Digital nomad insurance offers specialized coverage tailored for remote workers who travel frequently, including protection for health, belongings, and liability across multiple countries. Student insurance primarily focuses on providing affordable health and accident coverage within a specific country or university, often emphasizing emergency medical services and tuition reimbursement. Explore the key differences and benefits to find the insurance plan best suited for your lifestyle.

Why it is important

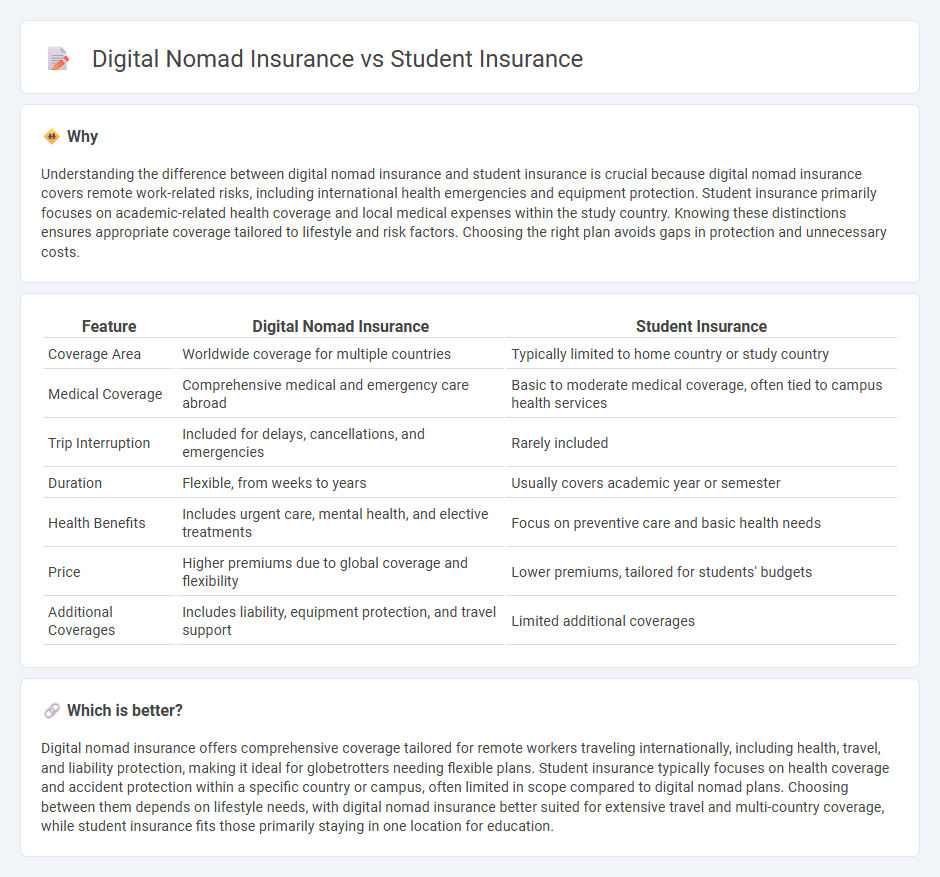

Understanding the difference between digital nomad insurance and student insurance is crucial because digital nomad insurance covers remote work-related risks, including international health emergencies and equipment protection. Student insurance primarily focuses on academic-related health coverage and local medical expenses within the study country. Knowing these distinctions ensures appropriate coverage tailored to lifestyle and risk factors. Choosing the right plan avoids gaps in protection and unnecessary costs.

Comparison Table

| Feature | Digital Nomad Insurance | Student Insurance |

|---|---|---|

| Coverage Area | Worldwide coverage for multiple countries | Typically limited to home country or study country |

| Medical Coverage | Comprehensive medical and emergency care abroad | Basic to moderate medical coverage, often tied to campus health services |

| Trip Interruption | Included for delays, cancellations, and emergencies | Rarely included |

| Duration | Flexible, from weeks to years | Usually covers academic year or semester |

| Health Benefits | Includes urgent care, mental health, and elective treatments | Focus on preventive care and basic health needs |

| Price | Higher premiums due to global coverage and flexibility | Lower premiums, tailored for students' budgets |

| Additional Coverages | Includes liability, equipment protection, and travel support | Limited additional coverages |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for remote workers traveling internationally, including health, travel, and liability protection, making it ideal for globetrotters needing flexible plans. Student insurance typically focuses on health coverage and accident protection within a specific country or campus, often limited in scope compared to digital nomad plans. Choosing between them depends on lifestyle needs, with digital nomad insurance better suited for extensive travel and multi-country coverage, while student insurance fits those primarily staying in one location for education.

Connection

Digital nomad insurance and student insurance share a focus on providing flexible, global coverage tailored to individuals frequently traveling or studying abroad. Both policies typically include health, travel, and liability protections designed to accommodate varying locations and temporary residencies. This connectivity highlights the growing demand for adaptable insurance solutions that support mobile lifestyles and international experiences.

Key Terms

Coverage Scope

Student insurance typically offers coverage for medical emergencies, accidents, and sometimes basic travel-related incidents like lost luggage or trip cancellations within a specific country or region. Digital nomad insurance provides broader, worldwide coverage including telemedicine, work equipment protection, and liability insurance tailored for remote professionals working across multiple countries. Explore detailed policy comparisons to understand which insurance best fits your lifestyle and needs.

Duration of Stay

Student insurance typically covers the duration of an academic semester or full academic year, often ranging from 6 to 12 months to align with study programs. Digital nomad insurance offers more flexible coverage options, generally allowing stays from a few months up to one or two years, accommodating varying travel and remote work durations. Explore comprehensive plans that suit your unique length of stay and lifestyle needs.

Geographical Limitations

Student insurance plans often provide coverage primarily within the country of study, with limited or no benefits for travel outside specified regions. Digital nomad insurance is designed for global mobility, offering expansive geographical coverage without restrictions, ideal for frequent international travel and remote work. Explore how these insurance types differ in protecting your health across borders to choose the best fit for your lifestyle.

Source and External Links

College student health insurance | Individuals & families - Student insurance plans offer lower cost deductibles and premiums with comprehensive benefits tailored for students, including coverage on campus and access to extensive physician networks.

Student Health Insurance Plan for Penn State - Penn State provides a comprehensive Student Health Insurance Plan available to various enrolled students, including undergraduates in 6 or more credits, international students, and graduate students, with set enrollment periods.

International Student Insurance | Student Health and Travel - International Student Insurance offers affordable, comprehensive health plans designed to meet U.S. visa requirements for international students including F1, M1, J1, and OPT visa holders, with plans starting at $29/month.

dowidth.com

dowidth.com