Short term rental insurance typically covers property damage, liability, and loss of rental income for rentals lasting less than 30 days, offering tailored protection for hosts managing frequent guest turnover. Vacation rental insurance often provides broader coverage, including protection against guest injuries, property damage, and potential legal claims, catering to properties rented seasonally or for longer durations. Explore the differences in coverage options and find the best insurance plan for your rental property needs.

Why it is important

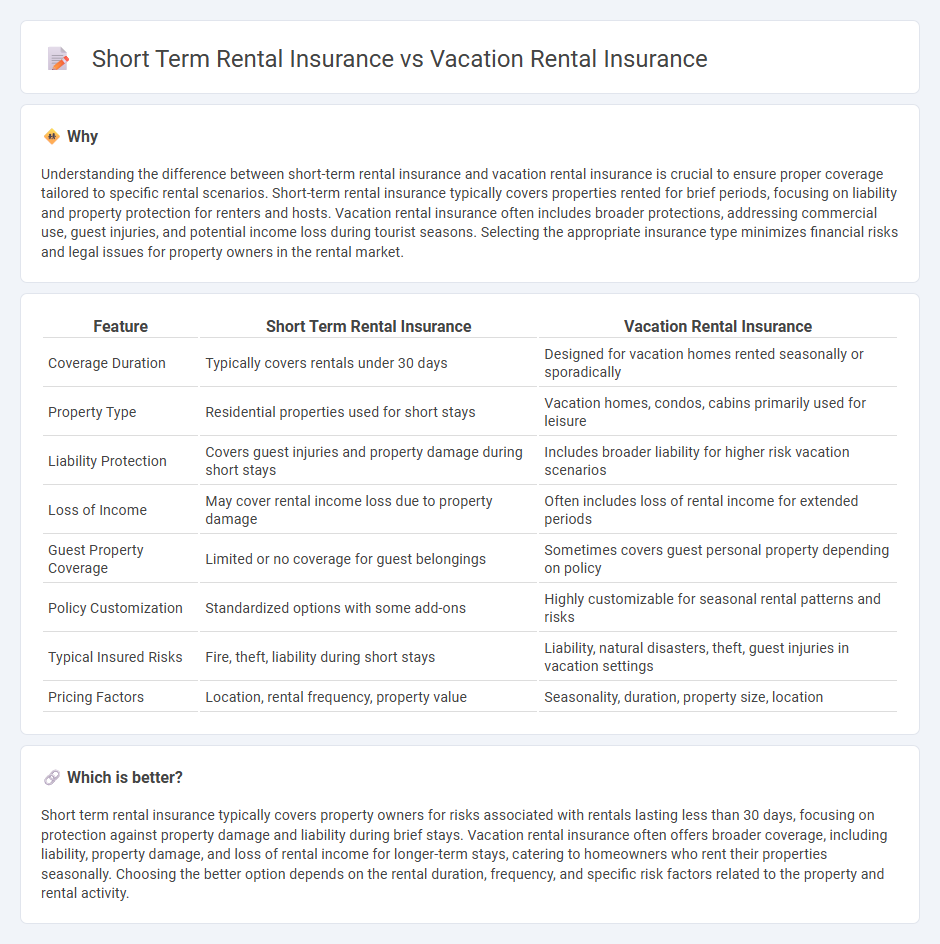

Understanding the difference between short-term rental insurance and vacation rental insurance is crucial to ensure proper coverage tailored to specific rental scenarios. Short-term rental insurance typically covers properties rented for brief periods, focusing on liability and property protection for renters and hosts. Vacation rental insurance often includes broader protections, addressing commercial use, guest injuries, and potential income loss during tourist seasons. Selecting the appropriate insurance type minimizes financial risks and legal issues for property owners in the rental market.

Comparison Table

| Feature | Short Term Rental Insurance | Vacation Rental Insurance |

|---|---|---|

| Coverage Duration | Typically covers rentals under 30 days | Designed for vacation homes rented seasonally or sporadically |

| Property Type | Residential properties used for short stays | Vacation homes, condos, cabins primarily used for leisure |

| Liability Protection | Covers guest injuries and property damage during short stays | Includes broader liability for higher risk vacation scenarios |

| Loss of Income | May cover rental income loss due to property damage | Often includes loss of rental income for extended periods |

| Guest Property Coverage | Limited or no coverage for guest belongings | Sometimes covers guest personal property depending on policy |

| Policy Customization | Standardized options with some add-ons | Highly customizable for seasonal rental patterns and risks |

| Typical Insured Risks | Fire, theft, liability during short stays | Liability, natural disasters, theft, guest injuries in vacation settings |

| Pricing Factors | Location, rental frequency, property value | Seasonality, duration, property size, location |

Which is better?

Short term rental insurance typically covers property owners for risks associated with rentals lasting less than 30 days, focusing on protection against property damage and liability during brief stays. Vacation rental insurance often offers broader coverage, including liability, property damage, and loss of rental income for longer-term stays, catering to homeowners who rent their properties seasonally. Choosing the better option depends on the rental duration, frequency, and specific risk factors related to the property and rental activity.

Connection

Short term rental insurance and vacation rental insurance both provide specialized coverage for property owners who lease their homes for brief periods, protecting against risks such as property damage, liability claims, and loss of income. These insurance types often overlap in coverage terms, addressing the unique challenges of transient guests and short-duration stays in residential properties. Brokers and insurers tailor policies to accommodate the high guest turnover and potential for increased liability inherent in short term and vacation rentals.

Key Terms

Coverage Scope

Vacation rental insurance primarily covers personal property, liability, and rental income loss for homeowners renting their properties occasionally, while short term rental insurance extends broader protection to include commercial risks, guest injuries, and damage during frequent rentals. Coverage scope for short term rentals often encompasses specialized liability, property damage, and business interruption, tailored for higher occupancy rates and increased risk exposure. Explore detailed comparisons to determine the best insurance solution for your rental property needs.

Liability Protection

Vacation rental insurance and short term rental insurance differ primarily in the scope of liability protection they offer, with vacation rental insurance typically covering property damage and personal injury related to longer stays. Short term rental insurance often includes enhanced liability coverage tailored to frequent guest turnover and potential accidents within days of occupancy. Explore detailed comparisons to determine which insurance policy best safeguards your rental investment.

Policy Duration

Vacation rental insurance typically covers properties rented out for longer periods, often spanning weeks to months, whereas short term rental insurance is designed for stays lasting only a few days to weeks, aligning with platforms like Airbnb or VRBO. The policy duration directly impacts coverage specifics, including claims related to property damage, liability, and loss of rental income, making it crucial to choose a plan that matches your rental frequency. Explore more about how policy duration can influence your insurance needs for better protection.

Source and External Links

Vacation Rental Insurance Plans - Travel Guard - Travel Guard offers vacation rental insurance covering trip cancellation/interruption, rental home lockout, and rental car coverage, protecting your travel investment when booking vacation rental homes.

Nationwide Vacation Renter Protector Insurance Plan - InsureMyTrip - Nationwide's Vacation Renter Protector plan provides coverage for accidental property damage during rentals plus trip cancellation, interruption, medical emergencies, and travel delays.

Vacation Rental Insurance: 6 of the Best Companies [2024] - Safely - Specialized vacation rental insurance is essential as homeowners policies usually do not cover rentals; leading companies offer comprehensive coverage for property damage, liability, theft, and income protection tailored to short-term rentals.

dowidth.com

dowidth.com