Pre-existing condition coverage ensures that individuals with prior health issues receive necessary insurance benefits without penalty, addressing a critical concern in healthcare access. Risk adjustment is a statistical process used by insurers to balance costs and premiums by accounting for the health status of policyholders, promoting fairness across diverse risk pools. Discover how these mechanisms impact insurance policies and patient protection to make informed decisions.

Why it is important

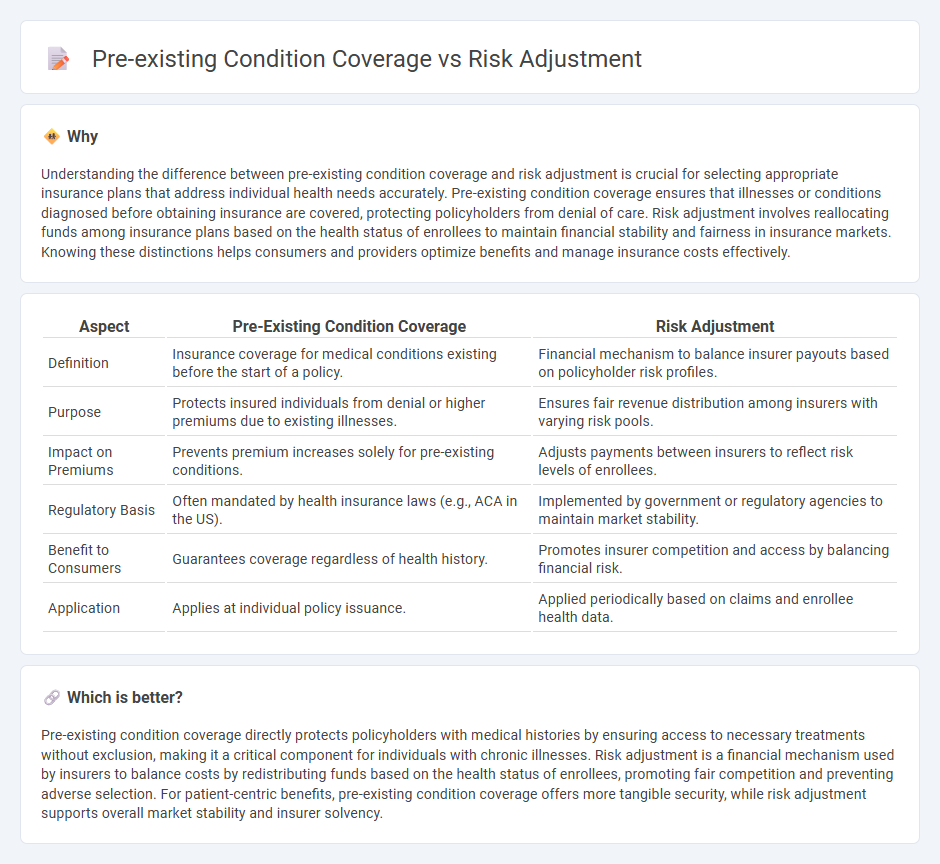

Understanding the difference between pre-existing condition coverage and risk adjustment is crucial for selecting appropriate insurance plans that address individual health needs accurately. Pre-existing condition coverage ensures that illnesses or conditions diagnosed before obtaining insurance are covered, protecting policyholders from denial of care. Risk adjustment involves reallocating funds among insurance plans based on the health status of enrollees to maintain financial stability and fairness in insurance markets. Knowing these distinctions helps consumers and providers optimize benefits and manage insurance costs effectively.

Comparison Table

| Aspect | Pre-Existing Condition Coverage | Risk Adjustment |

|---|---|---|

| Definition | Insurance coverage for medical conditions existing before the start of a policy. | Financial mechanism to balance insurer payouts based on policyholder risk profiles. |

| Purpose | Protects insured individuals from denial or higher premiums due to existing illnesses. | Ensures fair revenue distribution among insurers with varying risk pools. |

| Impact on Premiums | Prevents premium increases solely for pre-existing conditions. | Adjusts payments between insurers to reflect risk levels of enrollees. |

| Regulatory Basis | Often mandated by health insurance laws (e.g., ACA in the US). | Implemented by government or regulatory agencies to maintain market stability. |

| Benefit to Consumers | Guarantees coverage regardless of health history. | Promotes insurer competition and access by balancing financial risk. |

| Application | Applies at individual policy issuance. | Applied periodically based on claims and enrollee health data. |

Which is better?

Pre-existing condition coverage directly protects policyholders with medical histories by ensuring access to necessary treatments without exclusion, making it a critical component for individuals with chronic illnesses. Risk adjustment is a financial mechanism used by insurers to balance costs by redistributing funds based on the health status of enrollees, promoting fair competition and preventing adverse selection. For patient-centric benefits, pre-existing condition coverage offers more tangible security, while risk adjustment supports overall market stability and insurer solvency.

Connection

Pre-existing condition coverage directly impacts risk adjustment by influencing the assessment of an insured individual's health status and expected costs. Insurers use risk adjustment models to balance premiums based on the presence of pre-existing conditions, ensuring fair compensation for higher-risk enrollees. This connection promotes equitable coverage while maintaining financial stability in insurance markets.

Key Terms

Underwriting

Risk adjustment evaluates health plan risk profiles by redistributing funds to balance costs linked to enrollees' medical conditions, enhancing financial stability for insurers. Pre-existing condition coverage mandates insurers to accept applicants regardless of prior health issues, impacting underwriting criteria by limiting risk exclusion. Explore in-depth how these concepts reshape underwriting practices and protect consumers.

Adverse Selection

Risk adjustment mechanisms balance costs among insurers by redistributing funds based on enrollees' health risks, mitigating adverse selection that arises when high-risk individuals disproportionately enroll in specific plans. Pre-existing condition coverage prohibits denying or charging more to individuals with prior health issues, reducing incentives for insurers to avoid high-risk enrollees but potentially intensifying adverse selection without proper risk adjustment. Explore how integrated risk adjustment and pre-existing condition coverage policies protect both consumers and insurers from adverse selection consequences.

Premium Calculation

Risk adjustment involves redistributing funds among health plans based on the risk profile of enrollees, ensuring fair premium calculation by accounting for varying health statuses. Pre-existing condition coverage mandates insurers to include individuals with prior health issues without charging higher premiums, influencing overall premium setting strategies. Explore detailed methodologies of how these factors impact premium calculation and insurance pricing models.

Source and External Links

Explaining Health Care Reform: Risk Adjustment, Reinsurance, and ... - Risk adjustment transfers funds from plans with healthier enrollees to those with sicker enrollees to stabilize premiums and discourage insurers from avoiding high-risk individuals.

What Is Risk Adjustment? - Risk adjustment assigns each person a risk score based on health status to predict costs and ensure insurers are fairly compensated for covering members with higher healthcare needs.

The Basics of Risk Adjustment - Risk adjustment modifies provider payments in capitated systems based on patient health characteristics, ensuring adequate compensation for treating sicker patients and encouraging care for all, regardless of health status.

dowidth.com

dowidth.com