Digital nomad insurance provides comprehensive coverage tailored for individuals working remotely while traveling across multiple countries, including health, liability, and travel-related protection. Short-term insurance offers temporary coverage for specific needs such as travel health, vehicle, or gadget protection, typically limited to a fixed duration or event. Explore the key differences to determine which insurance option best suits your lifestyle and travel plans.

Why it is important

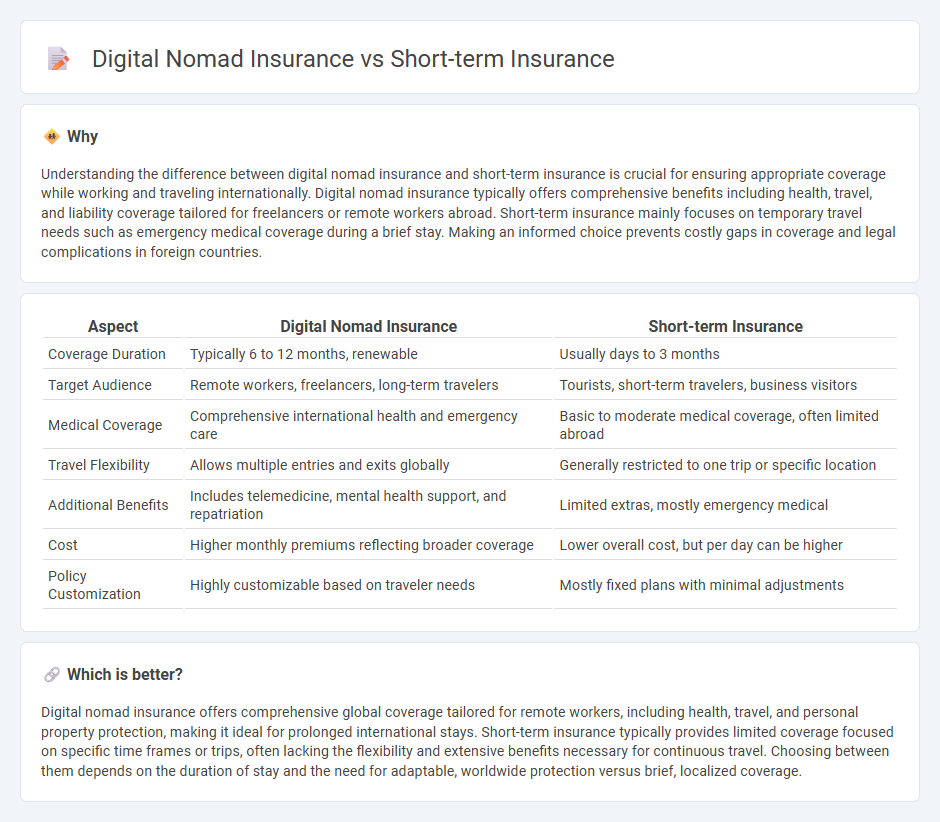

Understanding the difference between digital nomad insurance and short-term insurance is crucial for ensuring appropriate coverage while working and traveling internationally. Digital nomad insurance typically offers comprehensive benefits including health, travel, and liability coverage tailored for freelancers or remote workers abroad. Short-term insurance mainly focuses on temporary travel needs such as emergency medical coverage during a brief stay. Making an informed choice prevents costly gaps in coverage and legal complications in foreign countries.

Comparison Table

| Aspect | Digital Nomad Insurance | Short-term Insurance |

|---|---|---|

| Coverage Duration | Typically 6 to 12 months, renewable | Usually days to 3 months |

| Target Audience | Remote workers, freelancers, long-term travelers | Tourists, short-term travelers, business visitors |

| Medical Coverage | Comprehensive international health and emergency care | Basic to moderate medical coverage, often limited abroad |

| Travel Flexibility | Allows multiple entries and exits globally | Generally restricted to one trip or specific location |

| Additional Benefits | Includes telemedicine, mental health support, and repatriation | Limited extras, mostly emergency medical |

| Cost | Higher monthly premiums reflecting broader coverage | Lower overall cost, but per day can be higher |

| Policy Customization | Highly customizable based on traveler needs | Mostly fixed plans with minimal adjustments |

Which is better?

Digital nomad insurance offers comprehensive global coverage tailored for remote workers, including health, travel, and personal property protection, making it ideal for prolonged international stays. Short-term insurance typically provides limited coverage focused on specific time frames or trips, often lacking the flexibility and extensive benefits necessary for continuous travel. Choosing between them depends on the duration of stay and the need for adaptable, worldwide protection versus brief, localized coverage.

Connection

Digital nomad insurance and short-term insurance intersect by offering flexible, location-independent coverage tailored for transient lifestyles. They both prioritize adaptable plans that manage risks like health emergencies, travel interruptions, and equipment loss for individuals constantly on the move. Digital nomad insurance often integrates short-term policies, ensuring comprehensive protection across various countries without long-term commitments.

Key Terms

Short-term insurance:

Short-term insurance provides temporary coverage tailored for brief periods, ideal for travelers or those with short stays in a location. It typically covers essential risks like medical emergencies, trip cancellations, and lost belongings without the commitment of long-term policies. Explore more to find the best short-term insurance options that suit your specific travel needs.

Coverage Duration

Short-term insurance typically offers coverage for a fixed period, ranging from a few days to several months, ideal for travelers or temporary stays. Digital nomad insurance provides flexible, renewable policies designed to accommodate the unpredictable and extended travel patterns of remote workers living abroad. Discover more about the nuances of insurance duration and how to select the best plan tailored to your travel lifestyle.

Policy Flexibility

Short-term insurance policies typically offer limited flexibility, covering specific periods or events with fixed terms and conditions tailored to short durations. Digital nomad insurance prioritizes policy flexibility, allowing adjustments in coverage, duration, and geographic scope to accommodate the unpredictable lifestyle of remote workers traveling internationally. Discover how choosing the right flexible insurance policy can optimize your protection while maintaining freedom.

Source and External Links

Short Term Health Insurance | eHealth - Offers temporary, limited coverage during gaps in permanent insurance, with quick approval and flexible terms, but excludes pre-existing conditions and many standard benefits.

Short-Term Health Insurance Plans - Provides fast, flexible, and affordable coverage for transitional periods, adjustable deductible and coverage length, but does not cover pre-existing conditions.

Short term health insurance | Individuals & families - Quick, temporary plans that bridge coverage gaps, offer immediate coverage, large provider networks, and multiple deductible options, but lack comprehensive benefits.

dowidth.com

dowidth.com