Flood insurance integration focuses on protecting properties from financial losses due to water damage caused by natural flooding events, while professional indemnity insurance integration aims to cover legal costs and claims arising from professional negligence or errors. Both insurance types require tailored integration solutions to address specific risk management needs and regulatory compliance within their respective industries. Discover more about how these insurance integrations can safeguard your assets and professional reputation.

Why it is important

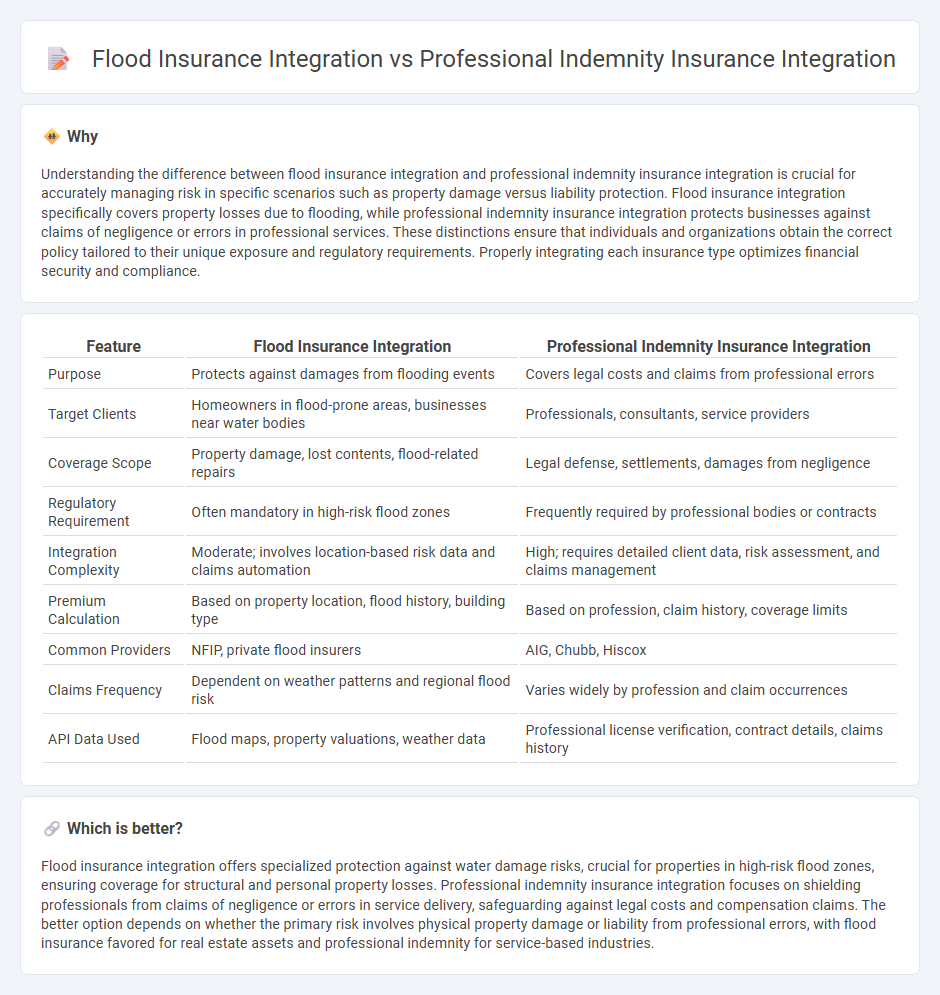

Understanding the difference between flood insurance integration and professional indemnity insurance integration is crucial for accurately managing risk in specific scenarios such as property damage versus liability protection. Flood insurance integration specifically covers property losses due to flooding, while professional indemnity insurance integration protects businesses against claims of negligence or errors in professional services. These distinctions ensure that individuals and organizations obtain the correct policy tailored to their unique exposure and regulatory requirements. Properly integrating each insurance type optimizes financial security and compliance.

Comparison Table

| Feature | Flood Insurance Integration | Professional Indemnity Insurance Integration |

|---|---|---|

| Purpose | Protects against damages from flooding events | Covers legal costs and claims from professional errors |

| Target Clients | Homeowners in flood-prone areas, businesses near water bodies | Professionals, consultants, service providers |

| Coverage Scope | Property damage, lost contents, flood-related repairs | Legal defense, settlements, damages from negligence |

| Regulatory Requirement | Often mandatory in high-risk flood zones | Frequently required by professional bodies or contracts |

| Integration Complexity | Moderate; involves location-based risk data and claims automation | High; requires detailed client data, risk assessment, and claims management |

| Premium Calculation | Based on property location, flood history, building type | Based on profession, claim history, coverage limits |

| Common Providers | NFIP, private flood insurers | AIG, Chubb, Hiscox |

| Claims Frequency | Dependent on weather patterns and regional flood risk | Varies widely by profession and claim occurrences |

| API Data Used | Flood maps, property valuations, weather data | Professional license verification, contract details, claims history |

Which is better?

Flood insurance integration offers specialized protection against water damage risks, crucial for properties in high-risk flood zones, ensuring coverage for structural and personal property losses. Professional indemnity insurance integration focuses on shielding professionals from claims of negligence or errors in service delivery, safeguarding against legal costs and compensation claims. The better option depends on whether the primary risk involves physical property damage or liability from professional errors, with flood insurance favored for real estate assets and professional indemnity for service-based industries.

Connection

Flood insurance integration and professional indemnity insurance integration are connected through comprehensive risk management strategies that protect businesses from both physical property damage and liability claims. By combining these insurance types, organizations can address risks associated with natural disasters and errors or omissions in professional services, ensuring financial stability. This integration supports seamless claims processing and policy administration, enhancing overall coverage efficiency.

Key Terms

Liability Coverage

Professional indemnity insurance integration centers on protecting businesses and professionals against claims of negligence, errors, or omissions in their professional services, emphasizing liability coverage for legal defense and damages. Flood insurance integration focuses on covering physical property damage caused by flooding, which typically excludes liability claims but safeguards assets from environmental risks. Explore more to understand how each insurance type aligns with your risk management strategy and compliance needs.

Sum Insured

Professional indemnity insurance integration centers on calculating an adequate sum insured based on potential legal liabilities, while flood insurance integration emphasizes coverage limits corresponding to property value and varying flood risk zones. Precise determination of the sum insured ensures comprehensive protection against financial losses in both insurance types, tailored to their specific risk exposures. Explore further to understand how sum insured optimization enhances risk management effectiveness in these integrations.

Peril Definition

Professional indemnity insurance integration centers on coverage for legal liabilities arising from errors, omissions, or negligent acts in professional services, specifically defining perils related to claims and lawsuits due to professional mistakes. Flood insurance integration focuses on natural disaster perils, explicitly covering physical damage or loss caused by flooding, which is typically excluded from standard property policies. Learn more about how peril definitions influence the scope and application of insurance integrations to enhance risk management strategies.

Source and External Links

How Extensions to Professional Indemnity Insurance Can Provide Customised Protection - Professional indemnity insurance (PI) can be integrated and tailored with various policy extensions to cover specific industry risks and liabilities, enhancing protection flexibility for services-based businesses.

Professional Liability for Integrated Project Delivery | NFP - For integrated project delivery (IPD) arrangements, professional liability insurance integration involves broad definitions of professional services, joint defense approaches, and clear exclusion clauses to align coverage with complex collaboration frameworks.

Professional Indemnity Insurance - WTW - Professional indemnity insurance is integrated with specialized industry knowledge and claims expertise to tailor policies that protect businesses from financial impact of errors, omissions, and negligence specific to multiple professional sectors.

dowidth.com

dowidth.com