Cyber risk underwriting evaluates digital threats and data breaches to determine coverage terms, focusing on vulnerabilities tied to technology and online assets. Surety underwriting centers on assessing the risk of contract performance and financial guarantees, ensuring obligations are met by principals in construction or service agreements. Explore the key differences between these underwriting approaches to better understand their specific risk assessments and industry applications.

Why it is important

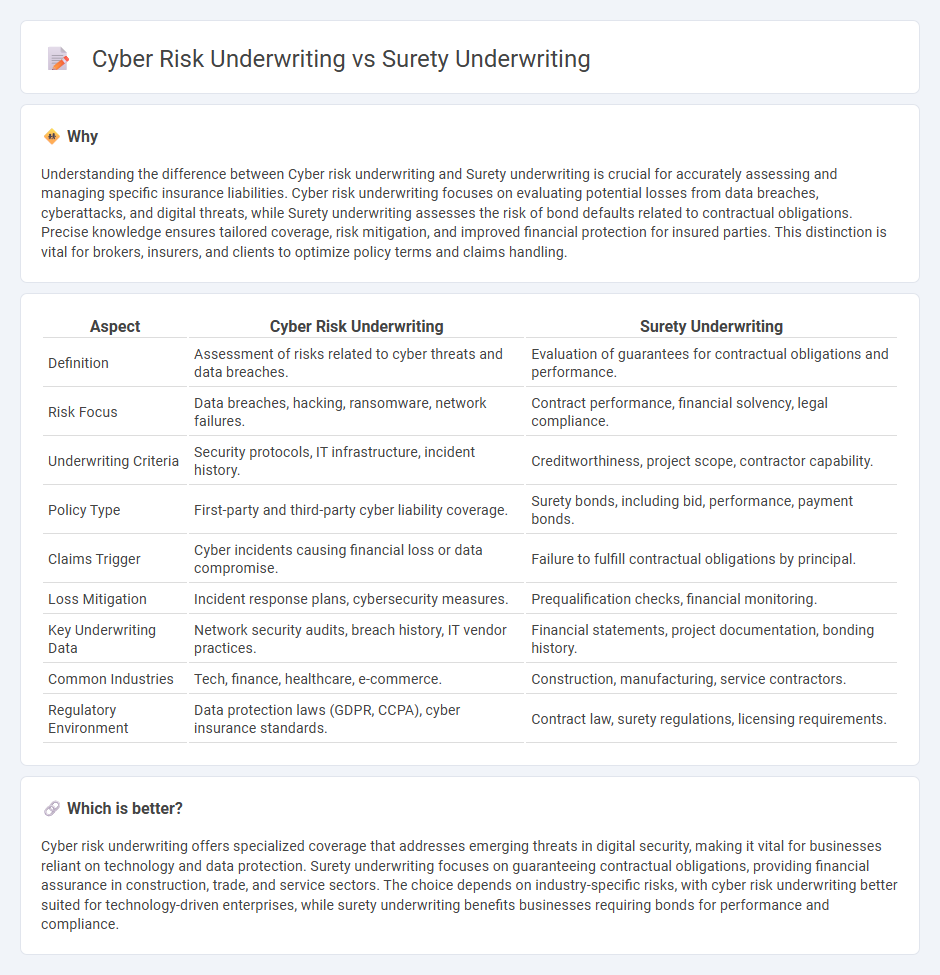

Understanding the difference between Cyber risk underwriting and Surety underwriting is crucial for accurately assessing and managing specific insurance liabilities. Cyber risk underwriting focuses on evaluating potential losses from data breaches, cyberattacks, and digital threats, while Surety underwriting assesses the risk of bond defaults related to contractual obligations. Precise knowledge ensures tailored coverage, risk mitigation, and improved financial protection for insured parties. This distinction is vital for brokers, insurers, and clients to optimize policy terms and claims handling.

Comparison Table

| Aspect | Cyber Risk Underwriting | Surety Underwriting |

|---|---|---|

| Definition | Assessment of risks related to cyber threats and data breaches. | Evaluation of guarantees for contractual obligations and performance. |

| Risk Focus | Data breaches, hacking, ransomware, network failures. | Contract performance, financial solvency, legal compliance. |

| Underwriting Criteria | Security protocols, IT infrastructure, incident history. | Creditworthiness, project scope, contractor capability. |

| Policy Type | First-party and third-party cyber liability coverage. | Surety bonds, including bid, performance, payment bonds. |

| Claims Trigger | Cyber incidents causing financial loss or data compromise. | Failure to fulfill contractual obligations by principal. |

| Loss Mitigation | Incident response plans, cybersecurity measures. | Prequalification checks, financial monitoring. |

| Key Underwriting Data | Network security audits, breach history, IT vendor practices. | Financial statements, project documentation, bonding history. |

| Common Industries | Tech, finance, healthcare, e-commerce. | Construction, manufacturing, service contractors. |

| Regulatory Environment | Data protection laws (GDPR, CCPA), cyber insurance standards. | Contract law, surety regulations, licensing requirements. |

Which is better?

Cyber risk underwriting offers specialized coverage that addresses emerging threats in digital security, making it vital for businesses reliant on technology and data protection. Surety underwriting focuses on guaranteeing contractual obligations, providing financial assurance in construction, trade, and service sectors. The choice depends on industry-specific risks, with cyber risk underwriting better suited for technology-driven enterprises, while surety underwriting benefits businesses requiring bonds for performance and compliance.

Connection

Cyber risk underwriting and surety underwriting intersect through their shared focus on assessing and managing financial risks associated with potential losses. Both disciplines analyze the likelihood of default or breach, applying rigorous evaluation of client credibility, operational vulnerabilities, and external threat environments. Integrating insights from cyber risk assessments enhances surety underwriting by accounting for digital threats that could compromise contractual obligations or financial guarantees.

Key Terms

Obligee/Principal/Indemnity (Surety Underwriting)

Surety underwriting focuses on assessing the creditworthiness and performance capability of the Principal to ensure the Obligee is protected against non-performance or default, relying heavily on the indemnity agreement between parties. Cyber risk underwriting evaluates the potential financial and operational impacts of cyber threats, emphasizing the risk landscape and mitigation measures but does not involve an Obligee or Principal structure. Explore further to understand the nuanced risk evaluation metrics distinctive to each underwriting type.

Data Breach/Privacy Liability (Cyber Risk Underwriting)

Surety underwriting primarily evaluates financial risk associated with contract performance guarantees, while cyber risk underwriting focuses on assessing exposure to data breaches and privacy liabilities that can result in significant financial and reputational damage. Cyber risk underwriters analyze factors such as the size of data held, security protocols, regulatory compliance, and incident response plans to determine potential losses from privacy violations or cyber attacks. Explore deeper into the evolving methodologies that differentiate surety and cyber risk underwriting to enhance your understanding of industry practices.

Financial Strength Assessment (both, but differing criteria)

Surety underwriting emphasizes financial strength through detailed analysis of credit history, liquidity ratios, and debt capacity to ensure obligors can fulfill contract obligations. Cyber risk underwriting prioritizes evaluating a company's cybersecurity infrastructure, historical breach incidents, and technical controls alongside financial metrics to assess risk exposure and resilience. Explore more to understand how these distinct financial strength assessments impact underwriting decisions across these sectors.

Source and External Links

What is Surety Bond Underwriting - This webpage explains that surety bond underwriting is a pre-approval evaluation by the surety of both the bond performance requirements and the principal's financial situation to assess risk.

Surety Underwriting - This article discusses how surety underwriters review an applicant's qualifications and recommend or discourage surety bond support, focusing on the "three C's" of underwriting: Capital, Capacity, and Character.

What Surety Underwriters Review on Your Applications & Contracts - This article describes what surety underwriters review in bond applications and construction contracts, emphasizing the importance of the principal's qualifications for performance bonds in construction projects.

dowidth.com

dowidth.com