Micro-mobility insurance covers electric scooters, bikes, and other small vehicles, providing protection against theft, liability, and accidents specific to short-distance urban travel. Rideshare insurance targets drivers working for platforms like Uber and Lyft, offering coverage gaps between personal auto policies and commercial liability during passenger transport. Discover the key differences and benefits of each insurance type to ensure optimal protection for your transportation needs.

Why it is important

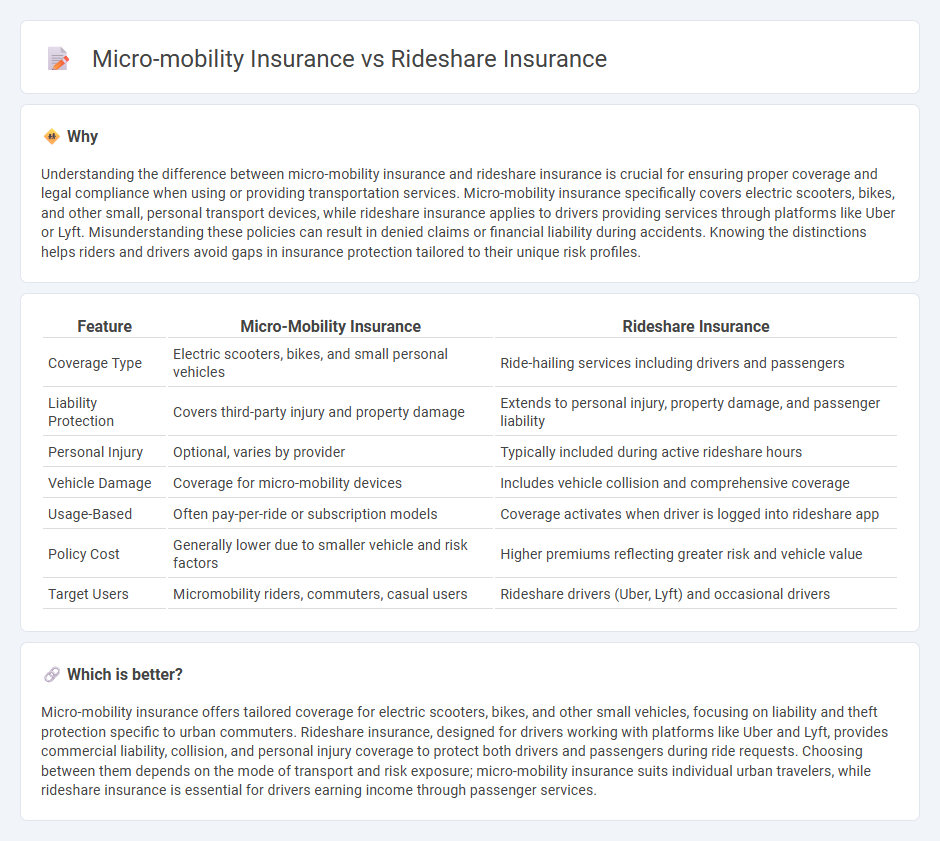

Understanding the difference between micro-mobility insurance and rideshare insurance is crucial for ensuring proper coverage and legal compliance when using or providing transportation services. Micro-mobility insurance specifically covers electric scooters, bikes, and other small, personal transport devices, while rideshare insurance applies to drivers providing services through platforms like Uber or Lyft. Misunderstanding these policies can result in denied claims or financial liability during accidents. Knowing the distinctions helps riders and drivers avoid gaps in insurance protection tailored to their unique risk profiles.

Comparison Table

| Feature | Micro-Mobility Insurance | Rideshare Insurance |

|---|---|---|

| Coverage Type | Electric scooters, bikes, and small personal vehicles | Ride-hailing services including drivers and passengers |

| Liability Protection | Covers third-party injury and property damage | Extends to personal injury, property damage, and passenger liability |

| Personal Injury | Optional, varies by provider | Typically included during active rideshare hours |

| Vehicle Damage | Coverage for micro-mobility devices | Includes vehicle collision and comprehensive coverage |

| Usage-Based | Often pay-per-ride or subscription models | Coverage activates when driver is logged into rideshare app |

| Policy Cost | Generally lower due to smaller vehicle and risk factors | Higher premiums reflecting greater risk and vehicle value |

| Target Users | Micromobility riders, commuters, casual users | Rideshare drivers (Uber, Lyft) and occasional drivers |

Which is better?

Micro-mobility insurance offers tailored coverage for electric scooters, bikes, and other small vehicles, focusing on liability and theft protection specific to urban commuters. Rideshare insurance, designed for drivers working with platforms like Uber and Lyft, provides commercial liability, collision, and personal injury coverage to protect both drivers and passengers during ride requests. Choosing between them depends on the mode of transport and risk exposure; micro-mobility insurance suits individual urban travelers, while rideshare insurance is essential for drivers earning income through passenger services.

Connection

Micro-mobility insurance and rideshare insurance both provide coverage for emerging transportation methods, addressing unique risks associated with shared and short-distance travel. They cover liability, injury protection, and property damage for users of electric scooters, bikes, and rideshare vehicles, ensuring financial protection in accident scenarios. This specialized insurance supports the growth of urban mobility by enabling safe, compliant operation across overlapping gig economy platforms.

Key Terms

Coverage Gap

Rideshare insurance primarily addresses the coverage gap that arises when drivers use personal vehicles for commercial purposes, filling the void between personal auto insurance and rideshare company policies. Micro-mobility insurance covers electric scooters, bikes, and other small vehicles, protecting against liability and damage not typically included in traditional auto policies. Explore in-depth differences and protections offered by both insurance types to secure your coverage needs effectively.

Vehicle Type

Rideshare insurance primarily covers traditional passenger vehicles such as cars and SUVs used for services like Uber and Lyft, protecting drivers against liability, collision, and personal injury. Micro-mobility insurance targets smaller, low-speed vehicles such as electric scooters, bikes, and e-bikes, addressing unique risks like battery malfunctions, theft, and shared usage in urban environments. Explore comprehensive comparisons to understand which insurance solution best suits your vehicle type and usage needs.

Usage Purpose

Rideshare insurance specifically covers drivers using personal vehicles for transporting passengers or goods via platforms like Uber or Lyft, ensuring protection during commercial use. Micro-mobility insurance targets operators of small electric vehicles such as e-scooters and bike-sharing services, addressing liabilities unique to urban short-distance travel. Explore how usage purpose influences coverage needs and policy selection to safeguard your mobility business effectively.

Source and External Links

Rideshare Insurance - ERIE - ERIE offers rideshare insurance coverage that protects drivers during all phases of a trip--including when the app is on but no ride is accepted--by adding a "business use" designation to your personal auto policy, ensuring continuous liability, comprehensive, and collision coverage with affordable premiums.

Rideshare Insurance: Everything You Need to Know - The Zebra - Rideshare insurance is an endorsement that fills the coverage gaps between personal auto insurance and limited rideshare company policies, covering drivers until a ride is accepted; adding this endorsement typically increases premiums by around $94 on average across providers.

Rideshare Insurance Coverage - Progressive - Progressive makes it easy to add rideshare coverage to a personal auto policy, providing protection when waiting for ride requests and complementing limited commercial insurance offered by rideshare companies like Uber and Lyft, with the requirement that rideshare drivers add this coverage for complete protection.

dowidth.com

dowidth.com