Usage-Based Insurance (UBI) harnesses telematics technology to monitor driving behaviors such as speed, acceleration, and braking patterns, allowing insurers to tailor premiums based on actual vehicle usage. Pay-How-You-Drive (PHYD) represents a subset of UBI focused specifically on evaluating driving habits to reward safe, responsible drivers with lower insurance costs. Discover how these innovative insurance models can transform your coverage by aligning costs with real-world driving risk.

Why it is important

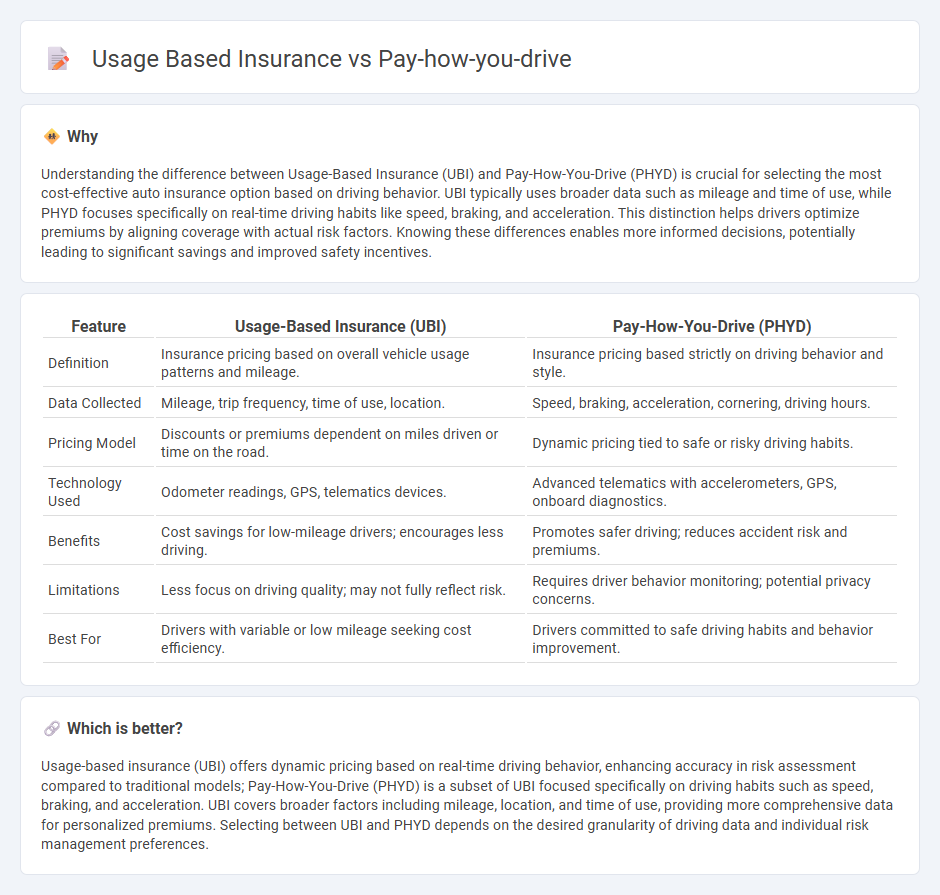

Understanding the difference between Usage-Based Insurance (UBI) and Pay-How-You-Drive (PHYD) is crucial for selecting the most cost-effective auto insurance option based on driving behavior. UBI typically uses broader data such as mileage and time of use, while PHYD focuses specifically on real-time driving habits like speed, braking, and acceleration. This distinction helps drivers optimize premiums by aligning coverage with actual risk factors. Knowing these differences enables more informed decisions, potentially leading to significant savings and improved safety incentives.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Pay-How-You-Drive (PHYD) |

|---|---|---|

| Definition | Insurance pricing based on overall vehicle usage patterns and mileage. | Insurance pricing based strictly on driving behavior and style. |

| Data Collected | Mileage, trip frequency, time of use, location. | Speed, braking, acceleration, cornering, driving hours. |

| Pricing Model | Discounts or premiums dependent on miles driven or time on the road. | Dynamic pricing tied to safe or risky driving habits. |

| Technology Used | Odometer readings, GPS, telematics devices. | Advanced telematics with accelerometers, GPS, onboard diagnostics. |

| Benefits | Cost savings for low-mileage drivers; encourages less driving. | Promotes safer driving; reduces accident risk and premiums. |

| Limitations | Less focus on driving quality; may not fully reflect risk. | Requires driver behavior monitoring; potential privacy concerns. |

| Best For | Drivers with variable or low mileage seeking cost efficiency. | Drivers committed to safe driving habits and behavior improvement. |

Which is better?

Usage-based insurance (UBI) offers dynamic pricing based on real-time driving behavior, enhancing accuracy in risk assessment compared to traditional models; Pay-How-You-Drive (PHYD) is a subset of UBI focused specifically on driving habits such as speed, braking, and acceleration. UBI covers broader factors including mileage, location, and time of use, providing more comprehensive data for personalized premiums. Selecting between UBI and PHYD depends on the desired granularity of driving data and individual risk management preferences.

Connection

Usage-based insurance (UBI) leverages telematics technology to monitor real-time driving behaviors, directly influencing premium calculations. Pay-how-you-drive models assess factors such as speed, braking, and acceleration to tailor insurance costs based on actual risk exposure. This data-driven approach enhances accuracy in risk assessment and promotes safer driving habits.

Key Terms

Telematics

Pay-how-you-drive insurance bases premiums on real-time driving behavior, using telematics devices to monitor factors like speed, braking, and acceleration. Usage-based insurance (UBI) encompasses a broader range of policies that utilize telematics data to assess overall vehicle usage, including mileage, time of day, and location, offering customized rates that reflect actual risk profiles. Explore the latest advancements in telematics to understand how these innovative insurance models can optimize your coverage and savings.

Premium Adjustment

Pay-how-you-drive (PHYD) insurance adjusts premiums based on driving behavior metrics such as speed, braking patterns, and acceleration, offering personalized risk assessment. Usage-Based Insurance (UBI) primarily considers mileage alongside driving habits for premium calculations, providing a broader evaluation of risk. Discover how these models redefine premium adjustment strategies for safer driving incentives.

Driving Behavior Data

Pay-how-you-drive insurance collects detailed driving behavior data such as speed, acceleration, braking patterns, and cornering to tailor premiums based on real-time risk assessment. Usage-based insurance (UBI) broadly incorporates factors like mileage, time of day, and location, but pay-how-you-drive emphasizes granular behavioral analytics to incentivize safer driving habits effectively. Discover how leveraging precise driving behavior data can optimize insurance pricing and improve road safety.

Source and External Links

All you need to know about Pay-As-You-Drive insurance - DriveQuant - Pay-As-You-Drive (PAYD) insurance bases premiums on actual vehicle use, charging a minimum base fee plus a rate per kilometer or minute driven, considering the driver's profile and offering savings through conditions like urban use or daytime driving only.

Telematics: 5 Reasons You Should Try "Pay How You Drive" Car Insurance - Travelers - "Pay How You Drive" car insurance uses telematics via a mobile app to monitor driving behavior, potentially lowering insurance costs by rewarding safer driving habits tracked over time.

Usage-based insurance - Wikipedia - Usage-based insurance, including Pay-As-You-Drive and Pay-How-You-Drive models, calculates premiums dynamically based on miles driven, driving behavior, location, and time, using data from odometers, GPS, or vehicle sensors.

dowidth.com

dowidth.com