Parametric insurance offers predetermined payouts based on specific triggers like rainfall levels or earthquake magnitude, providing rapid claims settlement without the need for damage assessment. Catastrophe bonds transfer risk to investors by issuing securities that pay out when defined catastrophic events occur, serving as an alternative capital source for insurers. Discover how these innovative financial tools are reshaping disaster risk management and enhancing resilience.

Why it is important

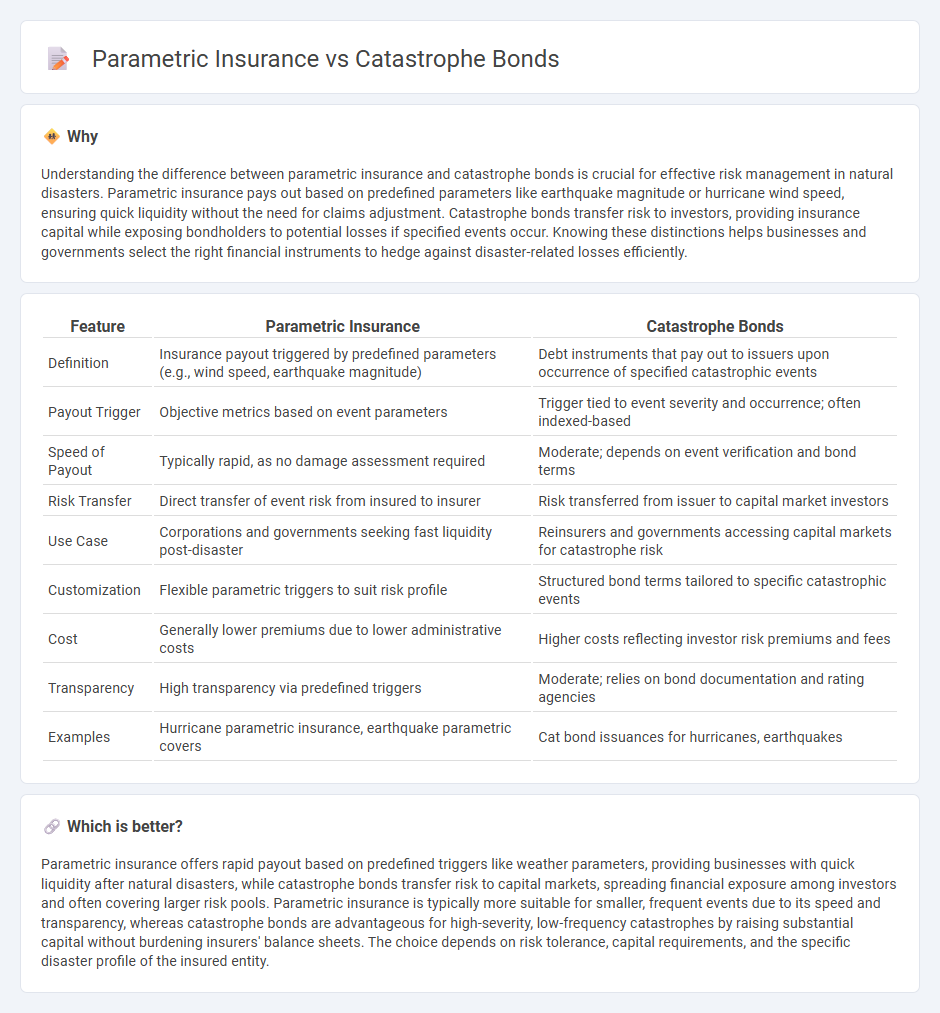

Understanding the difference between parametric insurance and catastrophe bonds is crucial for effective risk management in natural disasters. Parametric insurance pays out based on predefined parameters like earthquake magnitude or hurricane wind speed, ensuring quick liquidity without the need for claims adjustment. Catastrophe bonds transfer risk to investors, providing insurance capital while exposing bondholders to potential losses if specified events occur. Knowing these distinctions helps businesses and governments select the right financial instruments to hedge against disaster-related losses efficiently.

Comparison Table

| Feature | Parametric Insurance | Catastrophe Bonds |

|---|---|---|

| Definition | Insurance payout triggered by predefined parameters (e.g., wind speed, earthquake magnitude) | Debt instruments that pay out to issuers upon occurrence of specified catastrophic events |

| Payout Trigger | Objective metrics based on event parameters | Trigger tied to event severity and occurrence; often indexed-based |

| Speed of Payout | Typically rapid, as no damage assessment required | Moderate; depends on event verification and bond terms |

| Risk Transfer | Direct transfer of event risk from insured to insurer | Risk transferred from issuer to capital market investors |

| Use Case | Corporations and governments seeking fast liquidity post-disaster | Reinsurers and governments accessing capital markets for catastrophe risk |

| Customization | Flexible parametric triggers to suit risk profile | Structured bond terms tailored to specific catastrophic events |

| Cost | Generally lower premiums due to lower administrative costs | Higher costs reflecting investor risk premiums and fees |

| Transparency | High transparency via predefined triggers | Moderate; relies on bond documentation and rating agencies |

| Examples | Hurricane parametric insurance, earthquake parametric covers | Cat bond issuances for hurricanes, earthquakes |

Which is better?

Parametric insurance offers rapid payout based on predefined triggers like weather parameters, providing businesses with quick liquidity after natural disasters, while catastrophe bonds transfer risk to capital markets, spreading financial exposure among investors and often covering larger risk pools. Parametric insurance is typically more suitable for smaller, frequent events due to its speed and transparency, whereas catastrophe bonds are advantageous for high-severity, low-frequency catastrophes by raising substantial capital without burdening insurers' balance sheets. The choice depends on risk tolerance, capital requirements, and the specific disaster profile of the insured entity.

Connection

Parametric insurance and catastrophe bonds are connected through their shared focus on providing rapid financial relief after natural disasters by using predefined triggers such as hurricane wind speed or earthquake magnitude. Both instruments rely on objective, measurable event parameters to facilitate quicker payouts compared to traditional insurance claims processes. This parametric approach helps insurers and investors manage catastrophe risk more efficiently by reducing uncertainty and accelerating post-disaster recovery funding.

Key Terms

Risk Transfer

Catastrophe bonds transfer financial risk from insurers to capital market investors by issuing securities that pay out upon the occurrence of predefined catastrophic events, providing a mechanism for large-scale loss absorption. Parametric insurance offers rapid indemnity based on predefined parameters, such as earthquake magnitude or hurricane wind speed, without the need for loss adjustment, enhancing speed and transparency in risk transfer. Explore the differences and benefits of catastrophe bonds and parametric insurance to optimize your risk management strategy.

Trigger Mechanism

Catastrophe bonds activate payouts based on predefined, measurable disaster parameters such as wind speed or earthquake magnitude, offering transparent and objective trigger mechanisms. Parametric insurance similarly relies on specific triggers but may integrate more flexible data points or models tailored to particular risks and policies. Explore the nuances of trigger mechanisms to understand how each solution effectively manages catastrophe risk.

Payout Structure

Catastrophe bonds provide payouts based on predefined loss thresholds tied to actual damages, transferring risk to investors if triggers like hurricane wind speed or earthquake magnitude are met. Parametric insurance offers fixed payouts linked to specific event parameters such as rainfall levels or wind speed, enabling faster claims without the need for damage assessment. Explore detailed comparisons to understand which payout structure best suits your risk management needs.

Source and External Links

Catastrophe bond - Catastrophe bonds are a subset of insurance-linked securities that transfer risks from insurers to investors, often used to cover natural disasters.

What is a catastrophe bond? - This resource provides an overview of catastrophe bonds as a form of insurance securitization, explaining how they can be structured to cover different types of risks.

The booming catastrophe bond market - The article discusses the growing catastrophe bond market, including how it has become more accessible to retail investors and the potential for high yields.

dowidth.com

dowidth.com