Telematics insurance uses real-time data collected from a vehicle's GPS and onboard diagnostics to monitor driving behavior and adjust premiums accordingly, providing personalized rates based on factors such as speed, braking, and mileage. Pay-as-you-drive insurance calculates premiums primarily based on the actual miles driven, offering cost savings for low-mileage drivers by linking insurance costs directly to vehicle usage. Explore the differences and benefits of telematics versus pay-as-you-drive insurance to find the best option tailored to your driving habits.

Why it is important

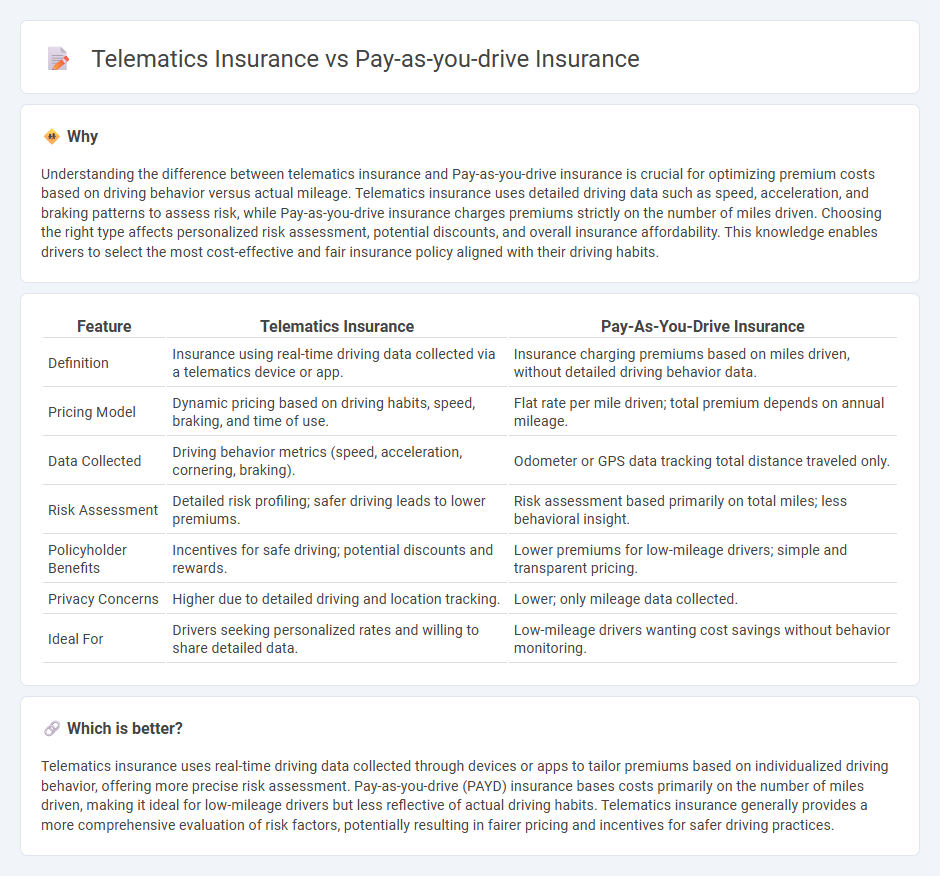

Understanding the difference between telematics insurance and Pay-as-you-drive insurance is crucial for optimizing premium costs based on driving behavior versus actual mileage. Telematics insurance uses detailed driving data such as speed, acceleration, and braking patterns to assess risk, while Pay-as-you-drive insurance charges premiums strictly on the number of miles driven. Choosing the right type affects personalized risk assessment, potential discounts, and overall insurance affordability. This knowledge enables drivers to select the most cost-effective and fair insurance policy aligned with their driving habits.

Comparison Table

| Feature | Telematics Insurance | Pay-As-You-Drive Insurance |

|---|---|---|

| Definition | Insurance using real-time driving data collected via a telematics device or app. | Insurance charging premiums based on miles driven, without detailed driving behavior data. |

| Pricing Model | Dynamic pricing based on driving habits, speed, braking, and time of use. | Flat rate per mile driven; total premium depends on annual mileage. |

| Data Collected | Driving behavior metrics (speed, acceleration, cornering, braking). | Odometer or GPS data tracking total distance traveled only. |

| Risk Assessment | Detailed risk profiling; safer driving leads to lower premiums. | Risk assessment based primarily on total miles; less behavioral insight. |

| Policyholder Benefits | Incentives for safe driving; potential discounts and rewards. | Lower premiums for low-mileage drivers; simple and transparent pricing. |

| Privacy Concerns | Higher due to detailed driving and location tracking. | Lower; only mileage data collected. |

| Ideal For | Drivers seeking personalized rates and willing to share detailed data. | Low-mileage drivers wanting cost savings without behavior monitoring. |

Which is better?

Telematics insurance uses real-time driving data collected through devices or apps to tailor premiums based on individualized driving behavior, offering more precise risk assessment. Pay-as-you-drive (PAYD) insurance bases costs primarily on the number of miles driven, making it ideal for low-mileage drivers but less reflective of actual driving habits. Telematics insurance generally provides a more comprehensive evaluation of risk factors, potentially resulting in fairer pricing and incentives for safer driving practices.

Connection

Telematics insurance and Pay-as-you-drive (PAYD) insurance both utilize real-time driving data collected through GPS and onboard diagnostics to calculate premiums based on actual driving behavior and mileage. By monitoring speed, acceleration, braking patterns, and distance traveled, these insurance models provide personalized risk assessments that encourage safer driving habits. This data-driven approach allows insurers to offer more accurate, usage-based pricing that aligns cost with individual risk profiles.

Key Terms

Mileage Tracking

Pay-as-you-drive insurance bases premiums primarily on the total miles driven, using odometer readings or periodic mileage reports to assess risk and cost. Telematics insurance incorporates advanced in-vehicle devices or smartphone apps to monitor real-time driving behavior, including mileage, speed, acceleration, and braking patterns, offering a more comprehensive analysis of risk. Explore how mileage tracking impacts your insurance premiums and discover which option suits your driving habits best.

Driving Behavior Monitoring

Pay-as-you-drive insurance bases premiums primarily on the distance driven, offering a straightforward cost-saving method for low-mileage drivers. Telematics insurance uses detailed driving behavior monitoring, analyzing factors such as speed, acceleration, braking, and cornering patterns to customize rates more precisely. Explore the advantages of each option to determine which aligns best with your driving habits and insurance needs.

Premium Calculation

Pay-as-you-drive insurance calculates premiums based primarily on the number of miles driven, directly linking cost to usage and encouraging reduced driving for savings. Telematics insurance uses real-time data from a device or app to assess driving behavior such as speed, braking, and acceleration, providing a more personalized premium based on risk factors. Explore the nuances of premium calculation to determine which insurance model best suits your driving habits and financial goals.

Source and External Links

Buy Pay As You Drive Car Insurance Online - Policybazaar - Pay-as-you-drive car insurance allows you to pay a premium based on the total number of kilometres driven each year, potentially saving money if you drive infrequently, and includes options to top up kilometres if needed.

Pay as You Drive (PAYD) Car Insurance by Digit, Up to 90% Off - Digit's PAYD is an add-on for comprehensive or own damage policies that offers discounts up to 85% on premiums if you drive less than 10,000 km annually, with simple declarations and no need for special tracking devices.

dowidth.com

dowidth.com