Flood insurance integration offers targeted protection against water damage risks, essential for properties in flood-prone areas, while title insurance integration secures ownership rights by protecting against title defects and disputes. Both integrations are crucial for comprehensive real estate risk management but address distinctly different threats to property value and ownership security. Discover how combining these insurance types can enhance your property investment safeguards.

Why it is important

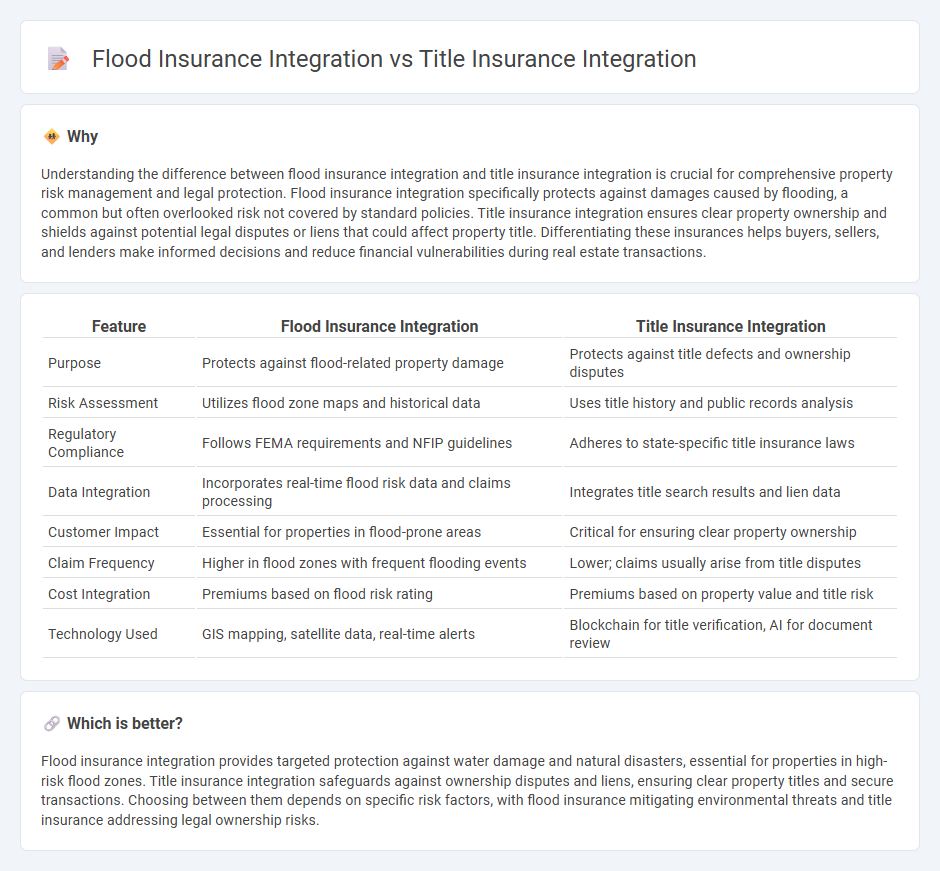

Understanding the difference between flood insurance integration and title insurance integration is crucial for comprehensive property risk management and legal protection. Flood insurance integration specifically protects against damages caused by flooding, a common but often overlooked risk not covered by standard policies. Title insurance integration ensures clear property ownership and shields against potential legal disputes or liens that could affect property title. Differentiating these insurances helps buyers, sellers, and lenders make informed decisions and reduce financial vulnerabilities during real estate transactions.

Comparison Table

| Feature | Flood Insurance Integration | Title Insurance Integration |

|---|---|---|

| Purpose | Protects against flood-related property damage | Protects against title defects and ownership disputes |

| Risk Assessment | Utilizes flood zone maps and historical data | Uses title history and public records analysis |

| Regulatory Compliance | Follows FEMA requirements and NFIP guidelines | Adheres to state-specific title insurance laws |

| Data Integration | Incorporates real-time flood risk data and claims processing | Integrates title search results and lien data |

| Customer Impact | Essential for properties in flood-prone areas | Critical for ensuring clear property ownership |

| Claim Frequency | Higher in flood zones with frequent flooding events | Lower; claims usually arise from title disputes |

| Cost Integration | Premiums based on flood risk rating | Premiums based on property value and title risk |

| Technology Used | GIS mapping, satellite data, real-time alerts | Blockchain for title verification, AI for document review |

Which is better?

Flood insurance integration provides targeted protection against water damage and natural disasters, essential for properties in high-risk flood zones. Title insurance integration safeguards against ownership disputes and liens, ensuring clear property titles and secure transactions. Choosing between them depends on specific risk factors, with flood insurance mitigating environmental threats and title insurance addressing legal ownership risks.

Connection

Flood insurance integration and title insurance integration are connected through their roles in risk assessment and property protection during real estate transactions. Flood insurance assesses potential water damage risks, while title insurance ensures clear ownership and protects against title defects; combining both provides comprehensive coverage against financial loss from natural hazards and legal claims. This integration streamlines due diligence by addressing both physical risks and legal ownership issues, enhancing overall security for buyers and lenders.

Key Terms

Title Search

Title search is a critical process in title insurance integration, ensuring clear property ownership and identifying potential liens or encumbrances. Flood insurance integration emphasizes flood zone determination based on geographic and environmental data during property assessment. Explore how these integrations impact risk management and property transactions in greater detail.

Flood Zone Determination

Flood insurance integration centers on accurate flood zone determination using FEMA maps and advanced GIS data, essential for underwriting flood risk and compliance with the National Flood Insurance Program (NFIP). Title insurance integration typically involves property title verification and lien assessments but increasingly incorporates flood zone data to identify risks affecting title validity. Explore how combining title and flood insurance integrations enhances property risk assessment and regulatory compliance.

Lien Priority

Title insurance integration ensures protection against defects affecting property ownership and lien priority, safeguarding investors from hidden claims or encumbrances. Flood insurance integration addresses flood-related risks but does not impact lien priority or title status. Explore how combining these insurances optimizes comprehensive property risk management and lien security.

Source and External Links

Introducing the General Title Integration in SoftPro 360! - SoftPro 360 integrates with General Title Insurance Company, allowing agents to order and generate title insurance documents directly through the SoftPro platform, improving efficiency and accuracy by eliminating manual steps in multiple states.

Encompass Integration - First Title & Escrow - First Title provides a direct integration with Ellie Mae's Encompass platform enabling lenders nationwide to instantly generate and manage accurate title insurance and closing cost documents fully automated within Encompass.

Digital Title Platform Integration - CLOSED(r) Title - CLOSED(r) offers a turnkey title platform integration designed to digitize and streamline title and escrow services, featuring online closings, instant funding, and real-time notifications integrated directly into real estate business platforms.

dowidth.com

dowidth.com