Earthquake microinsurance offers targeted financial protection against seismic events, covering damages to property and personal belongings caused by earthquakes. Fire microinsurance focuses on mitigating losses from fire-related incidents, providing quick claims and support for affected households and small businesses. Explore detailed benefits and coverage options to determine which microinsurance best suits your risk profile.

Why it is important

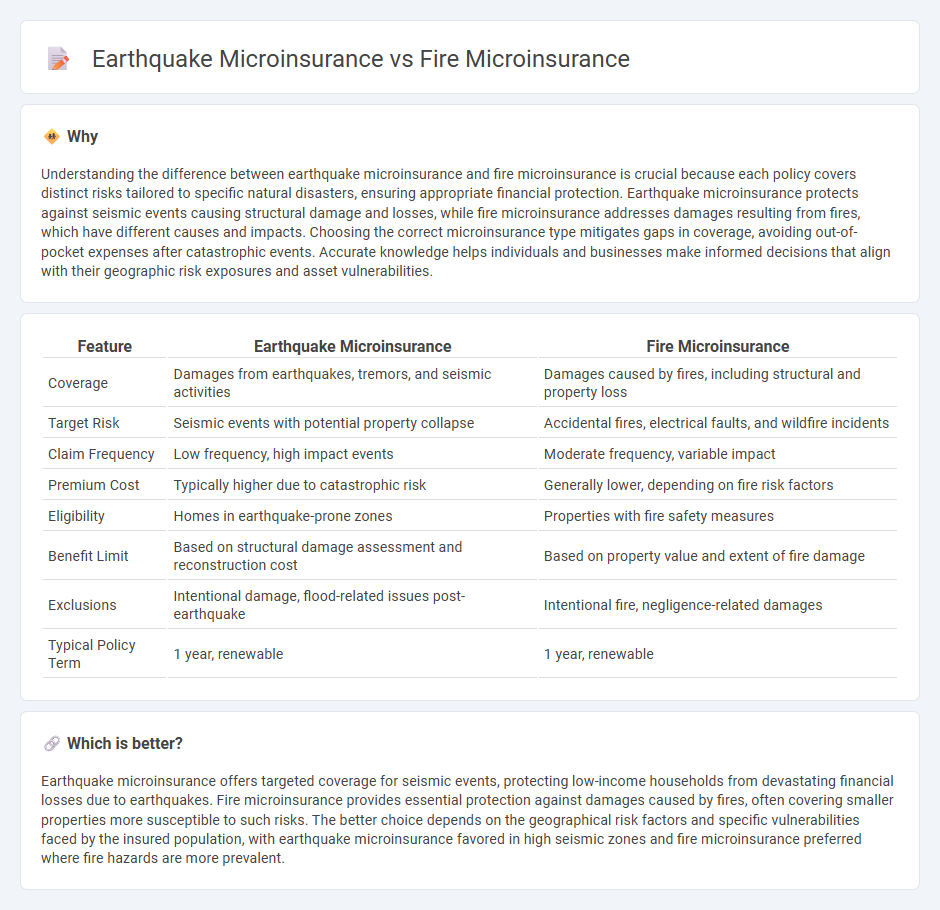

Understanding the difference between earthquake microinsurance and fire microinsurance is crucial because each policy covers distinct risks tailored to specific natural disasters, ensuring appropriate financial protection. Earthquake microinsurance protects against seismic events causing structural damage and losses, while fire microinsurance addresses damages resulting from fires, which have different causes and impacts. Choosing the correct microinsurance type mitigates gaps in coverage, avoiding out-of-pocket expenses after catastrophic events. Accurate knowledge helps individuals and businesses make informed decisions that align with their geographic risk exposures and asset vulnerabilities.

Comparison Table

| Feature | Earthquake Microinsurance | Fire Microinsurance |

|---|---|---|

| Coverage | Damages from earthquakes, tremors, and seismic activities | Damages caused by fires, including structural and property loss |

| Target Risk | Seismic events with potential property collapse | Accidental fires, electrical faults, and wildfire incidents |

| Claim Frequency | Low frequency, high impact events | Moderate frequency, variable impact |

| Premium Cost | Typically higher due to catastrophic risk | Generally lower, depending on fire risk factors |

| Eligibility | Homes in earthquake-prone zones | Properties with fire safety measures |

| Benefit Limit | Based on structural damage assessment and reconstruction cost | Based on property value and extent of fire damage |

| Exclusions | Intentional damage, flood-related issues post-earthquake | Intentional fire, negligence-related damages |

| Typical Policy Term | 1 year, renewable | 1 year, renewable |

Which is better?

Earthquake microinsurance offers targeted coverage for seismic events, protecting low-income households from devastating financial losses due to earthquakes. Fire microinsurance provides essential protection against damages caused by fires, often covering smaller properties more susceptible to such risks. The better choice depends on the geographical risk factors and specific vulnerabilities faced by the insured population, with earthquake microinsurance favored in high seismic zones and fire microinsurance preferred where fire hazards are more prevalent.

Connection

Earthquake microinsurance and fire microinsurance are interconnected as both provide essential financial protection against natural disasters that can severely impact vulnerable populations. These microinsurance products mitigate risks related to property damage and loss caused by earthquakes and fires, enabling faster recovery and economic stability for low-income households. Integrated risk management strategies often combine these coverages to address overlapping hazards in disaster-prone regions effectively.

Key Terms

Fire Microinsurance:

Fire microinsurance offers specialized coverage for losses caused by fire incidents, protecting low-income households and small businesses from devastating financial impacts. Unlike earthquake microinsurance, which covers seismic events, fire microinsurance focuses on rapid claims processing and affordable premiums tailored to urban and rural fire risks. Discover how fire microinsurance can safeguard your assets and enhance community resilience today.

Fire Peril Coverage

Fire microinsurance provides targeted financial protection against losses caused by fire outbreaks, covering property damage, business interruption, and asset replacement. Earthquake microinsurance focuses on damages from seismic activities, offering compensation primarily for structural damage and related costs but typically excludes fire damage resulting from earthquakes. Explore detailed differences in coverage scope, claims process, and policy benefits to select the best microinsurance tailored to your risk profile.

Sum Insured

Fire microinsurance typically offers a sum insured based on the replacement cost of the insured property or assets, ensuring coverage for damages caused by fire incidents. Earthquake microinsurance often involves a sum insured that reflects potential structural damage and loss from seismic events, frequently including coverage limits tied to property value and regional seismic risk assessments. Explore the specific sum insured options and coverage details to determine the best fit for your microinsurance needs.

Source and External Links

Group Micro-Insurance for California Wildfire Communities - This program involves group micro-insurance to provide deductible gap protection for low-income households in wildfire-prone areas, aiming to make insurance more affordable through collective purchasing power.

What is Microinsurance? - Microinsurance is characterized by low premiums and limited coverage, often used to protect against natural disasters like fires by providing a fixed amount of indemnity based on predetermined terms.

Micro Insurance Company's Evacuation Insurance - This company offers micro-insurance policies that provide funds for evacuation and mitigation before natural disasters, helping communities prepare financially for potential losses due to fires and other disasters.

dowidth.com

dowidth.com