Micro-mobility insurance covers electric scooters, bikes, and other small personal transport devices, focusing on accident liability and theft protection. Cargo insurance safeguards goods in transit, protecting against loss, damage, or theft during transportation by land, sea, or air. Explore the detailed features and benefits of both policies to choose the right coverage for your needs.

Why it is important

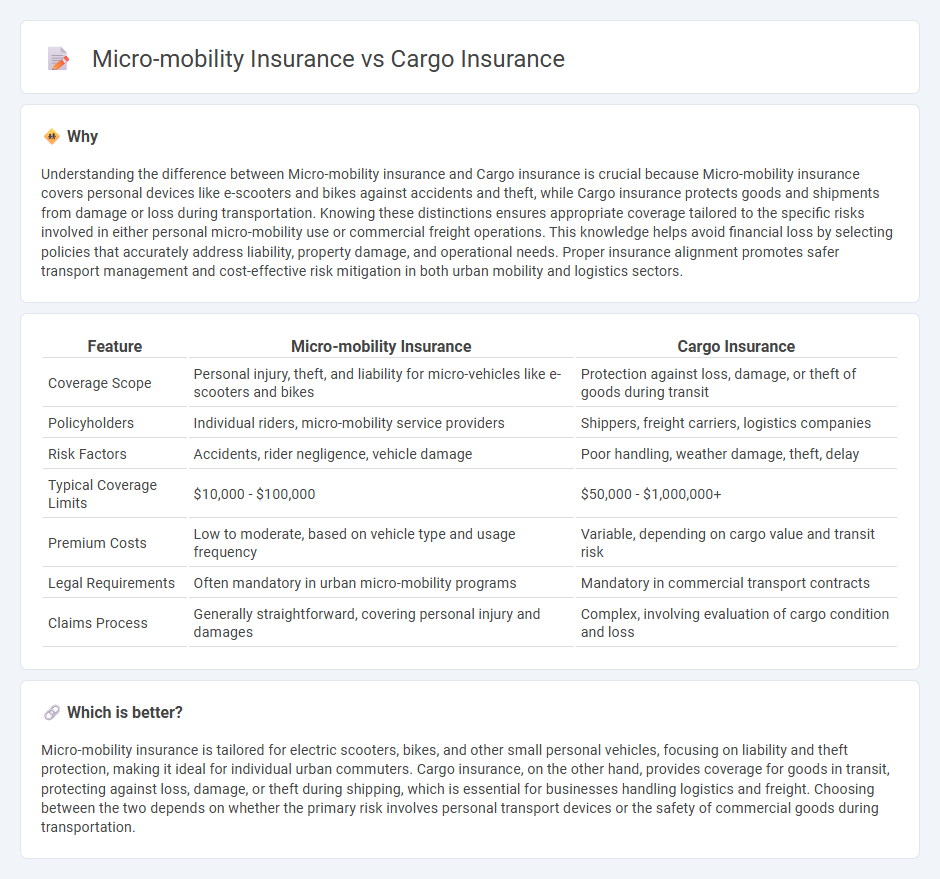

Understanding the difference between Micro-mobility insurance and Cargo insurance is crucial because Micro-mobility insurance covers personal devices like e-scooters and bikes against accidents and theft, while Cargo insurance protects goods and shipments from damage or loss during transportation. Knowing these distinctions ensures appropriate coverage tailored to the specific risks involved in either personal micro-mobility use or commercial freight operations. This knowledge helps avoid financial loss by selecting policies that accurately address liability, property damage, and operational needs. Proper insurance alignment promotes safer transport management and cost-effective risk mitigation in both urban mobility and logistics sectors.

Comparison Table

| Feature | Micro-mobility Insurance | Cargo Insurance |

|---|---|---|

| Coverage Scope | Personal injury, theft, and liability for micro-vehicles like e-scooters and bikes | Protection against loss, damage, or theft of goods during transit |

| Policyholders | Individual riders, micro-mobility service providers | Shippers, freight carriers, logistics companies |

| Risk Factors | Accidents, rider negligence, vehicle damage | Poor handling, weather damage, theft, delay |

| Typical Coverage Limits | $10,000 - $100,000 | $50,000 - $1,000,000+ |

| Premium Costs | Low to moderate, based on vehicle type and usage frequency | Variable, depending on cargo value and transit risk |

| Legal Requirements | Often mandatory in urban micro-mobility programs | Mandatory in commercial transport contracts |

| Claims Process | Generally straightforward, covering personal injury and damages | Complex, involving evaluation of cargo condition and loss |

Which is better?

Micro-mobility insurance is tailored for electric scooters, bikes, and other small personal vehicles, focusing on liability and theft protection, making it ideal for individual urban commuters. Cargo insurance, on the other hand, provides coverage for goods in transit, protecting against loss, damage, or theft during shipping, which is essential for businesses handling logistics and freight. Choosing between the two depends on whether the primary risk involves personal transport devices or the safety of commercial goods during transportation.

Connection

Micro-mobility insurance and cargo insurance intersect in the protection of goods transported via small electric vehicles like e-bikes and scooters, addressing risks such as theft, damage, and liability during last-mile deliveries. Both insurance types mitigate financial losses for businesses leveraging micro-mobility solutions in urban logistics by covering vehicle-related incidents and the cargo's integrity. Optimal coverage plans integrate micro-mobility and cargo insurance to ensure comprehensive risk management in dynamic, short-distance transport environments.

Key Terms

Cargo insurance:

Cargo insurance protects goods in transit against risks like theft, damage, or loss, covering shipments via road, sea, or air. This insurance is essential for businesses relying on supply chains to secure their financial investment in transported products. Explore the detailed benefits and coverage options of cargo insurance to safeguard your valuable shipments effectively.

Marine Policy

Cargo insurance primarily covers the loss or damage of goods during maritime transport, offering financial protection against risks such as weather events, theft, or accidents at sea. Micro-mobility insurance, although increasingly relevant in urban logistics, focuses on smaller vehicles like e-scooters and bikes and typically does not extend to marine environments. To explore detailed differences and coverage specifics between cargo marine policies and micro-mobility insurance, click here to learn more.

Insurable Interest

Cargo insurance protects the financial interest of shippers by covering goods against loss or damage during transit, requiring the policyholder to demonstrate an insurable interest in the cargo. Micro-mobility insurance safeguards shared electric scooters and bikes, ensuring coverage for property damage and liability while users maintain an insurable interest as registered riders or operators. Explore more about how insurable interest shapes insurance policies across diverse transport sectors.

Source and External Links

Cargo Insurance | Flexport - Offers specialized insurance coverage for goods transported by land, air, or sea, protecting against loss or damage during transit.

Cargo Insurance - Motor Truck & Freight - GEICO - Provides protection for accidents like collisions, load strikes, and fires, and is often required for for-hire truckers hauling others' property.

Motor Truck Cargo Insurance - Progressive Commercial - Covers damages, losses, or harm to transported materials, including incidents like fire and collision, and offers protection against liability for truckers.

dowidth.com

dowidth.com