Natural catastrophe bonds transfer disaster risk from insurers to capital markets, providing upfront capital to cover losses from events like hurricanes or earthquakes. Excess of loss treaties are reinsurance agreements where coverage kicks in after losses exceed a predefined retention limit, protecting insurers from extreme claims. Explore the advantages and differences of these risk management tools to better understand their roles in insurance.

Why it is important

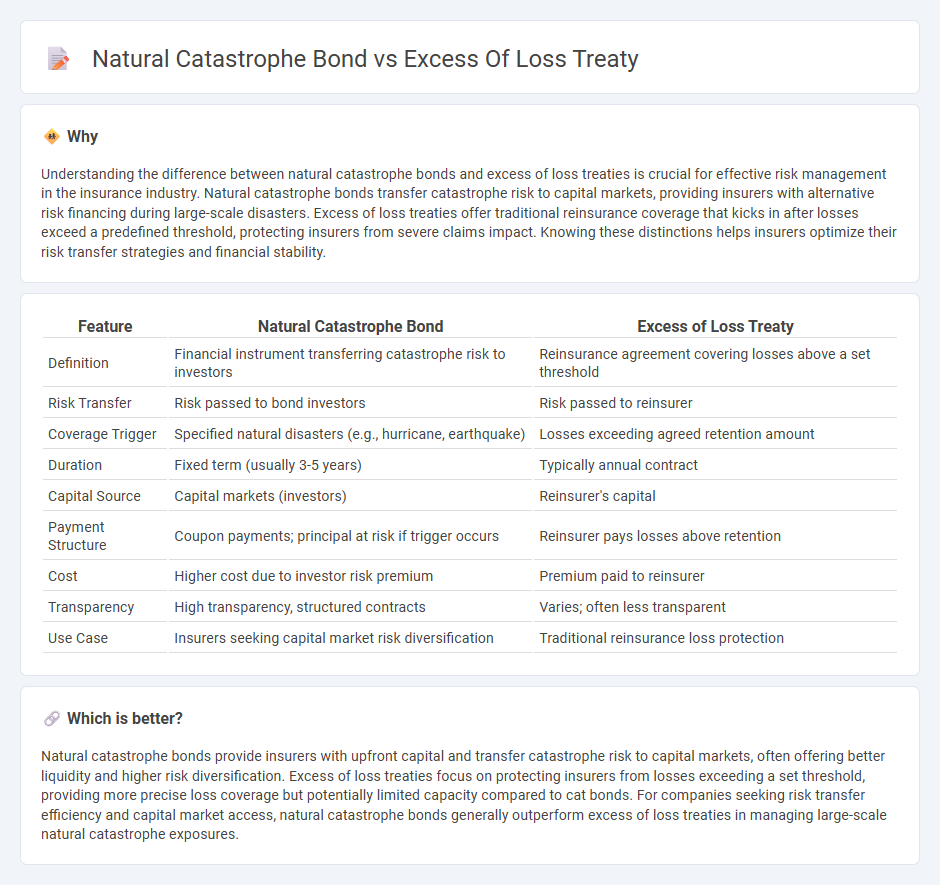

Understanding the difference between natural catastrophe bonds and excess of loss treaties is crucial for effective risk management in the insurance industry. Natural catastrophe bonds transfer catastrophe risk to capital markets, providing insurers with alternative risk financing during large-scale disasters. Excess of loss treaties offer traditional reinsurance coverage that kicks in after losses exceed a predefined threshold, protecting insurers from severe claims impact. Knowing these distinctions helps insurers optimize their risk transfer strategies and financial stability.

Comparison Table

| Feature | Natural Catastrophe Bond | Excess of Loss Treaty |

|---|---|---|

| Definition | Financial instrument transferring catastrophe risk to investors | Reinsurance agreement covering losses above a set threshold |

| Risk Transfer | Risk passed to bond investors | Risk passed to reinsurer |

| Coverage Trigger | Specified natural disasters (e.g., hurricane, earthquake) | Losses exceeding agreed retention amount |

| Duration | Fixed term (usually 3-5 years) | Typically annual contract |

| Capital Source | Capital markets (investors) | Reinsurer's capital |

| Payment Structure | Coupon payments; principal at risk if trigger occurs | Reinsurer pays losses above retention |

| Cost | Higher cost due to investor risk premium | Premium paid to reinsurer |

| Transparency | High transparency, structured contracts | Varies; often less transparent |

| Use Case | Insurers seeking capital market risk diversification | Traditional reinsurance loss protection |

Which is better?

Natural catastrophe bonds provide insurers with upfront capital and transfer catastrophe risk to capital markets, often offering better liquidity and higher risk diversification. Excess of loss treaties focus on protecting insurers from losses exceeding a set threshold, providing more precise loss coverage but potentially limited capacity compared to cat bonds. For companies seeking risk transfer efficiency and capital market access, natural catastrophe bonds generally outperform excess of loss treaties in managing large-scale natural catastrophe exposures.

Connection

Natural catastrophe bonds transfer disaster risk from insurers to capital markets, providing funds to cover losses from events like hurricanes or earthquakes. Excess of loss treaties offer reinsurance protection by limiting an insurer's losses above a specified retention level. Both mechanisms enhance an insurer's risk management strategy by mitigating large-scale catastrophe exposure and improving capital efficiency.

Key Terms

Attachment Point

An excess of loss treaty sets an attachment point representing the insurer's retained loss limit before the reinsurer covers the excess, typically based on historical loss data and risk tolerance. Natural catastrophe bonds have an attachment point defined by parametric triggers or modeled loss thresholds, linking payouts directly to predefined catastrophic event metrics. Explore the nuances of attachment point structures to understand their impact on risk transfer and capital efficiency.

Risk Transfer

Excess of loss treaties transfer risk from insurers to reinsurers by capping losses beyond a specified retention, effectively protecting insurers from large individual claims or aggregate losses. Natural catastrophe bonds (cat bonds) transfer risk to capital market investors by providing coverage for catastrophic events, with principal repayment contingent on the occurrence of predefined natural disasters. Explore the nuances of these risk transfer instruments to optimize your catastrophe risk management strategy.

Trigger Event

An excess of loss treaty triggers indemnity payments once incurred losses exceed a predetermined retention, providing layered reinsurance coverage based on actual loss experience. In contrast, a natural catastrophe bond activates payouts upon specific parametric or index-based trigger events, such as reaching a threshold wind speed or earthquake magnitude, independent of the insured's actual losses. Explore deeper insights on how these trigger mechanisms impact risk transfer strategies and capital efficiency.

Source and External Links

Pricing Excess-of-Loss Casualty Working Cover Reinsurance Treaties - An excess-of-loss reinsurance treaty provides the primary insurer protection by covering losses exceeding a fixed retention up to a maximum amount per loss event, transferring layers of risk from the insurance company to the reinsurer.

treaty reinsurance - IRMI - Excess-of-loss treaties are a form of nonproportional reinsurance that cover losses above a specified retention point, often layered to protect insurers against large or catastrophic claims by ceding risk over a certain threshold to reinsurers.

Excess of Loss Reinsurance 101 - Number Analytics - Excess of loss reinsurance is a treaty protecting insurers from losses exceeding a retention limit, mathematically representing how the reinsurer pays losses above a deductible up to a capped amount, which supports risk and capital management strategies.

dowidth.com

dowidth.com