Mental health insurance covers therapy, counseling, and psychiatric treatments, providing financial support for emotional and psychological well-being. Critical illness insurance offers a lump sum payout upon diagnosis of severe conditions like cancer, heart attack, or stroke, helping cover medical bills and associated expenses. Explore detailed benefits and coverage options to choose the best plan for your needs.

Why it is important

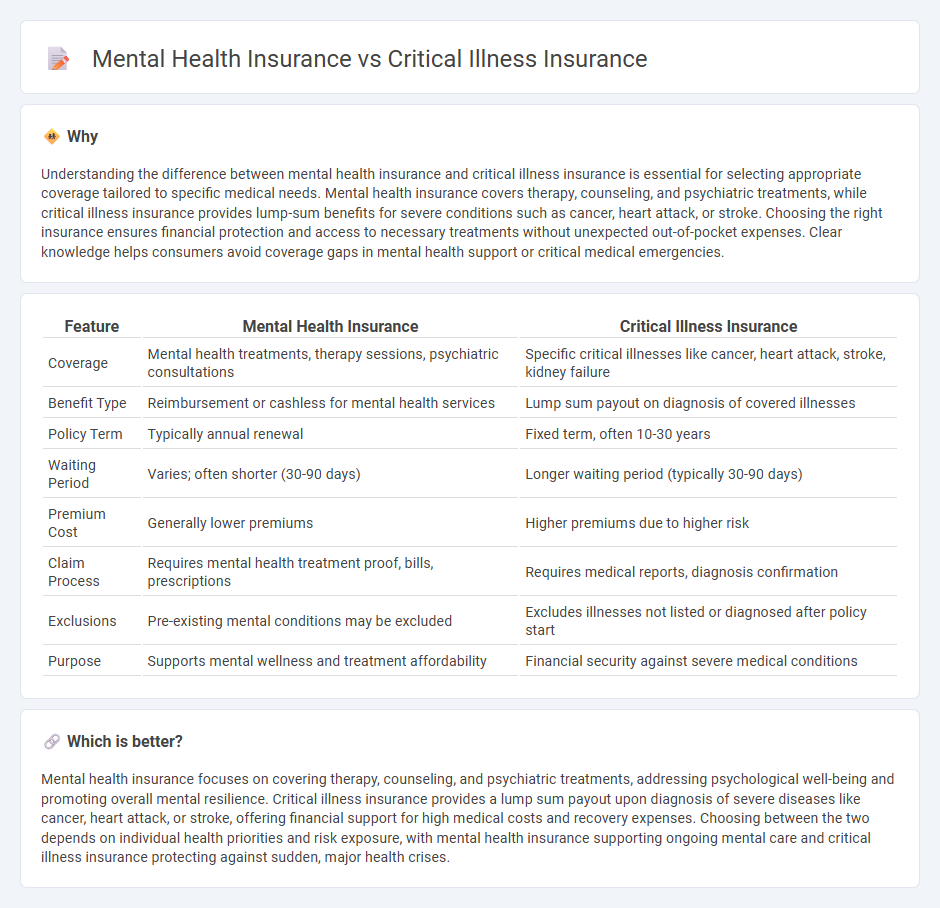

Understanding the difference between mental health insurance and critical illness insurance is essential for selecting appropriate coverage tailored to specific medical needs. Mental health insurance covers therapy, counseling, and psychiatric treatments, while critical illness insurance provides lump-sum benefits for severe conditions such as cancer, heart attack, or stroke. Choosing the right insurance ensures financial protection and access to necessary treatments without unexpected out-of-pocket expenses. Clear knowledge helps consumers avoid coverage gaps in mental health support or critical medical emergencies.

Comparison Table

| Feature | Mental Health Insurance | Critical Illness Insurance |

|---|---|---|

| Coverage | Mental health treatments, therapy sessions, psychiatric consultations | Specific critical illnesses like cancer, heart attack, stroke, kidney failure |

| Benefit Type | Reimbursement or cashless for mental health services | Lump sum payout on diagnosis of covered illnesses |

| Policy Term | Typically annual renewal | Fixed term, often 10-30 years |

| Waiting Period | Varies; often shorter (30-90 days) | Longer waiting period (typically 30-90 days) |

| Premium Cost | Generally lower premiums | Higher premiums due to higher risk |

| Claim Process | Requires mental health treatment proof, bills, prescriptions | Requires medical reports, diagnosis confirmation |

| Exclusions | Pre-existing mental conditions may be excluded | Excludes illnesses not listed or diagnosed after policy start |

| Purpose | Supports mental wellness and treatment affordability | Financial security against severe medical conditions |

Which is better?

Mental health insurance focuses on covering therapy, counseling, and psychiatric treatments, addressing psychological well-being and promoting overall mental resilience. Critical illness insurance provides a lump sum payout upon diagnosis of severe diseases like cancer, heart attack, or stroke, offering financial support for high medical costs and recovery expenses. Choosing between the two depends on individual health priorities and risk exposure, with mental health insurance supporting ongoing mental care and critical illness insurance protecting against sudden, major health crises.

Connection

Mental health insurance and critical illness insurance are interconnected through their shared focus on comprehensive healthcare coverage, addressing both psychological and physical health challenges. While mental health insurance provides benefits for therapy, counseling, and psychiatric treatments, critical illness insurance offers financial protection against severe medical conditions such as cancer, heart attack, or stroke, which often have psychological impacts requiring mental health support. This combined approach ensures holistic patient care by covering treatment costs for critical illnesses and facilitating mental health recovery during or after severe medical episodes.

Key Terms

Coverage Scope

Critical illness insurance covers severe medical conditions such as cancer, heart attack, and stroke, providing lump-sum payments upon diagnosis to help manage treatment costs and lost income. Mental health insurance primarily offers coverage for psychiatric treatments, therapy sessions, medications, and hospitalization related to mental health disorders. Explore the distinctive benefits and limitations of each to determine the best fit for your healthcare needs.

Exclusions

Critical illness insurance typically excludes coverage for mental health conditions, focusing instead on physical diseases such as cancer, heart attack, or stroke. Mental health insurance specializes in treatments related to psychological disorders, often excluding physical illness claims covered by critical illness policies. Explore detailed policy exclusions to choose the insurance plan best suited to your comprehensive health needs.

Payout Structure

Critical illness insurance provides a lump sum payout upon diagnosis of specified severe illnesses such as cancer, heart attack, or stroke, designed to cover medical treatments and associated expenses. Mental health insurance typically offers coverage for counseling sessions, therapy, and sometimes inpatient care, often featuring reimbursement or fixed-amount payouts tied to healthcare provider visits rather than lump sums. Explore detailed comparisons of payout structures to determine which policy best supports your specific health and financial needs.

Source and External Links

Critical Illness Insurance - What Is It | Anthem - Critical illness insurance provides supplemental coverage that pays a lump sum or monthly benefits after diagnosis of major illnesses like cancer, heart attack, or stroke, helping with financial burdens during recovery.

Critical illness insurance - Wikipedia - Critical illness insurance is a policy that pays a lump sum or income if the insured is diagnosed with specified serious diseases, often requiring survival a minimum number of days after diagnosis for payout.

Critical Illness Insurance Plans | MetLife - MetLife's critical illness insurance offers lump-sum payments to cover expenses not covered by medical insurance, providing financial support for families, with no waiting periods and portability.

dowidth.com

dowidth.com