Flood insurance integration focuses on protecting properties and infrastructure from water damage caused by floods, leveraging risk assessment models and satellite data for accurate coverage. Crop insurance integration emphasizes safeguarding agricultural yields against weather volatility and natural disasters, utilizing real-time climate analytics and yield prediction algorithms. Explore the differences and benefits of both insurance integrations to optimize your risk management strategy.

Why it is important

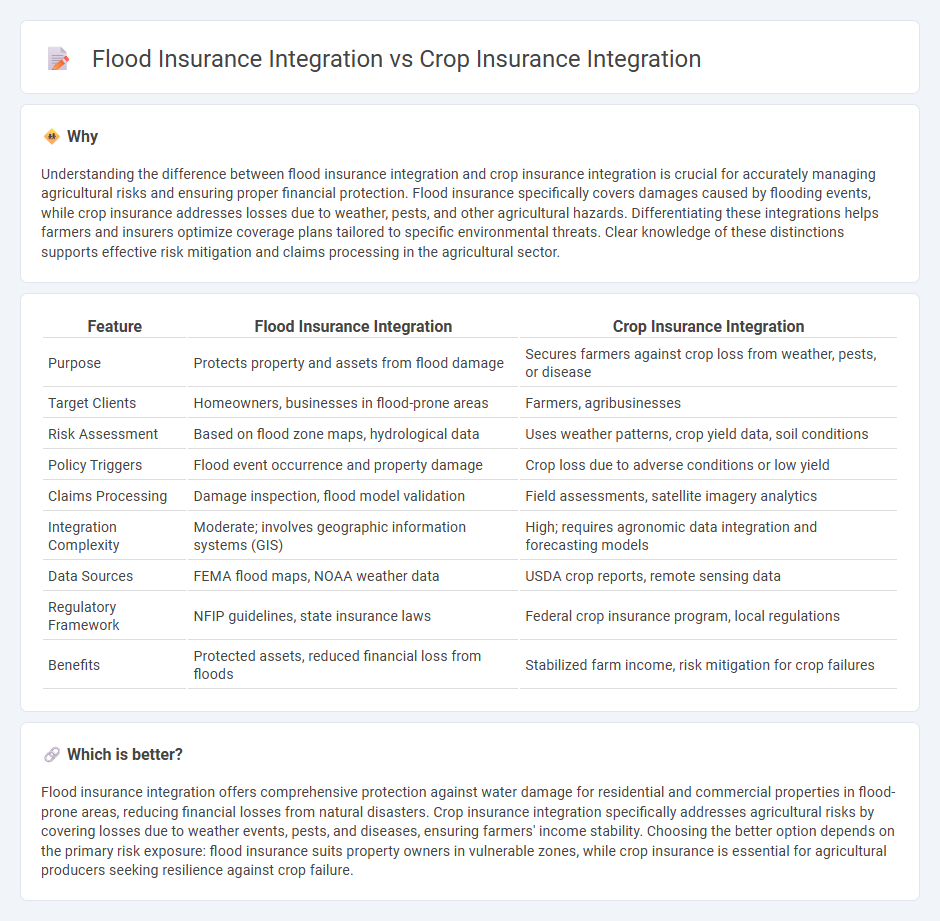

Understanding the difference between flood insurance integration and crop insurance integration is crucial for accurately managing agricultural risks and ensuring proper financial protection. Flood insurance specifically covers damages caused by flooding events, while crop insurance addresses losses due to weather, pests, and other agricultural hazards. Differentiating these integrations helps farmers and insurers optimize coverage plans tailored to specific environmental threats. Clear knowledge of these distinctions supports effective risk mitigation and claims processing in the agricultural sector.

Comparison Table

| Feature | Flood Insurance Integration | Crop Insurance Integration |

|---|---|---|

| Purpose | Protects property and assets from flood damage | Secures farmers against crop loss from weather, pests, or disease |

| Target Clients | Homeowners, businesses in flood-prone areas | Farmers, agribusinesses |

| Risk Assessment | Based on flood zone maps, hydrological data | Uses weather patterns, crop yield data, soil conditions |

| Policy Triggers | Flood event occurrence and property damage | Crop loss due to adverse conditions or low yield |

| Claims Processing | Damage inspection, flood model validation | Field assessments, satellite imagery analytics |

| Integration Complexity | Moderate; involves geographic information systems (GIS) | High; requires agronomic data integration and forecasting models |

| Data Sources | FEMA flood maps, NOAA weather data | USDA crop reports, remote sensing data |

| Regulatory Framework | NFIP guidelines, state insurance laws | Federal crop insurance program, local regulations |

| Benefits | Protected assets, reduced financial loss from floods | Stabilized farm income, risk mitigation for crop failures |

Which is better?

Flood insurance integration offers comprehensive protection against water damage for residential and commercial properties in flood-prone areas, reducing financial losses from natural disasters. Crop insurance integration specifically addresses agricultural risks by covering losses due to weather events, pests, and diseases, ensuring farmers' income stability. Choosing the better option depends on the primary risk exposure: flood insurance suits property owners in vulnerable zones, while crop insurance is essential for agricultural producers seeking resilience against crop failure.

Connection

Flood insurance integration and crop insurance integration both enhance agricultural risk management by providing comprehensive coverage against natural disasters. Integrating these insurance types allows farmers to protect their investments from water-related damages, including flooding and crop loss due to excessive rain or water runoff. This combined approach improves financial resilience and supports steady agricultural productivity in flood-prone areas.

Key Terms

Risk Assessment

Crop insurance integration emphasizes comprehensive risk assessment through historical yield data, weather patterns, and pest infestation probabilities to safeguard farmers' livelihoods. Flood insurance integration relies on detailed hydrological models, floodplain maps, and property elevation data to accurately estimate potential flood damage and risk exposure. Explore more to understand how these distinct risk assessment methods enhance insurance solutions.

Coverage Scope

Crop insurance integration primarily covers risks related to adverse weather conditions, pests, and disease affecting agricultural yields, ensuring financial protection for farmers. Flood insurance integration focuses specifically on property and asset protection against flood damage, often underwritten through government-backed programs like the National Flood Insurance Program (NFIP) in the United States. Explore further to understand how each insurance type enhances risk management strategies tailored to distinct exposure profiles.

Claims Process

Crop insurance integration streamlines claims processing through real-time data from satellite imagery and weather monitoring systems, enabling faster damage assessment and immediate payouts to farmers. Flood insurance integration uses advanced hydrological models and IoT sensors to assess flood extent and validate claims, minimizing fraud and expediting settlement times. Explore how combining these technologies enhances accuracy and efficiency in claims management.

Source and External Links

DON'T HARM CROP INSURANCE, IMPROVE IT! - This article discusses the importance of improving crop insurance without harming it, focusing on the need to integrate more effective risk management practices into the existing system.

New AFT Paper Strengthens the Case for Building Bridges between Crop Insurance and Soil Health - This paper highlights the potential benefits of integrating soil health practices into crop insurance to reduce risks and costs associated with climate impacts.

Rising Premiums and Climate Risks: The Future of Crop Insurance - This article explores how insurers can adapt crop insurance policies to better address environmental and technological changes affecting agricultural businesses.

dowidth.com

dowidth.com