Insurtech sandboxes foster innovation by providing a controlled environment for testing new insurance technologies and products under regulatory supervision. Digital claims processing leverages automation, AI, and data analytics to streamline claim submissions, reduce processing time, and enhance customer experience. Explore how these advancements transform the insurance landscape and drive efficiency in claims management.

Why it is important

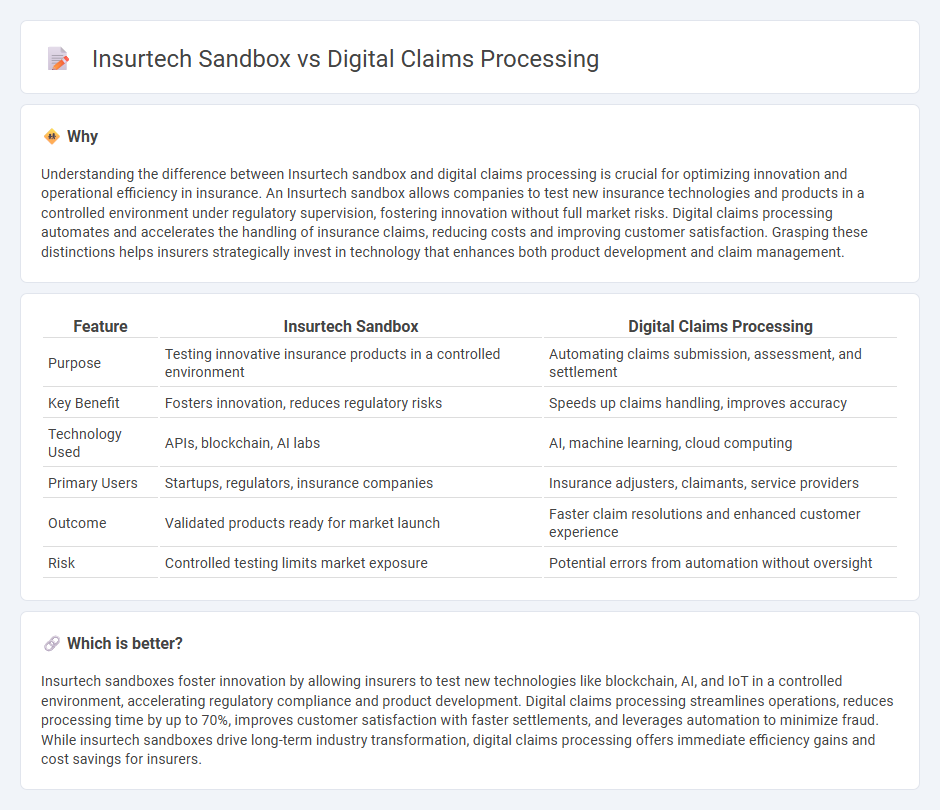

Understanding the difference between Insurtech sandbox and digital claims processing is crucial for optimizing innovation and operational efficiency in insurance. An Insurtech sandbox allows companies to test new insurance technologies and products in a controlled environment under regulatory supervision, fostering innovation without full market risks. Digital claims processing automates and accelerates the handling of insurance claims, reducing costs and improving customer satisfaction. Grasping these distinctions helps insurers strategically invest in technology that enhances both product development and claim management.

Comparison Table

| Feature | Insurtech Sandbox | Digital Claims Processing |

|---|---|---|

| Purpose | Testing innovative insurance products in a controlled environment | Automating claims submission, assessment, and settlement |

| Key Benefit | Fosters innovation, reduces regulatory risks | Speeds up claims handling, improves accuracy |

| Technology Used | APIs, blockchain, AI labs | AI, machine learning, cloud computing |

| Primary Users | Startups, regulators, insurance companies | Insurance adjusters, claimants, service providers |

| Outcome | Validated products ready for market launch | Faster claim resolutions and enhanced customer experience |

| Risk | Controlled testing limits market exposure | Potential errors from automation without oversight |

Which is better?

Insurtech sandboxes foster innovation by allowing insurers to test new technologies like blockchain, AI, and IoT in a controlled environment, accelerating regulatory compliance and product development. Digital claims processing streamlines operations, reduces processing time by up to 70%, improves customer satisfaction with faster settlements, and leverages automation to minimize fraud. While insurtech sandboxes drive long-term industry transformation, digital claims processing offers immediate efficiency gains and cost savings for insurers.

Connection

Insurtech sandboxes provide a controlled environment for testing innovative digital claims processing solutions, enabling faster validation and deployment of automated claims handling technologies. These sandboxes allow insurers to experiment with artificial intelligence, blockchain, and machine learning to enhance accuracy and reduce fraud in claims processing workflows. By fostering collaboration between startups and regulators, insurtech sandboxes accelerate the integration of digital claims platforms that improve customer experience and operational efficiency.

Key Terms

Digital claims processing:

Digital claims processing leverages advanced technologies like AI, machine learning, and automation to streamline insurance claim handling, reducing processing time and minimizing human error. This approach enhances customer satisfaction through faster settlements and improves operational efficiency for insurers. Explore further to understand how digital claims processing transforms insurance workflows and customer experiences.

Automation

Digital claims processing leverages advanced automation technologies such as AI, machine learning, and robotic process automation (RPA) to streamline claim validation, fraud detection, and settlement procedures, significantly reducing processing time and operational costs. Insurtech sandboxes provide a controlled environment for testing innovative automation tools and solutions, enabling insurers to evaluate new digital claims workflows with regulatory oversight and minimal risk. Explore how these cutting-edge automation advancements can transform your claims processing efficiency and compliance strategies.

Artificial Intelligence (AI)

Digital claims processing leverages Artificial Intelligence (AI) algorithms to automate claim assessments, accelerate decision-making, and reduce fraud, significantly enhancing operational efficiency in insurance. Insurtech sandboxes provide a controlled environment where innovative AI-driven solutions can be tested and validated, allowing insurers to mitigate risks and comply with regulatory standards. Explore how AI integration in claims processing and insurtech sandboxes is transforming the insurance landscape.

Source and External Links

The Shift to Digital Claims Processing - Digital claims processing involves using technology for efficient claim management, including automation, AI, and real-time updates, enhancing customer satisfaction and fraud detection.

Digital Claims: How to Create Frictionless Claims Workflows - This resource explores digital claims processing by leveraging technology and AI to streamline claims management, facilitating a seamless customer experience through automation and data analytics.

Benefits of AI in Claims Management - AI-driven claims processing accelerates claims handling, improves accuracy, and enhances customer experience while mitigating fraud in a modern insurance ecosystem.

dowidth.com

dowidth.com