Parametric insurance provides pre-agreed payouts based on specific event triggers such as weather conditions or earthquake intensity, eliminating lengthy claim assessments common in indemnity insurance, which compensates insured parties based on actual losses incurred. This approach offers faster, more transparent relief, particularly valuable in disaster-prone areas where timely funds are critical for recovery. Explore the benefits and best use cases of parametric insurance compared to traditional indemnity coverage to optimize your risk management strategy.

Why it is important

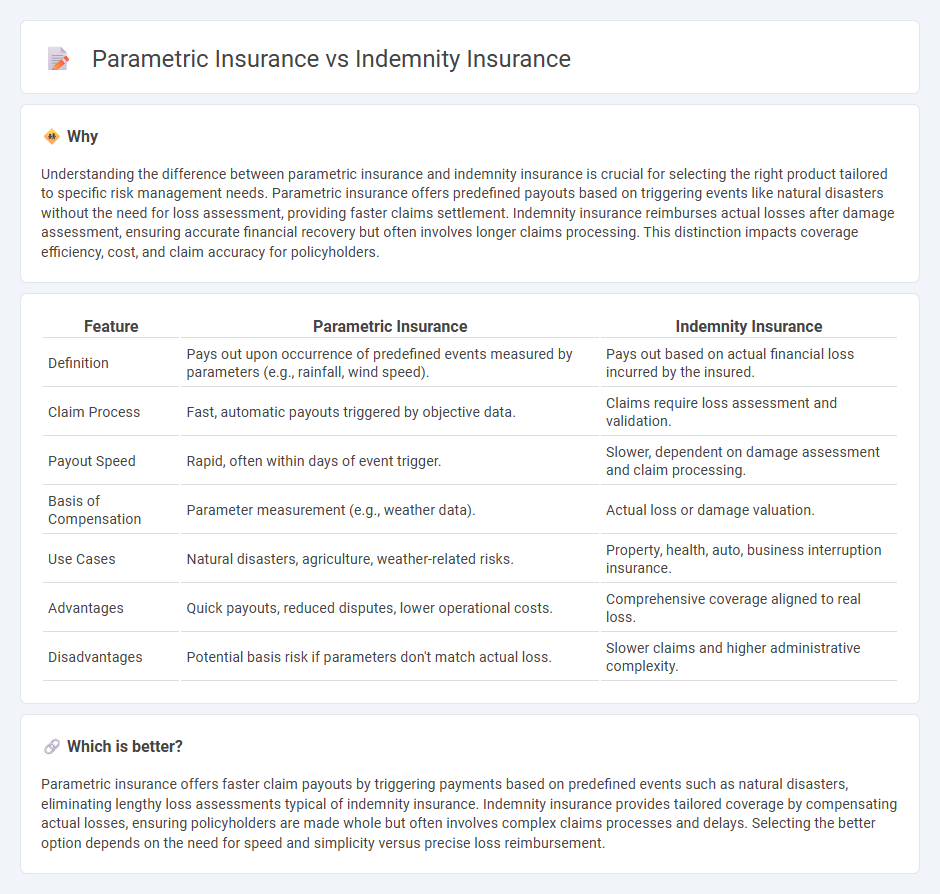

Understanding the difference between parametric insurance and indemnity insurance is crucial for selecting the right product tailored to specific risk management needs. Parametric insurance offers predefined payouts based on triggering events like natural disasters without the need for loss assessment, providing faster claims settlement. Indemnity insurance reimburses actual losses after damage assessment, ensuring accurate financial recovery but often involves longer claims processing. This distinction impacts coverage efficiency, cost, and claim accuracy for policyholders.

Comparison Table

| Feature | Parametric Insurance | Indemnity Insurance |

|---|---|---|

| Definition | Pays out upon occurrence of predefined events measured by parameters (e.g., rainfall, wind speed). | Pays out based on actual financial loss incurred by the insured. |

| Claim Process | Fast, automatic payouts triggered by objective data. | Claims require loss assessment and validation. |

| Payout Speed | Rapid, often within days of event trigger. | Slower, dependent on damage assessment and claim processing. |

| Basis of Compensation | Parameter measurement (e.g., weather data). | Actual loss or damage valuation. |

| Use Cases | Natural disasters, agriculture, weather-related risks. | Property, health, auto, business interruption insurance. |

| Advantages | Quick payouts, reduced disputes, lower operational costs. | Comprehensive coverage aligned to real loss. |

| Disadvantages | Potential basis risk if parameters don't match actual loss. | Slower claims and higher administrative complexity. |

Which is better?

Parametric insurance offers faster claim payouts by triggering payments based on predefined events such as natural disasters, eliminating lengthy loss assessments typical of indemnity insurance. Indemnity insurance provides tailored coverage by compensating actual losses, ensuring policyholders are made whole but often involves complex claims processes and delays. Selecting the better option depends on the need for speed and simplicity versus precise loss reimbursement.

Connection

Parametric insurance and indemnity insurance are connected through their function of risk transfer but differ in claim triggers; parametric insurance pays out based on predefined parameters or indexes such as weather events, while indemnity insurance reimburses actual financial losses proven by documentation. This connection highlights the evolving landscape of insurance products, where parametric models complement traditional indemnity approaches by offering faster, more predictable payouts. Both types aim to provide financial protection, yet their methodologies cater to diverse risk management needs across industries.

Key Terms

Compensation (Indemnity)

Indemnity insurance provides compensation based on the actual financial loss incurred, requiring detailed loss assessments and claims adjustments to determine the payout. Parametric insurance offers a fixed payout triggered by predefined parameters or events, such as rainfall levels or earthquake magnitude, regardless of the actual loss suffered. Explore how these compensation methods impact claims processing and risk management strategies by learning more about each insurance type.

Trigger Event (Parametric)

Indemnity insurance compensates policyholders based on the actual financial loss incurred after an event, requiring detailed claims assessment and proof of damages. Parametric insurance relies on predetermined trigger events, such as specific earthquake magnitudes or rainfall thresholds, activating payment automatically without loss adjustment. Explore the benefits and applications of parametric triggers in risk management to understand how this innovative approach streamlines compensation.

Claim Assessment

Indemnity insurance involves claim assessment based on actual financial losses verified through documentation, requiring detailed investigations and adjusting processes. Parametric insurance simplifies claim assessment by using predefined parameters or triggers, such as weather data or earthquake magnitude, enabling quicker and more transparent payouts. Explore how each method impacts risk management and payout efficiency in detail.

Source and External Links

Professional Indemnity Insurance: What Is It and Why Do You Need It - This webpage explains the role of professional indemnity insurance in protecting professionals from claims of negligence and other errors.

Indemnity Insurance Guide: Coverage, Costs, Pros & Cons - This guide provides an overview of indemnity insurance, including its functions and benefits for businesses in various professional services.

Hospital Indemnity Insurance - What Is It - This webpage describes hospital indemnity insurance as a supplement to traditional health insurance, helping cover expenses related to hospital stays.

dowidth.com

dowidth.com