Climate risk insurance protects businesses and individuals against losses from natural disasters linked to climate change, such as floods and hurricanes, by providing financial compensation for property damage and business interruption. Liability insurance covers legal costs and damages if a policyholder is found responsible for injury or property damage to others, helping mitigate risks from lawsuits. Explore the distinct benefits and applications of climate risk and liability insurance to safeguard your assets effectively.

Why it is important

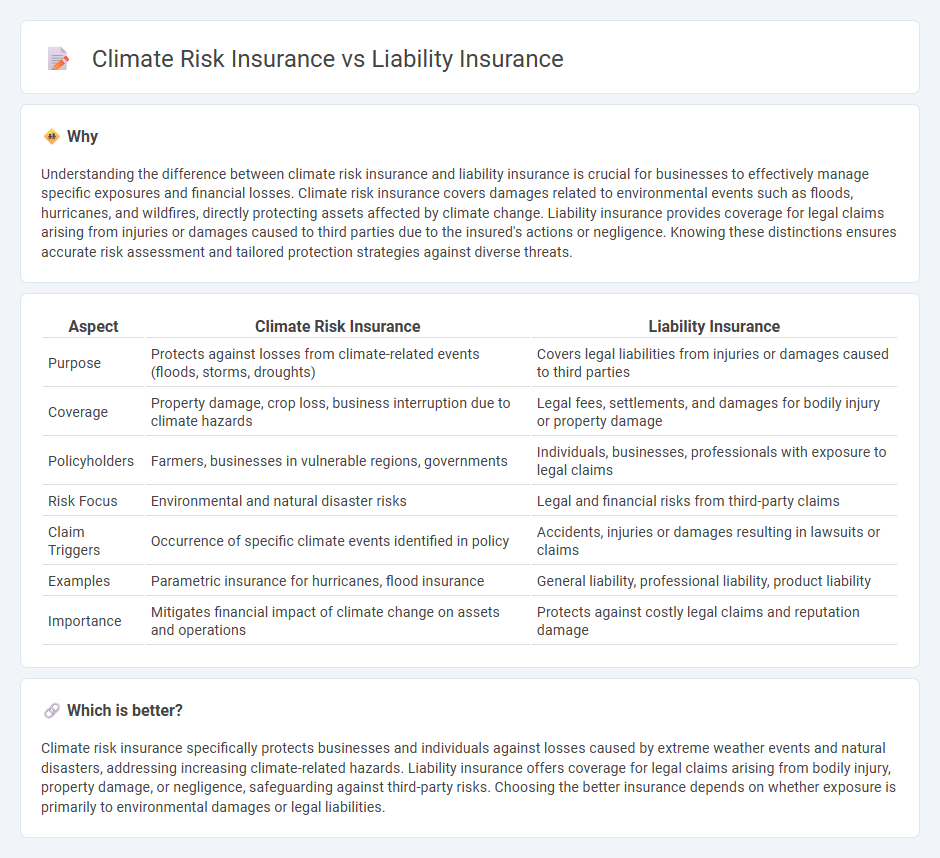

Understanding the difference between climate risk insurance and liability insurance is crucial for businesses to effectively manage specific exposures and financial losses. Climate risk insurance covers damages related to environmental events such as floods, hurricanes, and wildfires, directly protecting assets affected by climate change. Liability insurance provides coverage for legal claims arising from injuries or damages caused to third parties due to the insured's actions or negligence. Knowing these distinctions ensures accurate risk assessment and tailored protection strategies against diverse threats.

Comparison Table

| Aspect | Climate Risk Insurance | Liability Insurance |

|---|---|---|

| Purpose | Protects against losses from climate-related events (floods, storms, droughts) | Covers legal liabilities from injuries or damages caused to third parties |

| Coverage | Property damage, crop loss, business interruption due to climate hazards | Legal fees, settlements, and damages for bodily injury or property damage |

| Policyholders | Farmers, businesses in vulnerable regions, governments | Individuals, businesses, professionals with exposure to legal claims |

| Risk Focus | Environmental and natural disaster risks | Legal and financial risks from third-party claims |

| Claim Triggers | Occurrence of specific climate events identified in policy | Accidents, injuries or damages resulting in lawsuits or claims |

| Examples | Parametric insurance for hurricanes, flood insurance | General liability, professional liability, product liability |

| Importance | Mitigates financial impact of climate change on assets and operations | Protects against costly legal claims and reputation damage |

Which is better?

Climate risk insurance specifically protects businesses and individuals against losses caused by extreme weather events and natural disasters, addressing increasing climate-related hazards. Liability insurance offers coverage for legal claims arising from bodily injury, property damage, or negligence, safeguarding against third-party risks. Choosing the better insurance depends on whether exposure is primarily to environmental damages or legal liabilities.

Connection

Climate risk insurance and liability insurance are interconnected through their shared focus on managing financial exposure stemming from climate-related damages and legal responsibilities. Climate risk insurance provides coverage for property and business interruptions caused by extreme weather events, while liability insurance addresses claims arising from damages or harms attributed to an insured party's actions or negligence in the context of climate impacts. Both types of insurance are essential for comprehensive risk management strategies in sectors vulnerable to environmental hazards and regulatory accountability.

Key Terms

Liability Insurance:

Liability insurance covers legal responsibilities arising from injuries or damages caused by businesses or individuals, protecting against claims of negligence or wrongdoing. It includes general liability, professional liability, and product liability, ensuring financial security in lawsuits and settlements. Explore comprehensive coverage options to safeguard your assets effectively.

Negligence

Liability insurance covers damages or injuries caused by negligence, protecting policyholders from legal claims resulting from their failure to exercise reasonable care. Climate risk insurance addresses losses from climate-related events but typically does not cover negligence in environmental management or disaster prevention. Explore how these insurance types differ in managing accountability and financial protection under various risk scenarios.

Third-party claims

Liability insurance primarily covers third-party claims arising from bodily injury or property damage for which the insured is legally responsible, offering financial protection against lawsuits and settlements. In contrast, climate risk insurance addresses third-party claims linked to environmental damages and losses caused by climate-related events such as floods, storms, or wildfires, focusing on mitigating the financial impact of climate-induced liabilities. Explore how these insurance types protect businesses and communities from third-party claims in the evolving context of environmental risk.

Source and External Links

What is Liability Car Insurance Coverage? - Liability car insurance protects you financially if you're responsible for someone else's injuries or property damage during a covered accident or event.

Liability Insurance for Businesses - GEICO offers general liability insurance to protect businesses from claims related to bodily injuries, property damage, and advertising injuries.

What Is Liability Insurance? - Liability insurance helps protect you financially if you're found legally responsible for property damage or personal injury to a third party, particularly in business contexts.

dowidth.com

dowidth.com