Drone insurance covers liability and damage protection for unmanned aerial vehicles used in commercial or recreational activities, addressing risks such as property damage, bodily injury, and equipment loss. Travel insurance safeguards travelers against trip cancellations, medical emergencies, lost baggage, and flight disruptions during domestic or international journeys. Explore the key differences and benefits to find the right coverage for your specific needs.

Why it is important

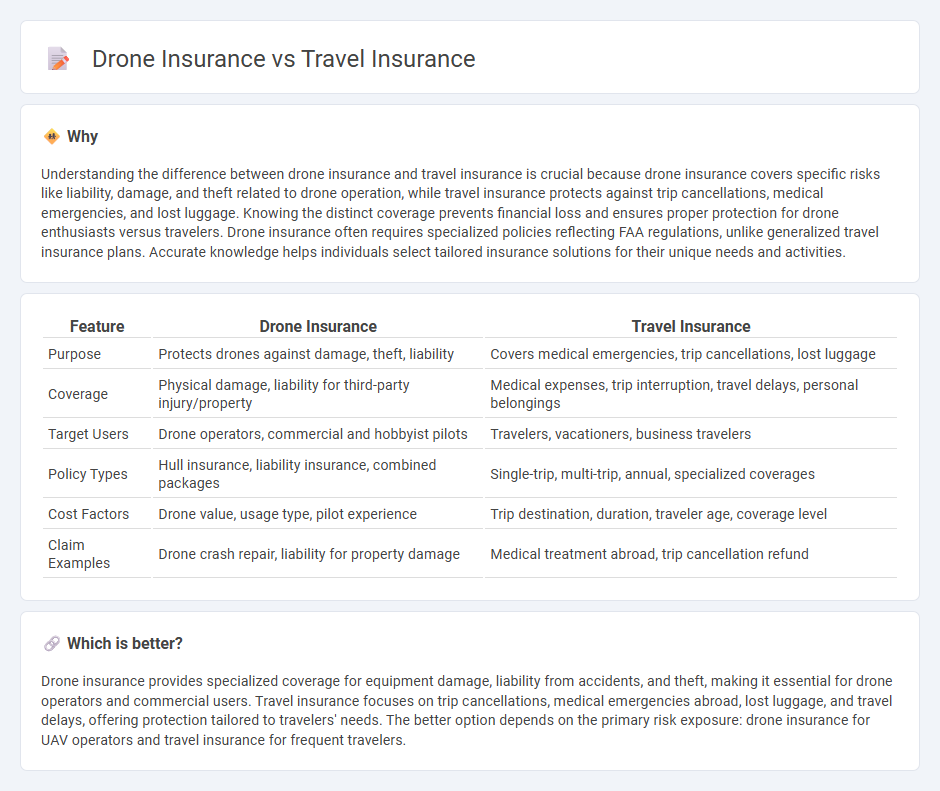

Understanding the difference between drone insurance and travel insurance is crucial because drone insurance covers specific risks like liability, damage, and theft related to drone operation, while travel insurance protects against trip cancellations, medical emergencies, and lost luggage. Knowing the distinct coverage prevents financial loss and ensures proper protection for drone enthusiasts versus travelers. Drone insurance often requires specialized policies reflecting FAA regulations, unlike generalized travel insurance plans. Accurate knowledge helps individuals select tailored insurance solutions for their unique needs and activities.

Comparison Table

| Feature | Drone Insurance | Travel Insurance |

|---|---|---|

| Purpose | Protects drones against damage, theft, liability | Covers medical emergencies, trip cancellations, lost luggage |

| Coverage | Physical damage, liability for third-party injury/property | Medical expenses, trip interruption, travel delays, personal belongings |

| Target Users | Drone operators, commercial and hobbyist pilots | Travelers, vacationers, business travelers |

| Policy Types | Hull insurance, liability insurance, combined packages | Single-trip, multi-trip, annual, specialized coverages |

| Cost Factors | Drone value, usage type, pilot experience | Trip destination, duration, traveler age, coverage level |

| Claim Examples | Drone crash repair, liability for property damage | Medical treatment abroad, trip cancellation refund |

Which is better?

Drone insurance provides specialized coverage for equipment damage, liability from accidents, and theft, making it essential for drone operators and commercial users. Travel insurance focuses on trip cancellations, medical emergencies abroad, lost luggage, and travel delays, offering protection tailored to travelers' needs. The better option depends on the primary risk exposure: drone insurance for UAV operators and travel insurance for frequent travelers.

Connection

Drone insurance and travel insurance are connected through their shared goal of mitigating risks associated with mobility and aerial operations during trips. Both policies can cover potential damages, liabilities, and losses involving drones used for recreational or professional purposes abroad, ensuring compliance with regional regulations and protection against unforeseen incidents. Integrating drone insurance within travel insurance plans offers comprehensive protection for travelers who rely on drones for capturing images or conducting inspections while on the move.

Key Terms

**Travel Insurance:**

Travel insurance provides comprehensive coverage for trip cancellations, medical emergencies, lost luggage, and travel delays, ensuring financial protection during unforeseen events on your journey. It typically covers medical expenses abroad, trip interruption, and emergency evacuation, making it essential for international travelers. Discover more about travel insurance benefits and policy options to safeguard your next adventure.

Trip Cancellation

Trip cancellation coverage in travel insurance typically reimburses non-refundable expenses such as flights and accommodations when unforeseen events disrupt travel plans. Drone insurance does not include trip cancellation benefits but focuses on protecting the drone against damage, theft, and liability during operation. Discover how each insurance type safeguards your investments and travel experience in detail.

Medical Emergency Coverage

Travel insurance typically includes medical emergency coverage that protects against unforeseen health issues, hospital stays, and emergency evacuations while abroad. Drone insurance, on the other hand, primarily covers liability claims, damage to the drone, and third-party property damage but does not provide medical emergency benefits. Discover how these insurance policies differ in protecting you and your gear in various situations.

Source and External Links

Travel Insurance - Travelers - Travel insurance helps protect you from losses and unexpected events during travel, covering things like trip cancellation, medical expenses, and baggage; you can choose single-trip or multi-trip plans and add options like Cancel for Any Reason within certain time limits to maximize protection.

Travel Insurance - Compare the Best Quotes & Buy Online - Squaremouth offers a comparison tool to find travel insurance plans that cover international medical emergencies, trip cancellations, and cruise travel, with options tailored to occasional or frequent travelers and benefits like pre-existing condition waivers available if purchased early.

Taking a Trip? Information About Travel Insurance You Should Know - Travel insurance generally costs 4-10% of the trip price and is recommended if you can't afford to cancel or your health insurance doesn't cover you abroad; coverage often excludes some events and pre-existing conditions, and policies vary in cancellation and emergency medical benefits.

dowidth.com

dowidth.com