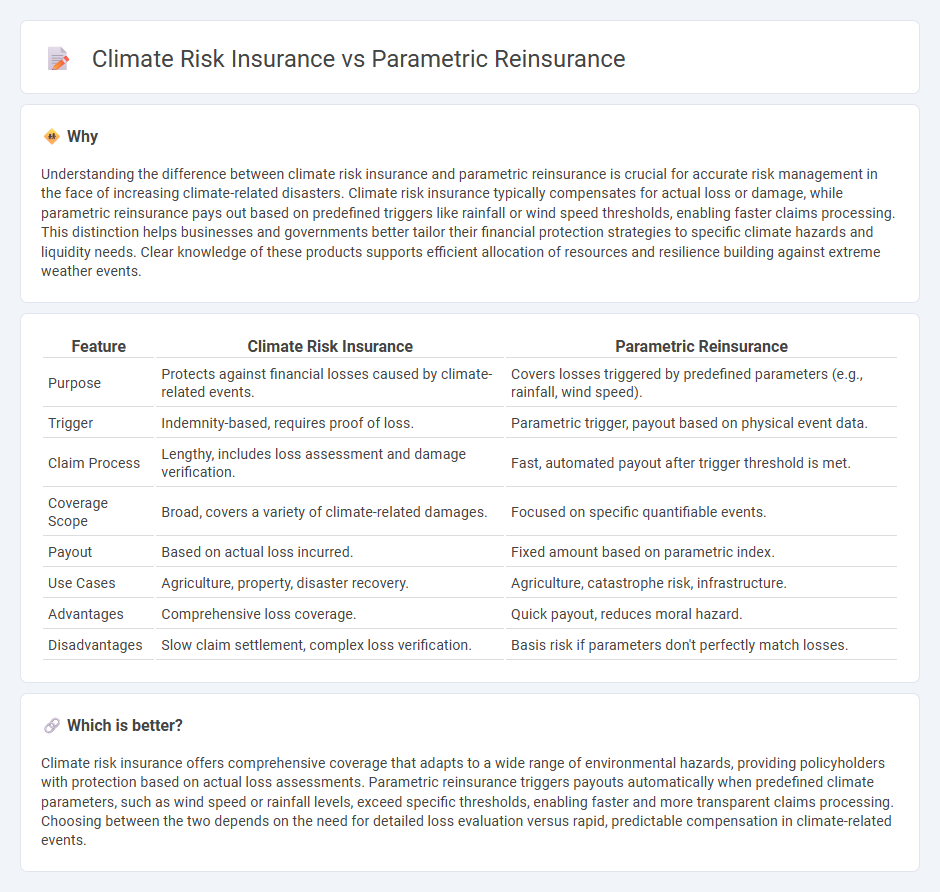

Understanding the difference between climate risk insurance and parametric reinsurance is crucial for accurate risk management in the face of increasing climate-related disasters. Climate risk insurance typically compensates for actual loss or damage, while parametric reinsurance pays out based on predefined triggers like rainfall or wind speed thresholds, enabling faster claims processing. This distinction helps businesses and governments better tailor their financial protection strategies to specific climate hazards and liquidity needs. Clear knowledge of these products supports efficient allocation of resources and resilience building against extreme weather events.

Comparison Table

| Feature | Climate Risk Insurance | Parametric Reinsurance |

|---|---|---|

| Purpose | Protects against financial losses caused by climate-related events. | Covers losses triggered by predefined parameters (e.g., rainfall, wind speed). |

| Trigger | Indemnity-based, requires proof of loss. | Parametric trigger, payout based on physical event data. |

| Claim Process | Lengthy, includes loss assessment and damage verification. | Fast, automated payout after trigger threshold is met. |

| Coverage Scope | Broad, covers a variety of climate-related damages. | Focused on specific quantifiable events. |

| Payout | Based on actual loss incurred. | Fixed amount based on parametric index. |

| Use Cases | Agriculture, property, disaster recovery. | Agriculture, catastrophe risk, infrastructure. |

| Advantages | Comprehensive loss coverage. | Quick payout, reduces moral hazard. |

| Disadvantages | Slow claim settlement, complex loss verification. | Basis risk if parameters don't perfectly match losses. |

Which is better?

Climate risk insurance offers comprehensive coverage that adapts to a wide range of environmental hazards, providing policyholders with protection based on actual loss assessments. Parametric reinsurance triggers payouts automatically when predefined climate parameters, such as wind speed or rainfall levels, exceed specific thresholds, enabling faster and more transparent claims processing. Choosing between the two depends on the need for detailed loss evaluation versus rapid, predictable compensation in climate-related events.

Connection

Climate risk insurance provides financial protection against losses caused by extreme weather events, while parametric reinsurance offers a streamlined payout mechanism triggered by predefined climate-related metrics such as hurricane wind speed or rainfall levels. This connection allows insurers to rapidly transfer climate risks to reinsurers using parametric triggers, reducing claims processing time and enhancing capital efficiency. Together, these insurance solutions improve resilience for vulnerable populations and businesses exposed to climate-induced natural disasters.

Key Terms

Trigger event

Parametric reinsurance relies on a predefined trigger event based on measurable parameters such as rainfall amount or wind speed, facilitating rapid payout without loss assessment. Climate risk insurance similarly uses trigger events linked to climate variables but is specifically designed to address risks from extreme weather and long-term climate changes. Explore more about how these trigger mechanisms shape risk management strategies.

Payout structure

Parametric reinsurance offers predetermined payouts triggered by specific measurable events, such as wind speed or rainfall, eliminating the need for loss assessment and accelerating claim settlements. Climate risk insurance, often indemnity-based, reimburses policyholders based on the actual losses incurred from climate-related events, requiring detailed damage verification and longer claim processing times. Explore the nuances of payout structures to understand which solution best fits your risk management needs.

Risk transfer

Parametric reinsurance offers rapid, transparent risk transfer by triggering payments based on predefined event parameters, such as wind speed or rainfall amounts, rather than actual losses, making it highly effective for climate-related events. Climate risk insurance encompasses both parametric and indemnity-based solutions, aiming to mitigate financial impacts from natural disasters exacerbated by climate change, but often involves complex loss assessments and longer claim processes. Explore how these innovative risk transfer mechanisms reshape resilience against climate threats and discover tailored solutions for your risk management.

Source and External Links

Parametric Insurance | Aon - Parametric insurance is a risk transfer solution that pays out based on predefined events, providing quick and flexible coverage for natural catastrophes and emerging risks.

Role of Parametric (Re)Insurance in Closing the Protection Gap - Parametric insurance offers a promising solution to bridge the protection gap by providing rapid payouts based on predefined triggers, enhancing financial resilience against evolving risks.

Why Parametric Insurance Could Be the Solution to Uncertain Relief Capital - Parametric reinsurance could provide fast and cost-effective relief capital, especially in regions with significant political or operational risks, by using predefined triggers for payouts.

dowidth.com

dowidth.com