Pay-as-you-drive insurance calculates premiums based on the actual miles driven, promoting cost savings for low-mileage drivers and encouraging reduced road usage. Telematics insurance uses devices or apps to monitor driving behavior, including speed, acceleration, and braking, enabling personalized risk assessments and tailored premiums. Explore the differences and benefits of these innovative insurance models to choose the best option for your driving habits.

Why it is important

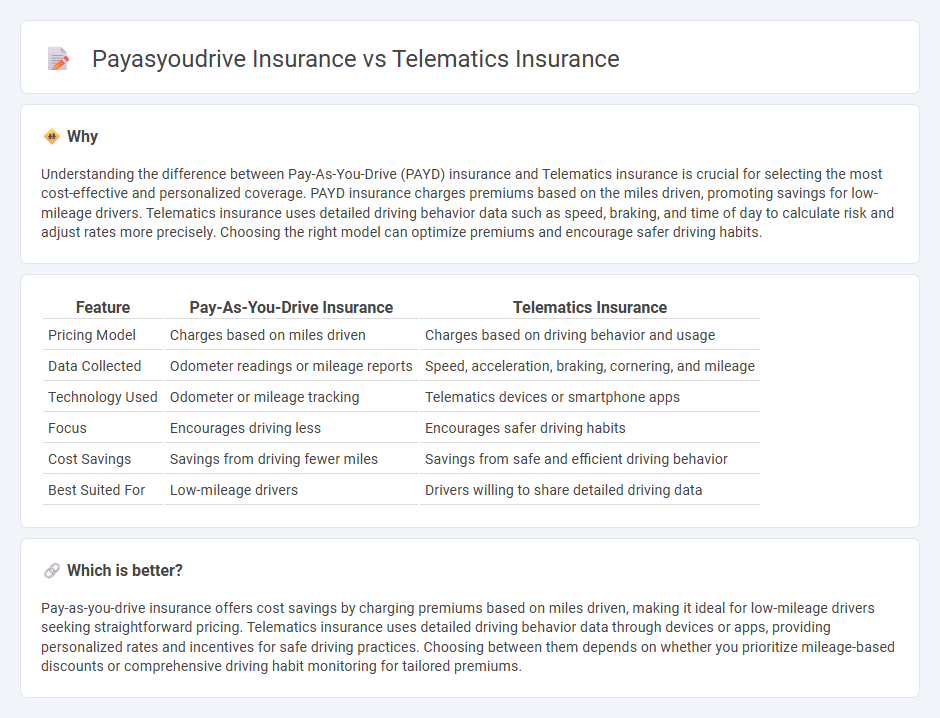

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Telematics insurance is crucial for selecting the most cost-effective and personalized coverage. PAYD insurance charges premiums based on the miles driven, promoting savings for low-mileage drivers. Telematics insurance uses detailed driving behavior data such as speed, braking, and time of day to calculate risk and adjust rates more precisely. Choosing the right model can optimize premiums and encourage safer driving habits.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Telematics Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on driving behavior and usage |

| Data Collected | Odometer readings or mileage reports | Speed, acceleration, braking, cornering, and mileage |

| Technology Used | Odometer or mileage tracking | Telematics devices or smartphone apps |

| Focus | Encourages driving less | Encourages safer driving habits |

| Cost Savings | Savings from driving fewer miles | Savings from safe and efficient driving behavior |

| Best Suited For | Low-mileage drivers | Drivers willing to share detailed driving data |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on miles driven, making it ideal for low-mileage drivers seeking straightforward pricing. Telematics insurance uses detailed driving behavior data through devices or apps, providing personalized rates and incentives for safe driving practices. Choosing between them depends on whether you prioritize mileage-based discounts or comprehensive driving habit monitoring for tailored premiums.

Connection

Pay-as-you-drive insurance and telematics insurance are interconnected through the use of real-time driving data collected via telematics devices or smartphone apps to calculate premiums based on actual vehicle usage and driving behavior. This data-driven approach enables insurers to offer personalized rates that reflect distance traveled, driving habits, and risk levels, promoting safer driving and cost savings. The integration of telematics technology is essential for accurately implementing pay-as-you-drive insurance models and enhancing policy transparency.

Key Terms

Data Collection

Telematics insurance collects comprehensive driving data, including speed, acceleration, braking patterns, and trip duration, via a built-in device or smartphone app to assess risk accurately. Pay-as-you-drive insurance primarily tracks mileage and driving exposure, using odometer readings or GPS data to calculate premiums based on distance driven. Explore the differences in data collection methods to understand which insurance model suits your driving habits best.

Pricing Model

Telematics insurance employs usage data from devices to tailor premiums based on driving behavior, offering risk-based pricing that often rewards safe drivers with lower rates. Pay-as-you-drive (PAYD) insurance calculates premiums primarily on the actual miles driven, providing a straightforward cost-saving model for low-mileage drivers. To explore how these pricing models fit your driving habits and budget, learn more about telematics and PAYD insurance options.

Usage Monitoring

Telematics insurance relies on continuous real-time data collection through devices installed in the vehicle to monitor driving behavior, enabling insurers to assess risk more accurately and offer personalized premiums. Pay-as-you-drive insurance calculates costs based primarily on the total miles driven, making it simpler but less detailed than telematics systems that track speed, acceleration, braking, and trip times. Explore further how usage monitoring technologies transform insurance pricing models and driver incentives.

Source and External Links

Telematics Insurance: How it Works, Benefits + Providers - Telematics insurance uses GPS trackers, mobile apps, or vehicle monitoring systems to collect driving data (like speed, braking, and mileage), allowing insurers to set personalized, usage-based premiums that reward safe driving and help lower overall costs by adjusting rates based on actual driving behavior rather than demographics.

What is Telematics Insurance? - Telematics insurance, often called black box insurance, involves installing a device in a vehicle to track driving habits, mileage, and location, generating a driving score that directly affects insurance premiums, with options including black box devices, OBD plug-ins, or smartphone apps, and some policies offering pay-as-you-go or pay-per-mile plans.

Background on: Pay-as-you drive auto insurance (telematics) - Telematics auto insurance, also known as usage-based insurance (UBI), uses technology to collect data on driving habits, mileage, and other factors (such as time of day and road conditions) to tailor premiums more precisely to individual risk profiles, moving away from traditional rate-setting based on broad categories.

dowidth.com

dowidth.com