Mental health insurance focuses on coverage for psychiatric services, therapy sessions, and treatment for disorders such as anxiety, depression, and bipolar disorder, while physical health insurance primarily covers medical expenses related to illness, injuries, surgeries, and preventive care like vaccinations and screenings. Both types of insurance play crucial roles in overall well-being, addressing different aspects of health and requiring specialized benefits and network providers. Discover more about how mental health and physical health insurance plans can complement each other for comprehensive coverage.

Why it is important

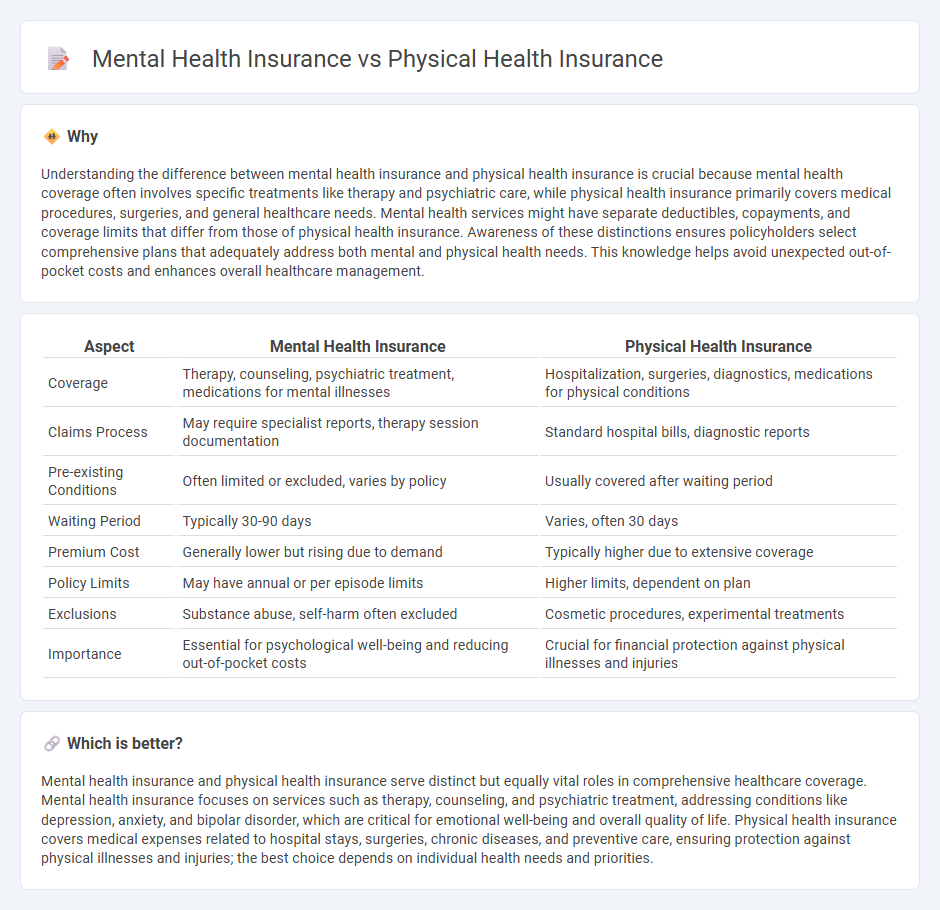

Understanding the difference between mental health insurance and physical health insurance is crucial because mental health coverage often involves specific treatments like therapy and psychiatric care, while physical health insurance primarily covers medical procedures, surgeries, and general healthcare needs. Mental health services might have separate deductibles, copayments, and coverage limits that differ from those of physical health insurance. Awareness of these distinctions ensures policyholders select comprehensive plans that adequately address both mental and physical health needs. This knowledge helps avoid unexpected out-of-pocket costs and enhances overall healthcare management.

Comparison Table

| Aspect | Mental Health Insurance | Physical Health Insurance |

|---|---|---|

| Coverage | Therapy, counseling, psychiatric treatment, medications for mental illnesses | Hospitalization, surgeries, diagnostics, medications for physical conditions |

| Claims Process | May require specialist reports, therapy session documentation | Standard hospital bills, diagnostic reports |

| Pre-existing Conditions | Often limited or excluded, varies by policy | Usually covered after waiting period |

| Waiting Period | Typically 30-90 days | Varies, often 30 days |

| Premium Cost | Generally lower but rising due to demand | Typically higher due to extensive coverage |

| Policy Limits | May have annual or per episode limits | Higher limits, dependent on plan |

| Exclusions | Substance abuse, self-harm often excluded | Cosmetic procedures, experimental treatments |

| Importance | Essential for psychological well-being and reducing out-of-pocket costs | Crucial for financial protection against physical illnesses and injuries |

Which is better?

Mental health insurance and physical health insurance serve distinct but equally vital roles in comprehensive healthcare coverage. Mental health insurance focuses on services such as therapy, counseling, and psychiatric treatment, addressing conditions like depression, anxiety, and bipolar disorder, which are critical for emotional well-being and overall quality of life. Physical health insurance covers medical expenses related to hospital stays, surgeries, chronic diseases, and preventive care, ensuring protection against physical illnesses and injuries; the best choice depends on individual health needs and priorities.

Connection

Mental health insurance and physical health insurance are interconnected through comprehensive healthcare plans that address the holistic well-being of individuals, recognizing the impact of mental health on physical conditions and vice versa. Integrated insurance policies provide coverage for treatments such as therapy, medication, preventive care, and chronic disease management, reducing the overall health risks and improving outcomes. Data from insurers shows that coordinated care between mental and physical health services lowers hospitalization rates and healthcare costs by promoting early intervention and continuous support.

Key Terms

Coverage Scope

Physical health insurance primarily covers medical treatments such as surgeries, hospital stays, and prescription medications, targeting diseases and injuries affecting the body. Mental health insurance focuses on services like therapy, psychiatric consultations, and treatment for conditions such as depression, anxiety, and bipolar disorder, addressing emotional and psychological well-being. Explore the differences further to understand how each type supports overall health and access to care.

Pre-existing Conditions

Physical health insurance often imposes stricter limitations or higher premiums for pre-existing conditions such as diabetes, heart disease, or asthma, reflecting the need for ongoing medical care. Mental health insurance coverage, governed by regulations like the Mental Health Parity and Addiction Equity Act (MHPAEA), generally prohibits discrimination based on pre-existing mental health disorders, promoting better access to therapy and psychiatric treatments. Explore more to understand how these differences impact your insurance choices and benefits.

Parity Laws

Parity laws mandate that mental health insurance benefits be provided on par with physical health coverage, ensuring equal access to necessary treatments for conditions like depression and chronic illnesses. Insurers must cover mental health services, including therapy and psychiatric medications, without imposing more restrictive limits than those applied to physical health benefits. Explore the impact of parity laws to better understand how they protect your comprehensive health insurance rights.

Source and External Links

Health Insurance Guide - Physical health insurance covers essential health benefits including hospital care, doctor visits, outpatient procedures, diagnostic tests, preventive services, rehabilitation therapy, and emergency care, all of which protect you financially from illness or injury costs and promote regular health care.

Health insurance plans | UnitedHealthcare - Health insurance plans vary by type, coverage, costs, and provider networks, but broadly include coverage for preventive care, hospital stays, prescription drugs, and mental health services, with enrollment typically during open enrollment periods.

Covered California(tm) | The Official Site of California's Health - Health insurance options in California, such as Covered California plans, offer tiered coverage from Bronze to Platinum, including health, dental, and vision care, with varying premiums and out-of-pocket costs, including programs for children, pregnancy, and families.

dowidth.com

dowidth.com