Digital nomad insurance focuses on flexible, short-term coverage tailored for remote workers frequently moving across countries, emphasizing health, travel, and equipment protection. Expat insurance provides comprehensive, long-term plans designed for individuals settling abroad, covering local healthcare, property, and liability needs. Discover more about choosing the right insurance solution for your global lifestyle.

Why it is important

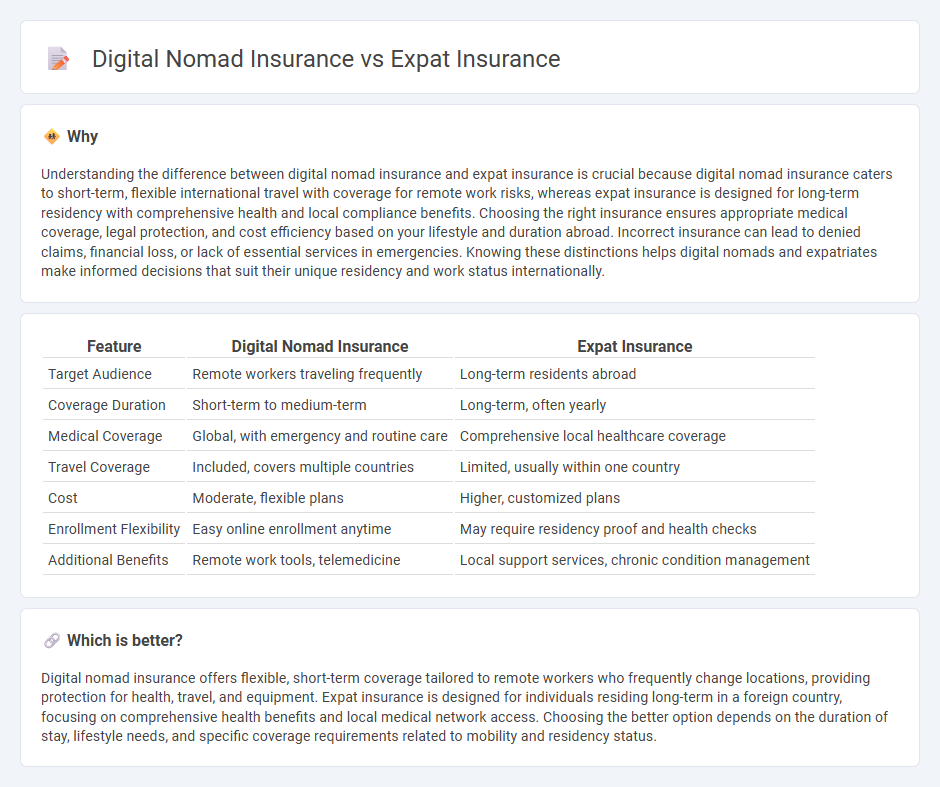

Understanding the difference between digital nomad insurance and expat insurance is crucial because digital nomad insurance caters to short-term, flexible international travel with coverage for remote work risks, whereas expat insurance is designed for long-term residency with comprehensive health and local compliance benefits. Choosing the right insurance ensures appropriate medical coverage, legal protection, and cost efficiency based on your lifestyle and duration abroad. Incorrect insurance can lead to denied claims, financial loss, or lack of essential services in emergencies. Knowing these distinctions helps digital nomads and expatriates make informed decisions that suit their unique residency and work status internationally.

Comparison Table

| Feature | Digital Nomad Insurance | Expat Insurance |

|---|---|---|

| Target Audience | Remote workers traveling frequently | Long-term residents abroad |

| Coverage Duration | Short-term to medium-term | Long-term, often yearly |

| Medical Coverage | Global, with emergency and routine care | Comprehensive local healthcare coverage |

| Travel Coverage | Included, covers multiple countries | Limited, usually within one country |

| Cost | Moderate, flexible plans | Higher, customized plans |

| Enrollment Flexibility | Easy online enrollment anytime | May require residency proof and health checks |

| Additional Benefits | Remote work tools, telemedicine | Local support services, chronic condition management |

Which is better?

Digital nomad insurance offers flexible, short-term coverage tailored to remote workers who frequently change locations, providing protection for health, travel, and equipment. Expat insurance is designed for individuals residing long-term in a foreign country, focusing on comprehensive health benefits and local medical network access. Choosing the better option depends on the duration of stay, lifestyle needs, and specific coverage requirements related to mobility and residency status.

Connection

Digital nomad insurance and expat insurance both provide tailored coverage for individuals living outside their home countries, addressing unique risks such as healthcare, travel disruptions, and liability. Both types of insurance prioritize flexible, global coverage that adapts to changing locations and regulatory environments. These policies often overlap in providing essential protections for long-term international stays, ensuring financial security and access to medical services worldwide.

Key Terms

Coverage Duration

Expat insurance typically offers long-term coverage designed for individuals living abroad indefinitely or for several years, covering health, property, and repatriation needs. Digital nomad insurance caters to short-term or flexible coverage periods aligned with the transient lifestyle, emphasizing travel health benefits and adaptability across multiple countries. Explore the differences in coverage duration and benefits to find the best insurance solution for your international lifestyle.

Portability

Expat insurance primarily covers individuals residing abroad long-term, often requiring local registrations, while digital nomad insurance emphasizes global portability, allowing seamless coverage across multiple countries. The portability feature of digital nomad insurance ensures continuous protection during frequent international travel without the need for policy adjustments. Explore comprehensive options to find insurance solutions tailored to your mobility needs.

Residency Requirements

Expat insurance typically requires proof of residency in a specific country, offering tailored coverage based on local healthcare systems and legal frameworks, whereas digital nomad insurance provides more flexible terms without stringent residency obligations, catering to individuals who move frequently across borders. Digital nomad plans often include global health coverage and emergency evacuation, essential for maintaining protection while transitioning between countries. Explore the differences in policy specifics and eligibility criteria to find the insurance that best suits your lifestyle.

Source and External Links

Expat Insurance for Individuals, Corporates & Families - Provides comprehensive expat insurance options for individuals, families, and corporates worldwide, covering health, life, and income protection.

Expat Health Insurance: What to Know Before Moving Abroad - Offers insights into expat health insurance, explaining the importance of coverage, costs, and tips for choosing the right plan.

Expat Insurance: Health, Life and Travel Plans for Expatriates - Specializes in providing comprehensive expatriate insurance plans, including health, life, disability, and income protection for those living abroad.

dowidth.com

dowidth.com