Gig worker insurance focuses on flexible coverage tailored to unpredictable income and lack of employer benefits, emphasizing health, disability, and liability protection specific to freelance or contract work. Retiree insurance prioritizes healthcare plans, long-term care, and supplemental coverage addressing the increased medical needs and fixed income concerns of retirees. Explore detailed comparisons to select the insurance best suited for your work status and life stage.

Why it is important

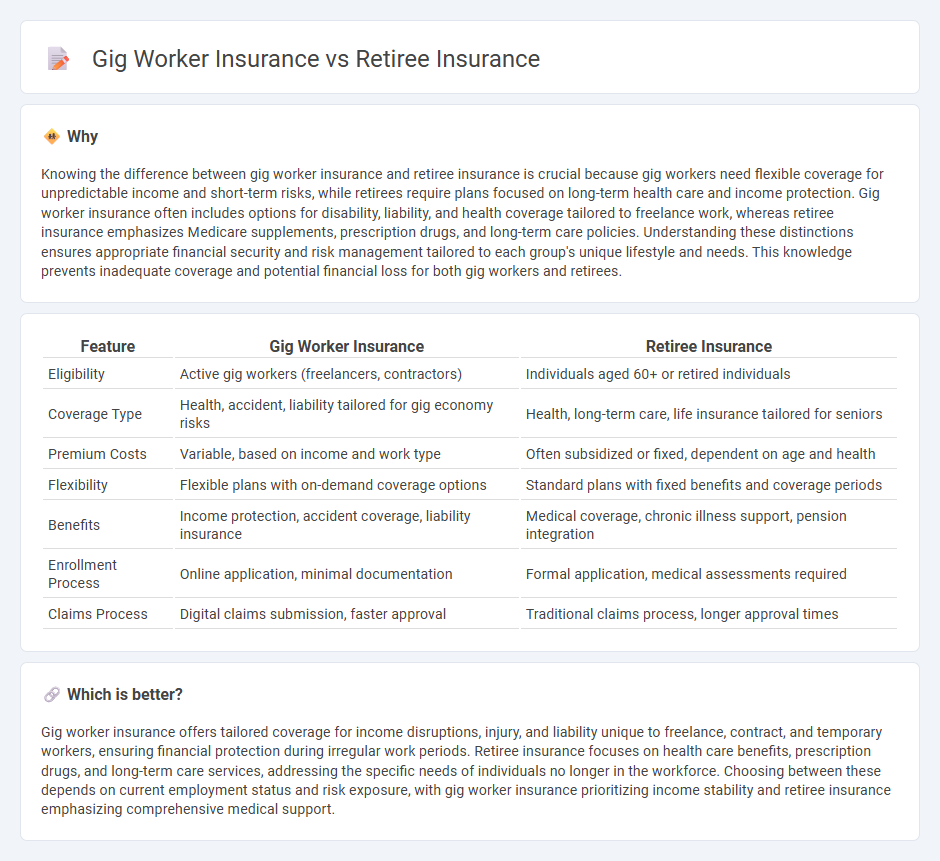

Knowing the difference between gig worker insurance and retiree insurance is crucial because gig workers need flexible coverage for unpredictable income and short-term risks, while retirees require plans focused on long-term health care and income protection. Gig worker insurance often includes options for disability, liability, and health coverage tailored to freelance work, whereas retiree insurance emphasizes Medicare supplements, prescription drugs, and long-term care policies. Understanding these distinctions ensures appropriate financial security and risk management tailored to each group's unique lifestyle and needs. This knowledge prevents inadequate coverage and potential financial loss for both gig workers and retirees.

Comparison Table

| Feature | Gig Worker Insurance | Retiree Insurance |

|---|---|---|

| Eligibility | Active gig workers (freelancers, contractors) | Individuals aged 60+ or retired individuals |

| Coverage Type | Health, accident, liability tailored for gig economy risks | Health, long-term care, life insurance tailored for seniors |

| Premium Costs | Variable, based on income and work type | Often subsidized or fixed, dependent on age and health |

| Flexibility | Flexible plans with on-demand coverage options | Standard plans with fixed benefits and coverage periods |

| Benefits | Income protection, accident coverage, liability insurance | Medical coverage, chronic illness support, pension integration |

| Enrollment Process | Online application, minimal documentation | Formal application, medical assessments required |

| Claims Process | Digital claims submission, faster approval | Traditional claims process, longer approval times |

Which is better?

Gig worker insurance offers tailored coverage for income disruptions, injury, and liability unique to freelance, contract, and temporary workers, ensuring financial protection during irregular work periods. Retiree insurance focuses on health care benefits, prescription drugs, and long-term care services, addressing the specific needs of individuals no longer in the workforce. Choosing between these depends on current employment status and risk exposure, with gig worker insurance prioritizing income stability and retiree insurance emphasizing comprehensive medical support.

Connection

Gig worker insurance and retiree insurance are connected through their focus on addressing non-traditional work patterns and long-term financial security. Both types of insurance cater to individuals lacking employer-sponsored benefits, offering tailored coverage such as health, disability, and income protection. This linkage highlights the evolving insurance market adapting to the growing gig economy and aging population needs.

Key Terms

Coverage Eligibility

Retiree insurance typically offers comprehensive coverage that includes Medicare or employer-sponsored retiree plans, with eligibility often based on age or prior employment history. Gig worker insurance focuses on flexible, individual plans such as health exchanges or short-term policies, accommodating variable income and lack of traditional employer benefits. Explore detailed comparisons to find the best insurance coverage suited to your unique needs.

Premium Structure

Retiree insurance typically features fixed premium structures often subsidized by government programs like Medicare, providing predictable costs tailored to older adults. Gig worker insurance premiums vary widely based on income, job risk, and coverage level, reflecting the dynamic nature of freelance employment. Explore detailed comparisons to understand which premium model fits your financial and coverage needs best.

Portability

Retiree insurance plans often offer limited portability since coverage is typically tied to a former employer or specific geographic regions. Gig worker insurance prioritizes portability by providing flexible, nationwide plans that accommodate frequent relocations and variable work locations. Explore detailed comparisons to understand which insurance best supports your lifestyle and mobility needs.

Source and External Links

Retiree health coverage and Medicare | News & articles - Retiree health coverage is group insurance some employers, unions, or trusts offer to retirees and their spouses, which may supplement Medicare but typically requires enrollment in Medicare when eligible.

Retiree insurance & Medicare - If you have both Medicare and employer-sponsored retiree insurance, Medicare generally pays first, and the retiree plan may cover additional costs or provide extra benefits like longer hospital stays or prescription drug coverage.

Retiree Health Insurance | Business Services Center - NY.gov - Retirees in New York State must enroll in Medicare Parts A and B when eligible and can pay for their health insurance through pension deductions or direct billing, with premium amounts matching those for active employees.

dowidth.com

dowidth.com