Digital nomad insurance offers comprehensive coverage tailored to long-term travelers working remotely, including health, liability, and gadget protection across multiple countries. Visitor insurance typically provides short-term medical and emergency coverage for tourists or short stays, focusing on immediate healthcare needs rather than work-related risks. Discover the key differences to choose the best insurance for your travel lifestyle.

Why it is important

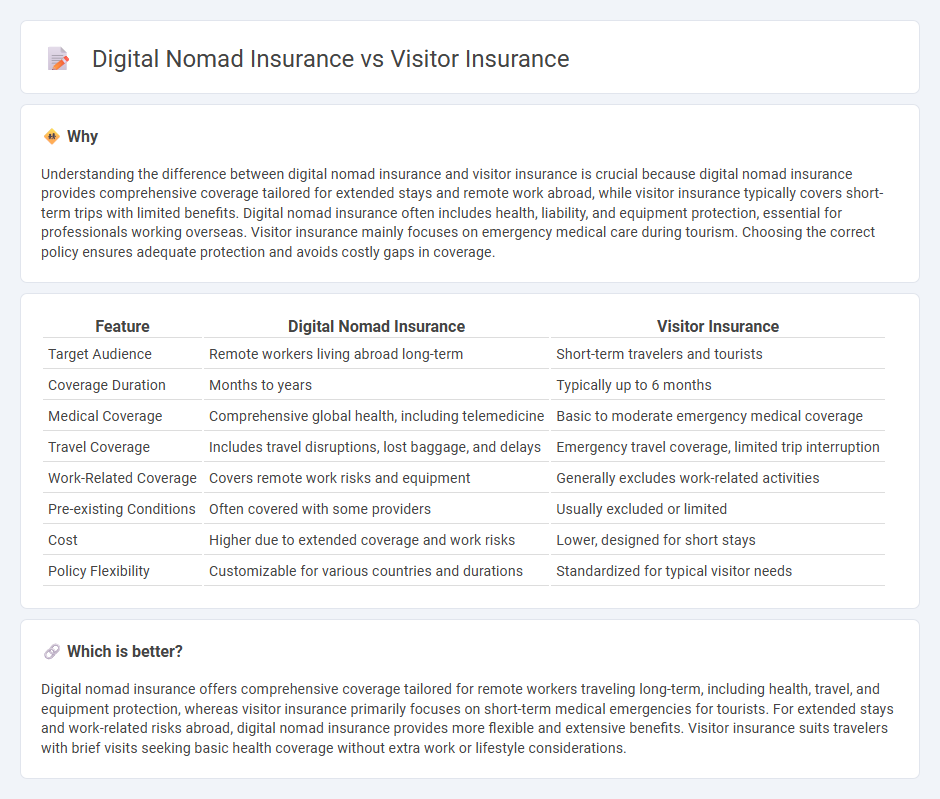

Understanding the difference between digital nomad insurance and visitor insurance is crucial because digital nomad insurance provides comprehensive coverage tailored for extended stays and remote work abroad, while visitor insurance typically covers short-term trips with limited benefits. Digital nomad insurance often includes health, liability, and equipment protection, essential for professionals working overseas. Visitor insurance mainly focuses on emergency medical care during tourism. Choosing the correct policy ensures adequate protection and avoids costly gaps in coverage.

Comparison Table

| Feature | Digital Nomad Insurance | Visitor Insurance |

|---|---|---|

| Target Audience | Remote workers living abroad long-term | Short-term travelers and tourists |

| Coverage Duration | Months to years | Typically up to 6 months |

| Medical Coverage | Comprehensive global health, including telemedicine | Basic to moderate emergency medical coverage |

| Travel Coverage | Includes travel disruptions, lost baggage, and delays | Emergency travel coverage, limited trip interruption |

| Work-Related Coverage | Covers remote work risks and equipment | Generally excludes work-related activities |

| Pre-existing Conditions | Often covered with some providers | Usually excluded or limited |

| Cost | Higher due to extended coverage and work risks | Lower, designed for short stays |

| Policy Flexibility | Customizable for various countries and durations | Standardized for typical visitor needs |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for remote workers traveling long-term, including health, travel, and equipment protection, whereas visitor insurance primarily focuses on short-term medical emergencies for tourists. For extended stays and work-related risks abroad, digital nomad insurance provides more flexible and extensive benefits. Visitor insurance suits travelers with brief visits seeking basic health coverage without extra work or lifestyle considerations.

Connection

Digital nomad insurance and visitor insurance both provide tailored coverage for individuals traveling or residing temporarily abroad, emphasizing health, emergency medical, and travel-related protection. These insurance types address the specific needs of transient lifestyles by covering unexpected medical expenses, trip interruptions, and liability issues. Shared features include flexibility in policy duration and global coverage, making them essential for safeguarding digital nomads and visitors in foreign countries.

Key Terms

Coverage Duration

Visitor insurance typically offers short-term coverage ranging from a few days up to one year, ideal for tourists or temporary visitors who need protection for medical emergencies and trip interruptions. Digital nomad insurance caters to long-term travelers, with coverage plans designed to span several months or even years, providing comprehensive health, travel, and remote work-related benefits. Explore different plans to find the best fit for your travel duration and insurance needs.

Eligible Activities

Visitor insurance primarily covers short-term travel activities such as sightseeing, attending conferences, and basic leisure activities, with limited protection for work-related tasks. Digital nomad insurance caters specifically to remote professionals engaging in prolonged stays while working online, offering coverage for coworking spaces, equipment protection, and telecommuting risks. Explore detailed comparisons to understand which plan best supports your eligible activities and lifestyle.

Geographic Coverage

Visitor insurance primarily offers short-term health coverage within a specific country or region, catering to travelers on limited stays. Digital nomad insurance extends broader geographic coverage, often worldwide, designed for remote workers residing in multiple countries over extended periods. Explore comprehensive plan options to find the best geographic coverage suited for your travel lifestyle.

Source and External Links

American Visitor Insurance - Offers visitor insurance plans for international travelers visiting the U.S., providing up to $1,000,000 in emergency medical expenses coverage.

Insubuy Visitors Insurance - Provides various visitor insurance plans with coverage options including medical evacuation and accidental death, tailored to individual needs.

IMG Visitor Insurance - Offers a range of visitor insurance plans with access to multilingual customer service and 24/7 assistance services for international travelers.

dowidth.com

dowidth.com