Crop insurance safeguards farmers against losses due to natural disasters, pests, and adverse weather, ensuring financial stability for agricultural operations. Auto insurance provides coverage for vehicle damage, liability, and medical expenses resulting from accidents, promoting road safety and legal compliance. Explore the differences and benefits of crop insurance versus auto insurance to make informed coverage choices.

Why it is important

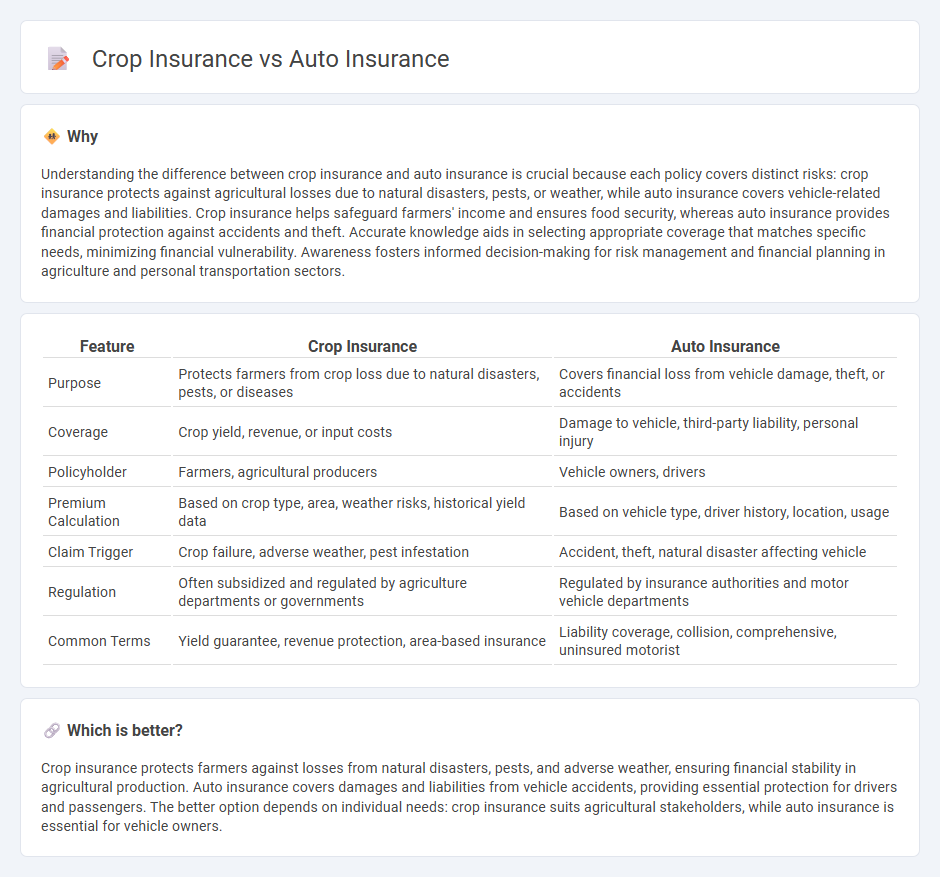

Understanding the difference between crop insurance and auto insurance is crucial because each policy covers distinct risks: crop insurance protects against agricultural losses due to natural disasters, pests, or weather, while auto insurance covers vehicle-related damages and liabilities. Crop insurance helps safeguard farmers' income and ensures food security, whereas auto insurance provides financial protection against accidents and theft. Accurate knowledge aids in selecting appropriate coverage that matches specific needs, minimizing financial vulnerability. Awareness fosters informed decision-making for risk management and financial planning in agriculture and personal transportation sectors.

Comparison Table

| Feature | Crop Insurance | Auto Insurance |

|---|---|---|

| Purpose | Protects farmers from crop loss due to natural disasters, pests, or diseases | Covers financial loss from vehicle damage, theft, or accidents |

| Coverage | Crop yield, revenue, or input costs | Damage to vehicle, third-party liability, personal injury |

| Policyholder | Farmers, agricultural producers | Vehicle owners, drivers |

| Premium Calculation | Based on crop type, area, weather risks, historical yield data | Based on vehicle type, driver history, location, usage |

| Claim Trigger | Crop failure, adverse weather, pest infestation | Accident, theft, natural disaster affecting vehicle |

| Regulation | Often subsidized and regulated by agriculture departments or governments | Regulated by insurance authorities and motor vehicle departments |

| Common Terms | Yield guarantee, revenue protection, area-based insurance | Liability coverage, collision, comprehensive, uninsured motorist |

Which is better?

Crop insurance protects farmers against losses from natural disasters, pests, and adverse weather, ensuring financial stability in agricultural production. Auto insurance covers damages and liabilities from vehicle accidents, providing essential protection for drivers and passengers. The better option depends on individual needs: crop insurance suits agricultural stakeholders, while auto insurance is essential for vehicle owners.

Connection

Crop insurance and auto insurance are connected through risk management strategies designed to protect financial assets against unpredictable events. Both types of insurance help mitigate losses--crop insurance covers agricultural production risks such as drought or pests, while auto insurance addresses vehicle damage and liability. Utilizing data analytics and actuarial assessments, insurers tailor policies that reduce exposure to natural disasters and accidents, ensuring stability for farmers and drivers alike.

Key Terms

**Liability Coverage**

Liability coverage in auto insurance protects policyholders against legal responsibility for bodily injury or property damage caused to others during a vehicle accident, typically covering medical expenses, repair costs, and legal fees. Crop insurance liability coverage, while less common, addresses third-party claims related to damage caused by farming operations, such as pesticide drift or equipment accidents, safeguarding farmers from potential lawsuits. Explore detailed comparisons and policy nuances to understand how liability coverage functions uniquely in auto and crop insurance.

**Comprehensive Coverage**

Comprehensive coverage in auto insurance protects vehicles from non-collision events such as theft, vandalism, natural disasters, and animal damage, providing extensive financial security for drivers. Crop insurance with comprehensive coverage safeguards farmers against a wide range of perils including drought, floods, pests, and disease, securing agricultural investments beyond basic yield losses. Explore detailed comparisons and benefits to understand which coverage suits your specific insurance needs.

**Yield Protection**

Yield Protection in crop insurance safeguards farmers against loss of expected harvest due to natural causes, ensuring financial stability when crops fail to meet projected yields. Unlike auto insurance, which covers vehicle damage or liability, crop insurance with Yield Protection specifically mitigates risks inherent to agriculture, including drought, pests, or weather events. Explore deeper insights into Yield Protection coverage to optimize your agricultural risk management strategy.

Source and External Links

Car Insurance - Get A Free Auto Insurance Quote Online - Farmers Insurance offers customizable auto insurance with coverage options including comprehensive, collision, and liability, tailored to protect you against various types of damages and accidents.

Auto Insurance - Office of Insurance and Safety Fire Commissioner - Auto insurance rates depend on underwriting and rating factors such as driving record, location, age, and vehicle type, with discounts available for various risk-reducing features; coverage requirements also vary by state depending on tort or no-fault systems.

Direct Auto: Auto Insurance - Get a Free Quote Today - Direct Auto provides affordable auto insurance with liability, collision, comprehensive, uninsured motorist, and personal injury protection, plus discounts up to 25% and flexible payment plans for different budgets.

dowidth.com

dowidth.com