Climate risk insurance offers financial protection against weather-related events such as floods, hurricanes, and droughts by transferring risk to insurers and providing rapid payouts to affected communities. Disaster risk financing encompasses a broader range of financial instruments, including contingency funds, bonds, and loans, aimed at securing funds before and after disasters for risk reduction, response, and recovery. Explore how these two strategies complement each other in building resilient financial systems against climate-induced disasters.

Why it is important

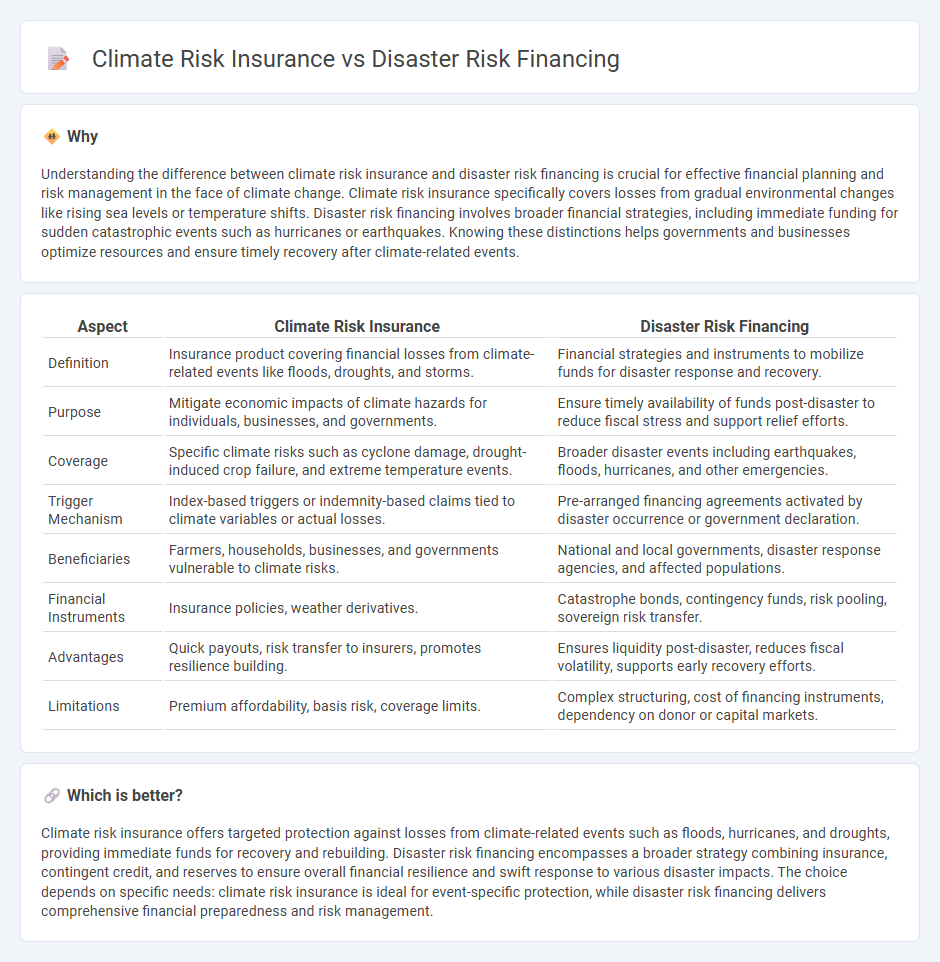

Understanding the difference between climate risk insurance and disaster risk financing is crucial for effective financial planning and risk management in the face of climate change. Climate risk insurance specifically covers losses from gradual environmental changes like rising sea levels or temperature shifts. Disaster risk financing involves broader financial strategies, including immediate funding for sudden catastrophic events such as hurricanes or earthquakes. Knowing these distinctions helps governments and businesses optimize resources and ensure timely recovery after climate-related events.

Comparison Table

| Aspect | Climate Risk Insurance | Disaster Risk Financing |

|---|---|---|

| Definition | Insurance product covering financial losses from climate-related events like floods, droughts, and storms. | Financial strategies and instruments to mobilize funds for disaster response and recovery. |

| Purpose | Mitigate economic impacts of climate hazards for individuals, businesses, and governments. | Ensure timely availability of funds post-disaster to reduce fiscal stress and support relief efforts. |

| Coverage | Specific climate risks such as cyclone damage, drought-induced crop failure, and extreme temperature events. | Broader disaster events including earthquakes, floods, hurricanes, and other emergencies. |

| Trigger Mechanism | Index-based triggers or indemnity-based claims tied to climate variables or actual losses. | Pre-arranged financing agreements activated by disaster occurrence or government declaration. |

| Beneficiaries | Farmers, households, businesses, and governments vulnerable to climate risks. | National and local governments, disaster response agencies, and affected populations. |

| Financial Instruments | Insurance policies, weather derivatives. | Catastrophe bonds, contingency funds, risk pooling, sovereign risk transfer. |

| Advantages | Quick payouts, risk transfer to insurers, promotes resilience building. | Ensures liquidity post-disaster, reduces fiscal volatility, supports early recovery efforts. |

| Limitations | Premium affordability, basis risk, coverage limits. | Complex structuring, cost of financing instruments, dependency on donor or capital markets. |

Which is better?

Climate risk insurance offers targeted protection against losses from climate-related events such as floods, hurricanes, and droughts, providing immediate funds for recovery and rebuilding. Disaster risk financing encompasses a broader strategy combining insurance, contingent credit, and reserves to ensure overall financial resilience and swift response to various disaster impacts. The choice depends on specific needs: climate risk insurance is ideal for event-specific protection, while disaster risk financing delivers comprehensive financial preparedness and risk management.

Connection

Climate risk insurance provides financial protection against losses from climate-related events such as floods and hurricanes, while disaster risk financing involves strategies to allocate funds for disaster response and recovery. Together, they form a comprehensive approach to managing the economic impact of climate hazards by combining risk transfer mechanisms with pre-arranged financial resources. This connection enhances the resilience of vulnerable communities by ensuring quicker access to funding and reducing the fiscal burden on governments during emergencies.

Key Terms

**Disaster Risk Financing:**

Disaster risk financing involves allocating financial resources and mechanisms to manage the economic impact of natural disasters, ensuring timely liquidity for recovery efforts. It leverages tools such as catastrophe bonds, reserve funds, and contingent credit to mitigate fiscal shocks post-event. Explore deeper insights on how disaster risk financing complements climate risk insurance to build resilient economies.

Contingent Credit

Disaster risk financing involves pre-arranged financial mechanisms, such as contingent credit lines, to provide rapid liquidity after natural disasters, reducing fiscal stress for governments. Climate risk insurance, typically parametric, offers payouts based on predefined climate-related triggers, helping insured entities manage disaster-related losses. Explore the benefits and applications of contingent credit within disaster risk financing to better understand its role in comprehensive climate resilience strategies.

Catastrophe Bonds

Disaster risk financing involves strategies to allocate funds for disaster response and recovery, while climate risk insurance provides financial protection against climate-related losses. Catastrophe bonds are innovative instruments that transfer disaster risk from insurers to investors, enhancing liquidity and resilience by covering predefined catastrophic events. Explore how catastrophe bonds integrate with disaster risk financing frameworks to optimize climate risk management.

Source and External Links

Disaster Risk Financing - This approach involves setting up forecast models and pre-arranging funds to protect people before disasters by using science and data to model risks and plan responses.

Climate and Disaster Risk Finance and Insurance - This strategy pre-arranges financial instruments to increase resilience against climate and disaster impacts, transforming disaster response from reactive to proactive management.

Disaster Risk Financing and Insurance Program - A program that helps countries develop financial protection strategies to ensure rapid and resilient responses to disasters through funding and expertise.

dowidth.com

dowidth.com