Deepfake insurance and business interruption insurance address distinct risks in the evolving digital landscape; deepfake insurance focuses on protection against fraudulent digital impersonations and reputation damage caused by manipulated videos or audio, while business interruption insurance covers financial losses from operational disruptions due to physical damage or unforeseen events. Companies increasingly recognize the need for tailored coverage to mitigate unique threats in cybersecurity and physical asset management. Explore more about how these insurance options safeguard modern businesses in an uncertain environment.

Why it is important

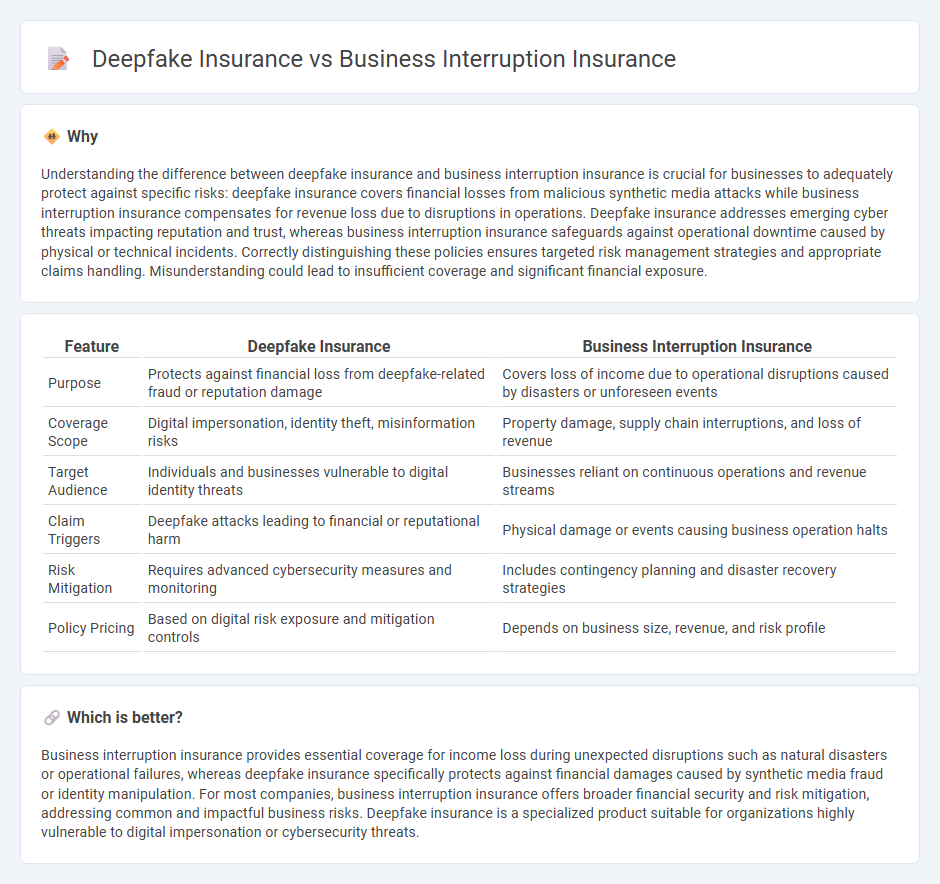

Understanding the difference between deepfake insurance and business interruption insurance is crucial for businesses to adequately protect against specific risks: deepfake insurance covers financial losses from malicious synthetic media attacks while business interruption insurance compensates for revenue loss due to disruptions in operations. Deepfake insurance addresses emerging cyber threats impacting reputation and trust, whereas business interruption insurance safeguards against operational downtime caused by physical or technical incidents. Correctly distinguishing these policies ensures targeted risk management strategies and appropriate claims handling. Misunderstanding could lead to insufficient coverage and significant financial exposure.

Comparison Table

| Feature | Deepfake Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Protects against financial loss from deepfake-related fraud or reputation damage | Covers loss of income due to operational disruptions caused by disasters or unforeseen events |

| Coverage Scope | Digital impersonation, identity theft, misinformation risks | Property damage, supply chain interruptions, and loss of revenue |

| Target Audience | Individuals and businesses vulnerable to digital identity threats | Businesses reliant on continuous operations and revenue streams |

| Claim Triggers | Deepfake attacks leading to financial or reputational harm | Physical damage or events causing business operation halts |

| Risk Mitigation | Requires advanced cybersecurity measures and monitoring | Includes contingency planning and disaster recovery strategies |

| Policy Pricing | Based on digital risk exposure and mitigation controls | Depends on business size, revenue, and risk profile |

Which is better?

Business interruption insurance provides essential coverage for income loss during unexpected disruptions such as natural disasters or operational failures, whereas deepfake insurance specifically protects against financial damages caused by synthetic media fraud or identity manipulation. For most companies, business interruption insurance offers broader financial security and risk mitigation, addressing common and impactful business risks. Deepfake insurance is a specialized product suitable for organizations highly vulnerable to digital impersonation or cybersecurity threats.

Connection

Deepfake insurance mitigates financial losses caused by synthetic media attacks, which can disrupt brand reputation and trust. Business interruption insurance covers income loss resulting from operational disruptions, including those triggered by cyberattacks like deepfake incidents. Both types of insurance provide complementary protection against risks associated with digital threats and business continuity challenges.

Key Terms

**Business Interruption Insurance:**

Business Interruption Insurance protects companies from income losses due to unexpected operational disruptions caused by events like natural disasters, fires, or cyberattacks. It covers ongoing expenses such as rent, payroll, and utilities during periods when business activities are halted. Explore how Business Interruption Insurance safeguards revenue stability and supports recovery to learn more.

Business Income Loss

Business interruption insurance provides coverage for lost income resulting from unforeseen events such as natural disasters, fire, or equipment failure, protecting companies against financial disruption. Deepfake insurance addresses risks associated with synthetic media, covering losses when manipulated videos or images cause reputational damage, fraud, or operational setbacks. Explore the key differences and benefits of each insurance type to safeguard your business income effectively.

Period of Restoration

Business interruption insurance provides coverage for lost income and expenses during the period of restoration following physical property damage, typically defined by the time needed to repair or replace the affected assets. Deepfake insurance, however, focuses on the period of restoration related to reputational harm and content remediation caused by manipulated digital media, which may extend beyond tangible recovery timelines. Explore how these distinct coverage scopes impact risk management strategies and claims processes in their respective domains.

Source and External Links

Business Interruption Insurance: Coverage, Quotes & Policies - Offers information on business interruption insurance, including its purpose, coverage types, and typical perils like fire and theft.

What Is Business Interruption Insurance? - Explains business interruption insurance as protection against income loss due to covered perils, helping businesses recover lost revenue and extra expenses.

What Is Business Interruption Insurance? - Describes business interruption insurance as a coverage that supplements business income during temporary shutdowns due to covered losses like property damage.

dowidth.com

dowidth.com