Drone insurance provides specialized coverage for physical damage, theft, and operational risks unique to unmanned aerial vehicles, while liability insurance primarily protects against third-party bodily injury and property damage claims. Understanding the distinctions between these insurance types is crucial for drone operators seeking comprehensive protection tailored to their specific activities and potential liabilities. Explore detailed comparisons to determine the best coverage for your drone operations.

Why it is important

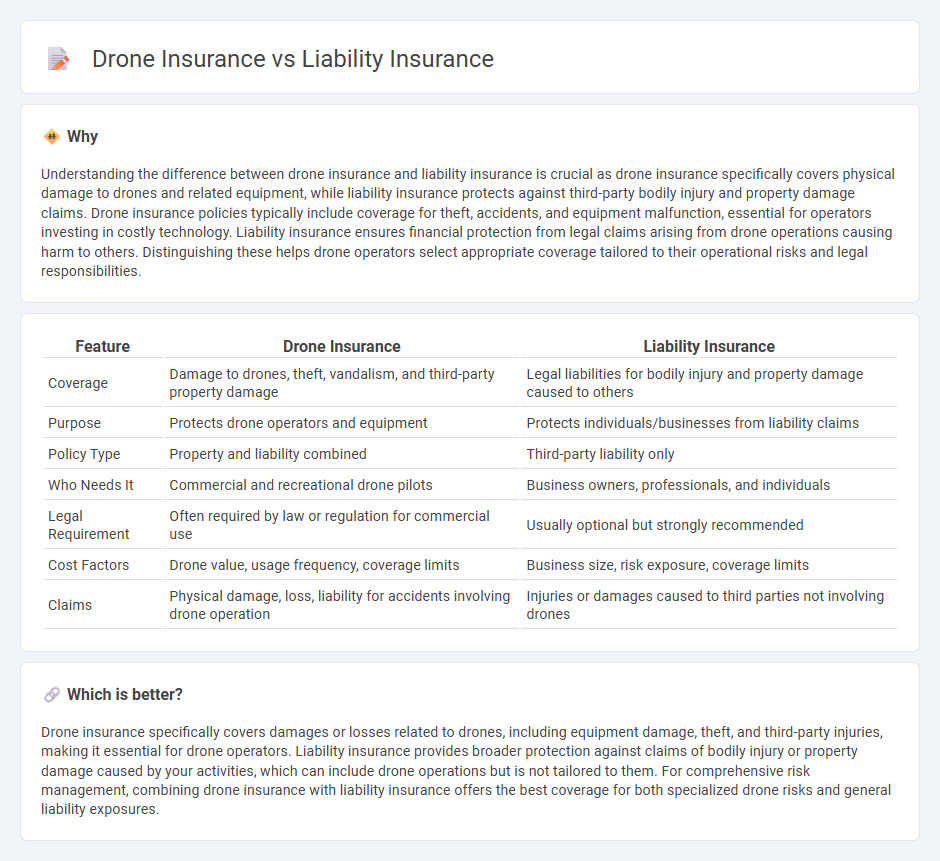

Understanding the difference between drone insurance and liability insurance is crucial as drone insurance specifically covers physical damage to drones and related equipment, while liability insurance protects against third-party bodily injury and property damage claims. Drone insurance policies typically include coverage for theft, accidents, and equipment malfunction, essential for operators investing in costly technology. Liability insurance ensures financial protection from legal claims arising from drone operations causing harm to others. Distinguishing these helps drone operators select appropriate coverage tailored to their operational risks and legal responsibilities.

Comparison Table

| Feature | Drone Insurance | Liability Insurance |

|---|---|---|

| Coverage | Damage to drones, theft, vandalism, and third-party property damage | Legal liabilities for bodily injury and property damage caused to others |

| Purpose | Protects drone operators and equipment | Protects individuals/businesses from liability claims |

| Policy Type | Property and liability combined | Third-party liability only |

| Who Needs It | Commercial and recreational drone pilots | Business owners, professionals, and individuals |

| Legal Requirement | Often required by law or regulation for commercial use | Usually optional but strongly recommended |

| Cost Factors | Drone value, usage frequency, coverage limits | Business size, risk exposure, coverage limits |

| Claims | Physical damage, loss, liability for accidents involving drone operation | Injuries or damages caused to third parties not involving drones |

Which is better?

Drone insurance specifically covers damages or losses related to drones, including equipment damage, theft, and third-party injuries, making it essential for drone operators. Liability insurance provides broader protection against claims of bodily injury or property damage caused by your activities, which can include drone operations but is not tailored to them. For comprehensive risk management, combining drone insurance with liability insurance offers the best coverage for both specialized drone risks and general liability exposures.

Connection

Drone insurance and liability insurance intersect by offering financial protection against damages caused by drone operations. Liability insurance specifically covers legal claims and third-party damages resulting from accidents or negligence during drone flights. Combining both policies ensures comprehensive coverage for drone owners, mitigating risks associated with property damage, bodily injury, and legal expenses.

Key Terms

Coverage Scope

Liability insurance primarily covers third-party bodily injury and property damage caused by drone operations, offering protection against legal claims and financial liabilities. Drone insurance extends coverage to include physical damage to the drone itself, equipment loss, theft, and sometimes payload coverage, tailored specifically for unmanned aerial vehicles. Explore detailed comparisons to understand which insurance type best suits your drone needs and operational risks.

Exclusions

Liability insurance typically excludes coverage for damages caused by unmanned aerial vehicles, whereas drone insurance specifically addresses risks such as property damage, bodily injury, and privacy violations linked to drone operations. Common exclusions in drone insurance policies include intentional damage, commercial use without proper licensing, and flying in restricted airspace. Explore detailed policy terms to fully understand exclusions and ensure adequate protection for your drone activities.

Premium Calculation

Liability insurance premiums are calculated based on factors such as coverage limits, business activities, and risk exposure, while drone insurance premiums specifically depend on drone model, flight frequency, usage purpose, and geographical operation zones. Drone insurance rates also reflect risks related to potential physical damage, theft, and liability from aerial operations. Explore more to understand how these factors uniquely influence premium costs and coverage options.

Source and External Links

What is Liability Car Insurance Coverage? - State Farm(r) - Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage during a covered accident or event, typically required by law for drivers and divided into bodily injury and property damage liability coverage.

Liability Insurance - General Coverage for Your Business - GEICO - General liability insurance protects businesses from claims arising from normal business operations, covering property damage, bodily injury, defense costs, and advertising injuries.

Liability Car Insurance | Allstate - Liability car insurance helps cover medical and legal fees if you're found legally responsible for someone else's injury or property damage, with coverage split into bodily injury liability and property damage liability.

dowidth.com

dowidth.com