Embedded insurance integrates coverage directly into the purchase of products or services, streamlining customer experience and increasing policy uptake through seamless inclusion. Affinity insurance targets specific groups or communities sharing common interests or traits, offering tailored policies that leverage group loyalty and reduce marketing costs. Explore how these innovative insurance models can transform risk protection strategies and customer engagement.

Why it is important

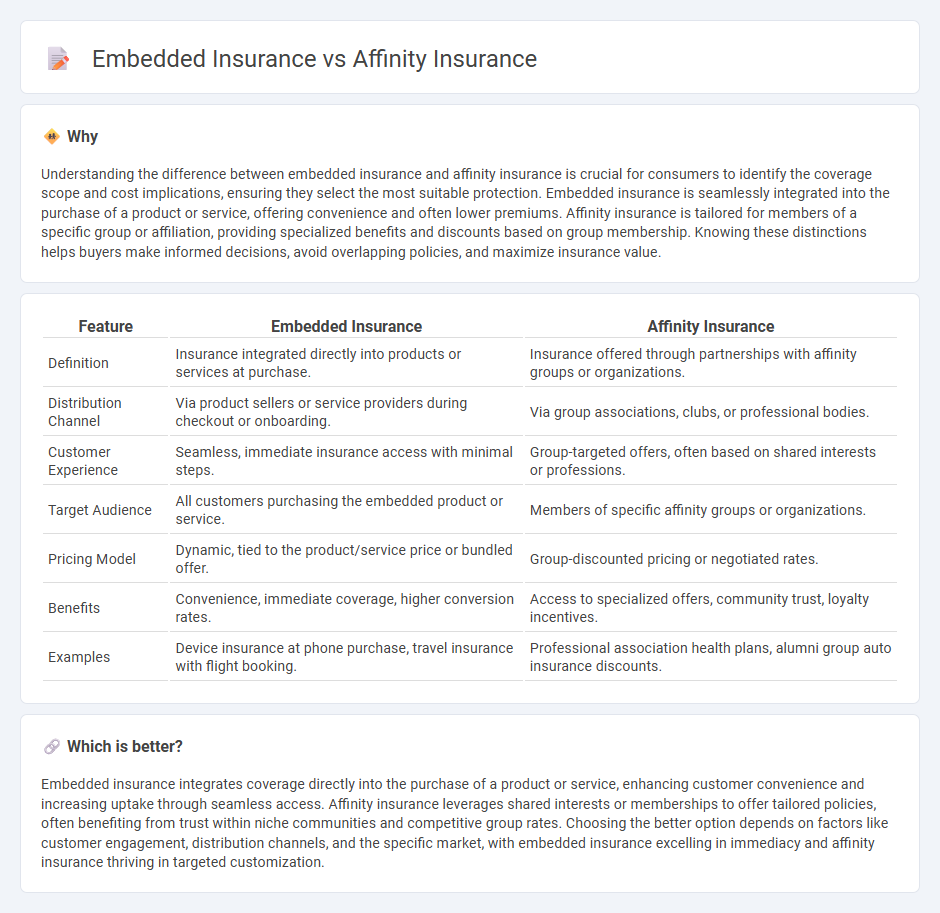

Understanding the difference between embedded insurance and affinity insurance is crucial for consumers to identify the coverage scope and cost implications, ensuring they select the most suitable protection. Embedded insurance is seamlessly integrated into the purchase of a product or service, offering convenience and often lower premiums. Affinity insurance is tailored for members of a specific group or affiliation, providing specialized benefits and discounts based on group membership. Knowing these distinctions helps buyers make informed decisions, avoid overlapping policies, and maximize insurance value.

Comparison Table

| Feature | Embedded Insurance | Affinity Insurance |

|---|---|---|

| Definition | Insurance integrated directly into products or services at purchase. | Insurance offered through partnerships with affinity groups or organizations. |

| Distribution Channel | Via product sellers or service providers during checkout or onboarding. | Via group associations, clubs, or professional bodies. |

| Customer Experience | Seamless, immediate insurance access with minimal steps. | Group-targeted offers, often based on shared interests or professions. |

| Target Audience | All customers purchasing the embedded product or service. | Members of specific affinity groups or organizations. |

| Pricing Model | Dynamic, tied to the product/service price or bundled offer. | Group-discounted pricing or negotiated rates. |

| Benefits | Convenience, immediate coverage, higher conversion rates. | Access to specialized offers, community trust, loyalty incentives. |

| Examples | Device insurance at phone purchase, travel insurance with flight booking. | Professional association health plans, alumni group auto insurance discounts. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of a product or service, enhancing customer convenience and increasing uptake through seamless access. Affinity insurance leverages shared interests or memberships to offer tailored policies, often benefiting from trust within niche communities and competitive group rates. Choosing the better option depends on factors like customer engagement, distribution channels, and the specific market, with embedded insurance excelling in immediacy and affinity insurance thriving in targeted customization.

Connection

Embedded insurance integrates coverage directly into the purchase of products or services, while affinity insurance leverages group memberships or shared interests for tailored offerings. Both models enhance customer experience by providing seamless access to insurance through trusted channels, increasing uptake rates and simplifying the buying process. The connection lies in their strategic use of existing customer relationships and platforms to distribute insurance efficiently and contextually.

Key Terms

Distribution Channel

Affinity insurance leverages existing relationships or groups, such as professional associations or alumni networks, to distribute insurance products through trusted channels, enhancing customer engagement and retention. Embedded insurance integrates insurance coverage directly within the purchase of a product or service, using digital platforms and ecosystems to offer seamless, real-time protection at the point of sale. Explore how these distribution strategies revolutionize customer access and drive growth in the insurance industry.

Customization

Affinity insurance offers tailored coverage options designed to meet the specific needs of a particular group, such as employees or members of an organization, providing high levels of customization and personalized benefits. Embedded insurance integrates insurance products directly within the primary service or product platform, enabling seamless, on-demand customization based on user behavior and transaction context. Explore how these innovative insurance models deliver personalized protection to better match customer preferences.

Integration

Affinity insurance integrates tailored policies within specific organizations or groups, leveraging existing relationships to offer relevant coverage, while embedded insurance seamlessly incorporates protection directly into the purchase of products or services, enhancing convenience and user experience. The level of integration in affinity insurance depends on partnerships and membership structures, whereas embedded insurance relies on technology platforms and APIs to automate policy issuance within customer journeys. Explore how these integration models revolutionize insurance accessibility and customer engagement.

Source and External Links

Affinity | Insurance Broking & Risk Management - Affinity insurance programs provide tailored coverage at competitive rates for specific groups--such as associations or franchises--by leveraging collective buying power and often include broker support for administration and claims.

Affinity Group Insurance Solutions - Zurich Affinity Solutions offers customizable supplemental health and travel insurance products to associations and groups, helping members manage out-of-pocket medical costs and travel disruptions.

Aon Affinity Home - Aon Affinity develops and administers specialized insurance programs for affinity organizations, providing access to top-rated carriers and comprehensive services from marketing to claims management.

dowidth.com

dowidth.com