Buy now insurance offers immediate, customizable coverage directly purchased by individuals, providing flexibility and control over plan options and costs. Employer-provided insurance typically comes as part of a benefits package with shared premium costs and standardized coverage, often lacking personalized features. Explore detailed comparisons to determine the most suitable insurance solution for your needs.

Why it is important

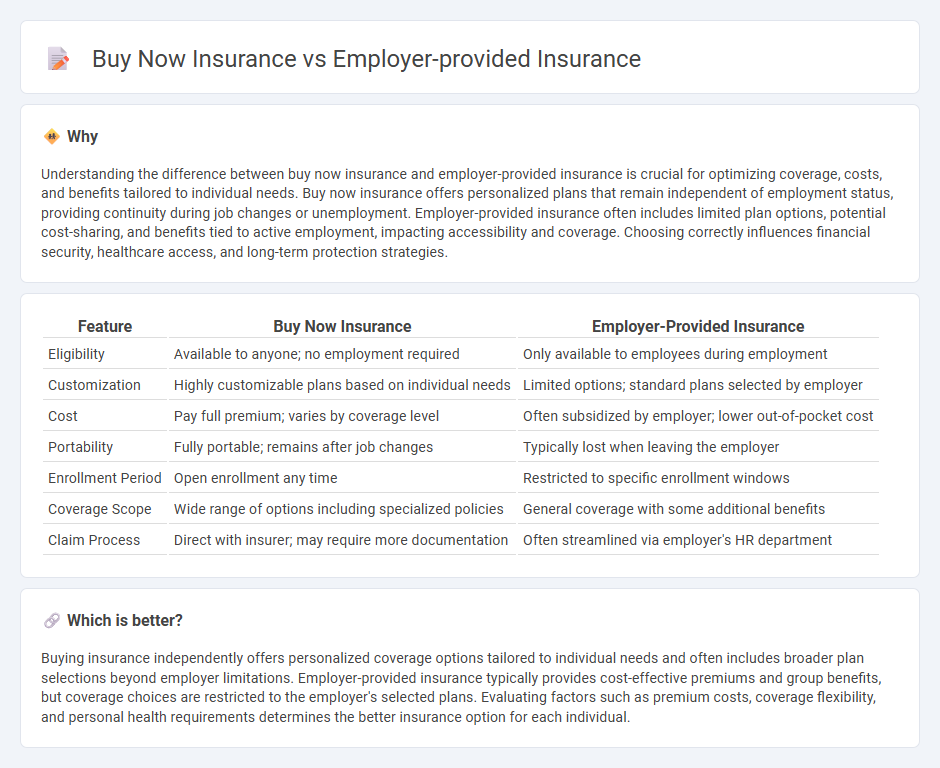

Understanding the difference between buy now insurance and employer-provided insurance is crucial for optimizing coverage, costs, and benefits tailored to individual needs. Buy now insurance offers personalized plans that remain independent of employment status, providing continuity during job changes or unemployment. Employer-provided insurance often includes limited plan options, potential cost-sharing, and benefits tied to active employment, impacting accessibility and coverage. Choosing correctly influences financial security, healthcare access, and long-term protection strategies.

Comparison Table

| Feature | Buy Now Insurance | Employer-Provided Insurance |

|---|---|---|

| Eligibility | Available to anyone; no employment required | Only available to employees during employment |

| Customization | Highly customizable plans based on individual needs | Limited options; standard plans selected by employer |

| Cost | Pay full premium; varies by coverage level | Often subsidized by employer; lower out-of-pocket cost |

| Portability | Fully portable; remains after job changes | Typically lost when leaving the employer |

| Enrollment Period | Open enrollment any time | Restricted to specific enrollment windows |

| Coverage Scope | Wide range of options including specialized policies | General coverage with some additional benefits |

| Claim Process | Direct with insurer; may require more documentation | Often streamlined via employer's HR department |

Which is better?

Buying insurance independently offers personalized coverage options tailored to individual needs and often includes broader plan selections beyond employer limitations. Employer-provided insurance typically provides cost-effective premiums and group benefits, but coverage choices are restricted to the employer's selected plans. Evaluating factors such as premium costs, coverage flexibility, and personal health requirements determines the better insurance option for each individual.

Connection

Employer-provided insurance often serves as a primary health coverage option, while buy now insurance plans allow individuals to supplement or extend that coverage for gaps or enhanced benefits. These buy now insurance options can include health, life, or disability policies designed to offer additional financial security beyond employer-sponsored plans. Utilizing buy now insurance helps employees tailor their overall insurance portfolio to better meet personal or family health and financial needs.

Key Terms

Group Coverage

Group coverage offered through employer-provided insurance typically offers lower premiums and comprehensive benefits due to risk pooling among employees. Buy-now insurance plans, while flexible and customizable, often come with higher individual costs and fewer negotiated perks. Explore the advantages of group coverage to make informed decisions about your insurance needs.

Underwriting

Employer-provided insurance underwriting often involves simplified or group-based assessments, leading to potentially lower individual risk scrutiny and easier access to coverage. Buy now insurance, typically individually underwritten, requires detailed personal health evaluations and risk profiling, resulting in customized premiums but possibly stricter eligibility criteria. Explore the nuances of underwriting differences to determine which insurance type suits your specific needs.

Premium

Employer-provided insurance often features lower premiums due to group rates negotiated by the employer, reducing individual financial burden. Buy now insurance requires higher premiums as rates are based on personal health, age, and risk factors without group discounts. Explore detailed comparisons to determine which premium structure suits your financial and coverage needs best.

Source and External Links

What is Employer Sponsored Coverage? - TurboTax - Intuit - Employer-sponsored health insurance is coverage provided by employers to their employees, generally required for businesses with 50 or more full-time workers, offering Minimum Essential Coverage with associated reporting and potential penalties for non-compliance.

What is employer-sponsored health insurance? - Healthinsurance.org - Employer-sponsored health insurance is the most common form of coverage in the U.S., where employers pay most premiums but employees also contribute, and businesses with 50+ full-time employees must provide affordable, minimum-value insurance under the ACA.

Employer-Sponsored Health Insurance 101 - KFF - Employer-sponsored insurance is the largest source of health coverage for non-elderly Americans, offering workplace-based plans with tax advantages but uneven access depending on income and firm size.

dowidth.com

dowidth.com