Insurance sandboxes provide a controlled regulatory environment where insurers can test innovative products and business models with real customers while minimizing risk. Innovation hubs offer ongoing support, resources, and collaboration opportunities for insurers to develop and implement new technologies without the strict testing constraints of a sandbox. Explore how these frameworks drive forward the future of insurance technology.

Why it is important

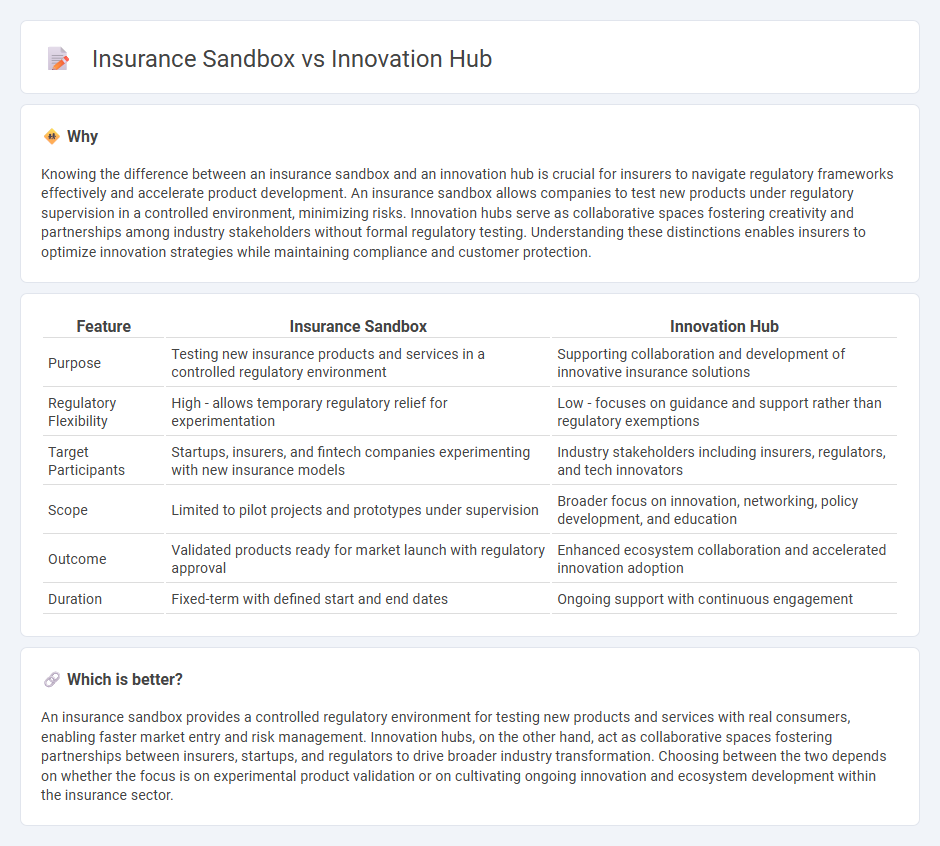

Knowing the difference between an insurance sandbox and an innovation hub is crucial for insurers to navigate regulatory frameworks effectively and accelerate product development. An insurance sandbox allows companies to test new products under regulatory supervision in a controlled environment, minimizing risks. Innovation hubs serve as collaborative spaces fostering creativity and partnerships among industry stakeholders without formal regulatory testing. Understanding these distinctions enables insurers to optimize innovation strategies while maintaining compliance and customer protection.

Comparison Table

| Feature | Insurance Sandbox | Innovation Hub |

|---|---|---|

| Purpose | Testing new insurance products and services in a controlled regulatory environment | Supporting collaboration and development of innovative insurance solutions |

| Regulatory Flexibility | High - allows temporary regulatory relief for experimentation | Low - focuses on guidance and support rather than regulatory exemptions |

| Target Participants | Startups, insurers, and fintech companies experimenting with new insurance models | Industry stakeholders including insurers, regulators, and tech innovators |

| Scope | Limited to pilot projects and prototypes under supervision | Broader focus on innovation, networking, policy development, and education |

| Outcome | Validated products ready for market launch with regulatory approval | Enhanced ecosystem collaboration and accelerated innovation adoption |

| Duration | Fixed-term with defined start and end dates | Ongoing support with continuous engagement |

Which is better?

An insurance sandbox provides a controlled regulatory environment for testing new products and services with real consumers, enabling faster market entry and risk management. Innovation hubs, on the other hand, act as collaborative spaces fostering partnerships between insurers, startups, and regulators to drive broader industry transformation. Choosing between the two depends on whether the focus is on experimental product validation or on cultivating ongoing innovation and ecosystem development within the insurance sector.

Connection

Insurance sandboxes provide a controlled regulatory environment where innovative insurance products and services can be tested with real customers under regulatory supervision. Innovation hubs support insurers and startups by offering resources, guidance, and collaboration opportunities to develop new technologies and business models. Both initiatives accelerate the adoption of cutting-edge solutions in the insurance sector, fostering regulatory compliance and market responsiveness.

Key Terms

**Innovation Hub:**

The Innovation Hub is a collaborative platform designed to foster dialogue and knowledge exchange between regulators and insurance industry players, accelerating the development of innovative insurance products and services. It provides a safe environment for testing and refining ideas without the constraints of formal regulatory processes, promoting creativity and rapid iteration. Discover how the Innovation Hub can drive transformation in your insurance business.

Collaboration

Innovation hubs foster collaboration by connecting startups, insurers, and technology providers to co-create solutions and accelerate digital transformation within the insurance sector. Insurance sandboxes facilitate a controlled environment where new products and technologies undergo regulatory testing, promoting safe innovation through real-world data and feedback loops. Discover how these frameworks drive collaborative growth in insurance by exploring their distinct roles and benefits.

Guidance

Innovation hubs provide continuous, real-time guidance and support to startups and fintech firms, fostering collaboration and knowledge sharing within the regulatory framework. Insurance sandboxes offer a controlled environment where companies can test new products or services under regulatory supervision, receiving specific, outcome-based feedback from authorities. Explore how these approaches shape the future of insurance regulation and innovation.

Source and External Links

Innovation Hub: Home Page - This innovation hub at Penn State offers resources like coworking spaces, rapid prototyping labs, and mentorship programs to foster entrepreneurship and innovation.

Regional Technology and Innovation Hubs - The Tech Hubs Program aims to transform U.S. regions into globally competitive innovation centers by investing in key technology areas.

FSU Innovation Hub - This hub provides a collaborative workspace for students to explore innovation through digital fabrication labs, design labs, and various courses and workshops.

dowidth.com

dowidth.com