Cyber risk insurance protects businesses from financial losses due to data breaches, cyberattacks, and other digital threats, while key person insurance provides financial support by insuring critical employees whose absence could disrupt company operations. Understanding the distinct coverage and benefits of cyber risk versus key person insurance helps organizations tailor their risk management strategies effectively. Explore detailed comparisons and benefits of these insurance types to safeguard your business comprehensively.

Why it is important

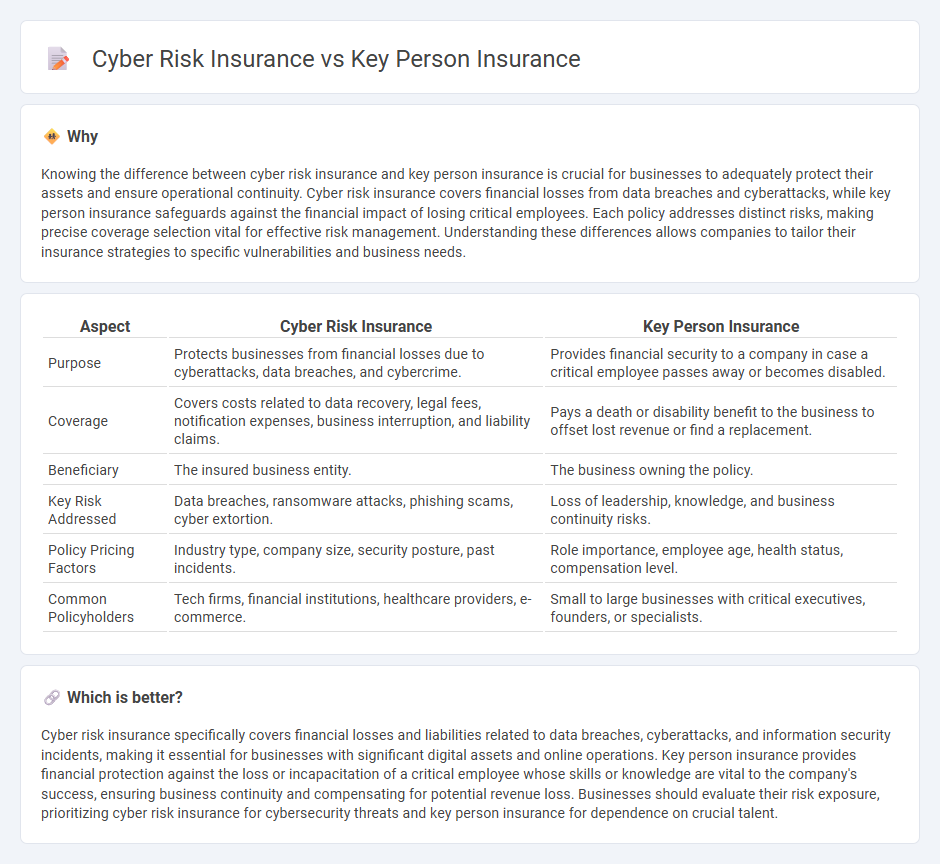

Knowing the difference between cyber risk insurance and key person insurance is crucial for businesses to adequately protect their assets and ensure operational continuity. Cyber risk insurance covers financial losses from data breaches and cyberattacks, while key person insurance safeguards against the financial impact of losing critical employees. Each policy addresses distinct risks, making precise coverage selection vital for effective risk management. Understanding these differences allows companies to tailor their insurance strategies to specific vulnerabilities and business needs.

Comparison Table

| Aspect | Cyber Risk Insurance | Key Person Insurance |

|---|---|---|

| Purpose | Protects businesses from financial losses due to cyberattacks, data breaches, and cybercrime. | Provides financial security to a company in case a critical employee passes away or becomes disabled. |

| Coverage | Covers costs related to data recovery, legal fees, notification expenses, business interruption, and liability claims. | Pays a death or disability benefit to the business to offset lost revenue or find a replacement. |

| Beneficiary | The insured business entity. | The business owning the policy. |

| Key Risk Addressed | Data breaches, ransomware attacks, phishing scams, cyber extortion. | Loss of leadership, knowledge, and business continuity risks. |

| Policy Pricing Factors | Industry type, company size, security posture, past incidents. | Role importance, employee age, health status, compensation level. |

| Common Policyholders | Tech firms, financial institutions, healthcare providers, e-commerce. | Small to large businesses with critical executives, founders, or specialists. |

Which is better?

Cyber risk insurance specifically covers financial losses and liabilities related to data breaches, cyberattacks, and information security incidents, making it essential for businesses with significant digital assets and online operations. Key person insurance provides financial protection against the loss or incapacitation of a critical employee whose skills or knowledge are vital to the company's success, ensuring business continuity and compensating for potential revenue loss. Businesses should evaluate their risk exposure, prioritizing cyber risk insurance for cybersecurity threats and key person insurance for dependence on crucial talent.

Connection

Cyber risk insurance and key person insurance are interconnected through their focus on mitigating organizational vulnerabilities. Cyber risk insurance protects against financial losses from data breaches and cyberattacks that could incapacitate critical personnel or disrupt operations. Key person insurance safeguards a company's financial stability by providing compensation if essential employees, who might also be targeted in cyber threats, are incapacitated or lost.

Key Terms

Key Person Insurance:

Key Person Insurance provides financial protection to businesses against the loss of critical employees whose expertise and leadership are vital for company stability and growth, ensuring operational continuity and covering expenses during transition periods. Unlike Cyber Risk Insurance, which addresses threats from data breaches and cyberattacks, Key Person Insurance focuses on mitigating risks related to human capital and leadership voids. Discover how Key Person Insurance can safeguard your business's most valuable assets.

Key Person

Key person insurance provides financial protection to a business in the event of the death or disability of a crucial employee whose expertise and leadership are vital to the company's success. It helps cover losses related to recruitment, training, and the temporary absence of the key individual, ensuring business continuity. Learn more about how key person insurance safeguards your enterprise's future.

Sum Assured

Key person insurance typically offers a sum assured based on the financial impact of losing a critical employee, often aligned with their salary and the cost of recruitment or business disruption. Cyber risk insurance's sum assured is calculated to cover potential expenses from data breaches, cyberattacks, and recovery costs, reflecting the magnitude of digital asset value and regulatory fines. Explore detailed comparisons to understand how sum assured structures affect risk management strategies in these insurance types.

Source and External Links

Key Person Insurance | Aon - Key person insurance is a risk management tool used by businesses and private equity firms to protect against financial losses caused by the death or incapacitation of a crucial executive, with the business as both the policy owner and beneficiary.

A Guide to Key Person Life Insurance | Guardian - Key person life insurance is a business-owned policy that pays out to the company if an owner, partner, or key employee dies, helping the business recover from financial loss and providing time to replace the lost individual.

Key Man Insurance | Key Person Life Insurance & Disability Coverage - Key person (or key man) insurance offers businesses financial protection if a top executive, salesperson, or owner is lost to death or disability, helping ensure continuity and stability during a critical transition.

dowidth.com

dowidth.com