Insurtech platforms leverage advanced technology to streamline insurance processes, offering scalable solutions that improve customer experience and operational efficiency. Digital MGAs act as specialized intermediaries authorized to underwrite and manage policies with agility and market-specific expertise, combining digital tools with underwriting authority. Explore how these innovative models are transforming the insurance landscape.

Why it is important

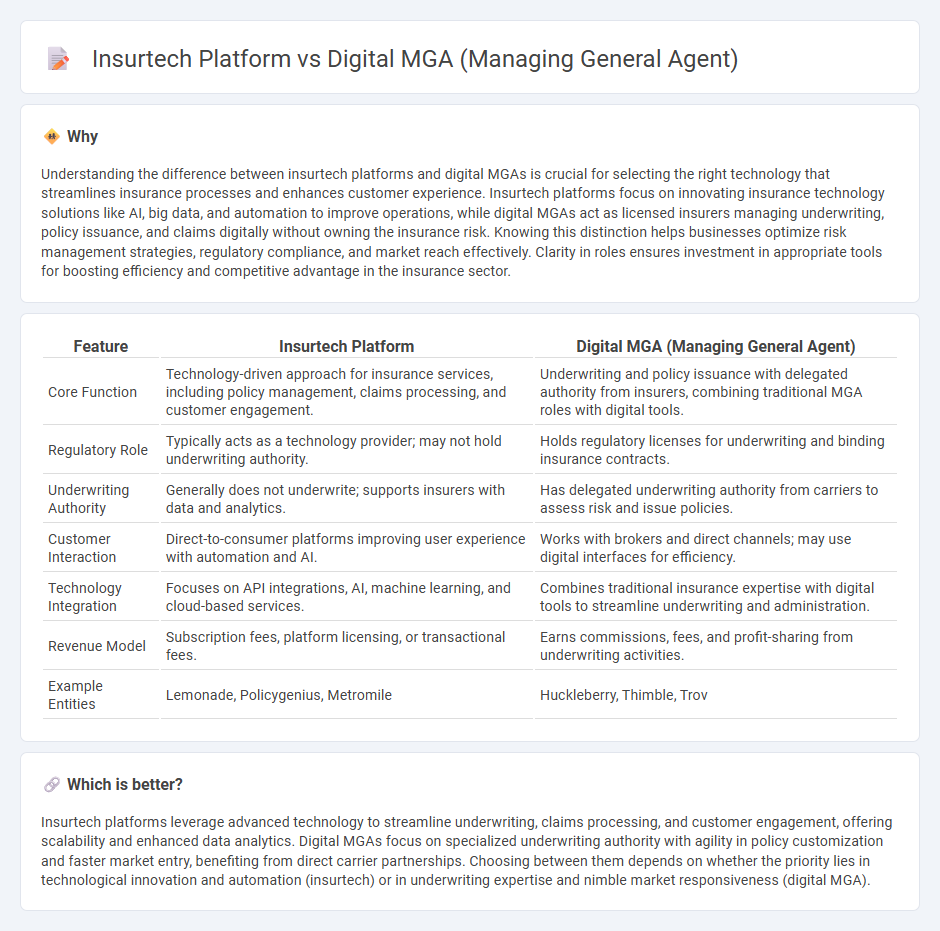

Understanding the difference between insurtech platforms and digital MGAs is crucial for selecting the right technology that streamlines insurance processes and enhances customer experience. Insurtech platforms focus on innovating insurance technology solutions like AI, big data, and automation to improve operations, while digital MGAs act as licensed insurers managing underwriting, policy issuance, and claims digitally without owning the insurance risk. Knowing this distinction helps businesses optimize risk management strategies, regulatory compliance, and market reach effectively. Clarity in roles ensures investment in appropriate tools for boosting efficiency and competitive advantage in the insurance sector.

Comparison Table

| Feature | Insurtech Platform | Digital MGA (Managing General Agent) |

|---|---|---|

| Core Function | Technology-driven approach for insurance services, including policy management, claims processing, and customer engagement. | Underwriting and policy issuance with delegated authority from insurers, combining traditional MGA roles with digital tools. |

| Regulatory Role | Typically acts as a technology provider; may not hold underwriting authority. | Holds regulatory licenses for underwriting and binding insurance contracts. |

| Underwriting Authority | Generally does not underwrite; supports insurers with data and analytics. | Has delegated underwriting authority from carriers to assess risk and issue policies. |

| Customer Interaction | Direct-to-consumer platforms improving user experience with automation and AI. | Works with brokers and direct channels; may use digital interfaces for efficiency. |

| Technology Integration | Focuses on API integrations, AI, machine learning, and cloud-based services. | Combines traditional insurance expertise with digital tools to streamline underwriting and administration. |

| Revenue Model | Subscription fees, platform licensing, or transactional fees. | Earns commissions, fees, and profit-sharing from underwriting activities. |

| Example Entities | Lemonade, Policygenius, Metromile | Huckleberry, Thimble, Trov |

Which is better?

Insurtech platforms leverage advanced technology to streamline underwriting, claims processing, and customer engagement, offering scalability and enhanced data analytics. Digital MGAs focus on specialized underwriting authority with agility in policy customization and faster market entry, benefiting from direct carrier partnerships. Choosing between them depends on whether the priority lies in technological innovation and automation (insurtech) or in underwriting expertise and nimble market responsiveness (digital MGA).

Connection

Insurtech platforms leverage advanced technology to streamline insurance processes, enabling digital MGAs (Managing General Agents) to operate efficiently by automating underwriting, policy management, and claims processing. Digital MGAs utilize these platforms to access real-time data analytics and AI-driven risk assessment tools, enhancing customer experience and operational agility. This integration accelerates product innovation and market responsiveness within the insurance industry.

Key Terms

**Digital MGA:**

Digital MGAs leverage advanced data analytics and automation to streamline underwriting, policy issuance, and claims processing, enhancing efficiency and risk assessment accuracy. They operate with greater agility compared to traditional insurers by integrating technology for real-time decision-making and customer-centric services. Discover how Digital MGAs transform the insurance landscape and drive innovation in risk management.

Underwriting Authority

A digital MGA holds underwriting authority, enabling them to assess and bind risks directly, streamline policy issuance, and tailor coverage with agility. Insurtech platforms primarily facilitate data analytics, automation, and customer engagement but often lack direct underwriting power. Explore how leveraging underwriting authority in digital MGAs transforms risk management and accelerates insurance innovation.

Risk Selection

Digital MGAs leverage advanced algorithms and data analytics to enhance risk selection by accurately assessing policyholder risk profiles and underwriting criteria. Insurtech platforms often integrate AI and machine learning tools that provide real-time risk evaluation, automating the underwriting process to improve decision accuracy. Explore how each approach transforms risk selection and underwriting efficiency in modern insurance.

Source and External Links

Digital MGA - A digital MGA uses a cloud-based platform to streamline underwriting and policy management processes by integrating data and automating workflows, enabling faster quote and policy issuance, real-time insights, and improved broker service.

A Digital Workforce for Managing General Agents - Digital MGAs benefit from robotic process automation to handle repetitive tasks such as pricing and data gathering, allowing MGAs to focus on value-added activities like client engagement and claims management.

What is a "Digital MGA"? - A digital MGA operates mostly online with little need for face-to-face interaction, leveraging advanced technologies like AI and blockchain to enhance underwriting and customer service, reflecting a shift toward automation and digital servicing in the MGA space.

dowidth.com

dowidth.com