Insurtech platforms leverage advanced technology such as AI, big data, and blockchain to streamline policy management, enhance customer experience, and reduce operational costs. Insurance underwriters focus on risk assessment, using actuarial data and industry expertise to determine policy terms and pricing. Explore the evolving landscape of insurance by understanding the synergy between insurtech platforms and traditional underwriting.

Why it is important

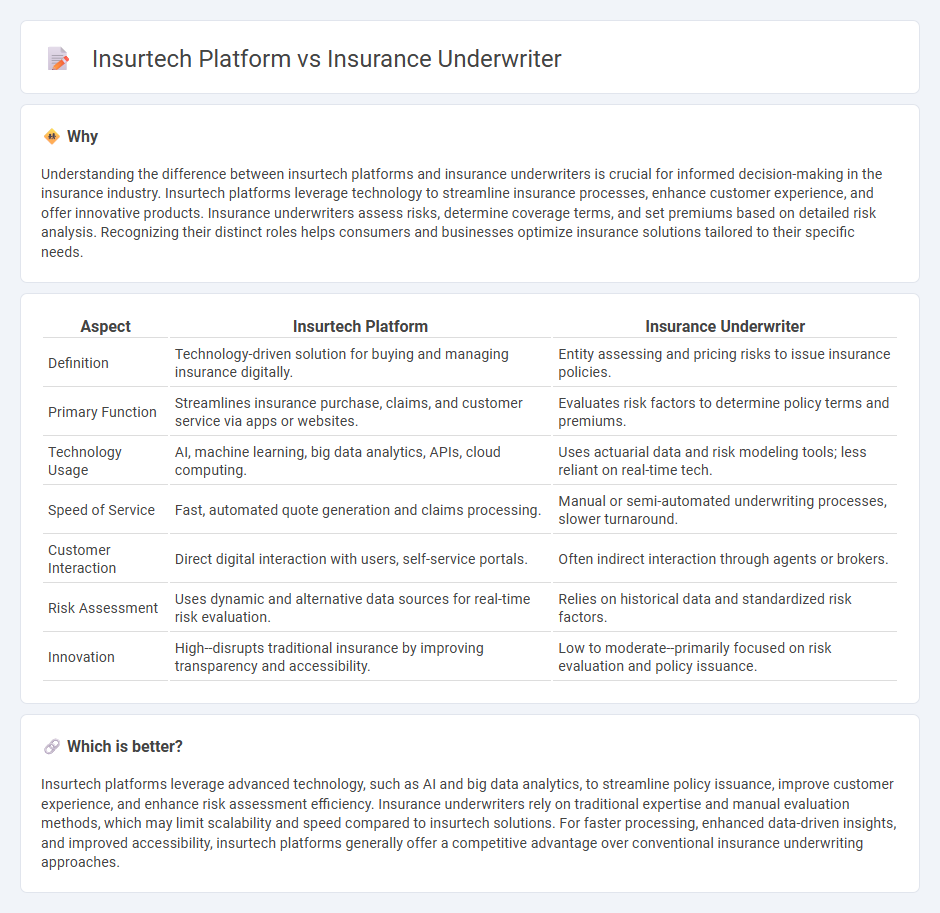

Understanding the difference between insurtech platforms and insurance underwriters is crucial for informed decision-making in the insurance industry. Insurtech platforms leverage technology to streamline insurance processes, enhance customer experience, and offer innovative products. Insurance underwriters assess risks, determine coverage terms, and set premiums based on detailed risk analysis. Recognizing their distinct roles helps consumers and businesses optimize insurance solutions tailored to their specific needs.

Comparison Table

| Aspect | Insurtech Platform | Insurance Underwriter |

|---|---|---|

| Definition | Technology-driven solution for buying and managing insurance digitally. | Entity assessing and pricing risks to issue insurance policies. |

| Primary Function | Streamlines insurance purchase, claims, and customer service via apps or websites. | Evaluates risk factors to determine policy terms and premiums. |

| Technology Usage | AI, machine learning, big data analytics, APIs, cloud computing. | Uses actuarial data and risk modeling tools; less reliant on real-time tech. |

| Speed of Service | Fast, automated quote generation and claims processing. | Manual or semi-automated underwriting processes, slower turnaround. |

| Customer Interaction | Direct digital interaction with users, self-service portals. | Often indirect interaction through agents or brokers. |

| Risk Assessment | Uses dynamic and alternative data sources for real-time risk evaluation. | Relies on historical data and standardized risk factors. |

| Innovation | High--disrupts traditional insurance by improving transparency and accessibility. | Low to moderate--primarily focused on risk evaluation and policy issuance. |

Which is better?

Insurtech platforms leverage advanced technology, such as AI and big data analytics, to streamline policy issuance, improve customer experience, and enhance risk assessment efficiency. Insurance underwriters rely on traditional expertise and manual evaluation methods, which may limit scalability and speed compared to insurtech solutions. For faster processing, enhanced data-driven insights, and improved accessibility, insurtech platforms generally offer a competitive advantage over conventional insurance underwriting approaches.

Connection

Insurtech platforms leverage data analytics and AI to streamline risk assessment, enabling insurance underwriters to make faster, more accurate pricing and coverage decisions. By integrating advanced algorithms, these platforms enhance underwriting efficiency, reduce manual processing, and improve fraud detection. This collaboration results in optimized policy issuance and a better customer experience within the insurance industry.

Key Terms

Risk Assessment

Insurance underwriters leverage traditional expertise and actuarial data to evaluate risk accurately, ensuring premium rates reflect potential losses. Insurtech platforms utilize advanced algorithms, AI, and big data analytics to enhance risk assessment efficiency and precision, often integrating real-time data for dynamic underwriting. Discover how the evolving landscape of risk assessment is transforming insurance by exploring the synergy between underwriters and insurtech innovations.

Automation

Insurance underwriters traditionally assess risk through manual analysis and experience-driven judgment, leading to longer processing times and possible human errors. Insurtech platforms leverage automation powered by AI, machine learning, and advanced data analytics to streamline underwriting, enhance accuracy, and accelerate decision-making. Explore the transformative impact of automation on underwriting by diving deeper into insurtech innovations.

Data Analytics

Insurance underwriters rely on traditional risk assessment models and historical data to evaluate policy applications, while insurtech platforms harness advanced data analytics, AI, and machine learning to provide real-time insights and more accurate risk predictions. Insurtech platforms integrate diverse data sources such as social media, IoT devices, and telematics to enhance underwriting precision and streamline decision-making. Explore how data analytics is revolutionizing insurance underwriting by bridging technology and risk management.

Source and External Links

How To Become an Insurance Underwriter (With Salary Info) - This article provides a step-by-step guide on how to become an insurance underwriter, including salary information and job duties.

What is an Underwriter? - This webpage defines the role of an insurance underwriter, explaining how they assess risks and determine premiums.

Insurance Underwriters - This page from the Bureau of Labor Statistics offers detailed information on the role, salary, and job outlook for insurance underwriters.

dowidth.com

dowidth.com