Digital nomad insurance offers tailored coverage for remote workers frequently traveling across multiple countries, focusing on mobility and flexible health benefits. Global citizen insurance provides comprehensive protection for individuals maintaining residences or significant ties in various nations, emphasizing broader legal and asset coverage alongside healthcare. Explore the key differences and benefits of each type to find the best insurance suited for your international lifestyle.

Why it is important

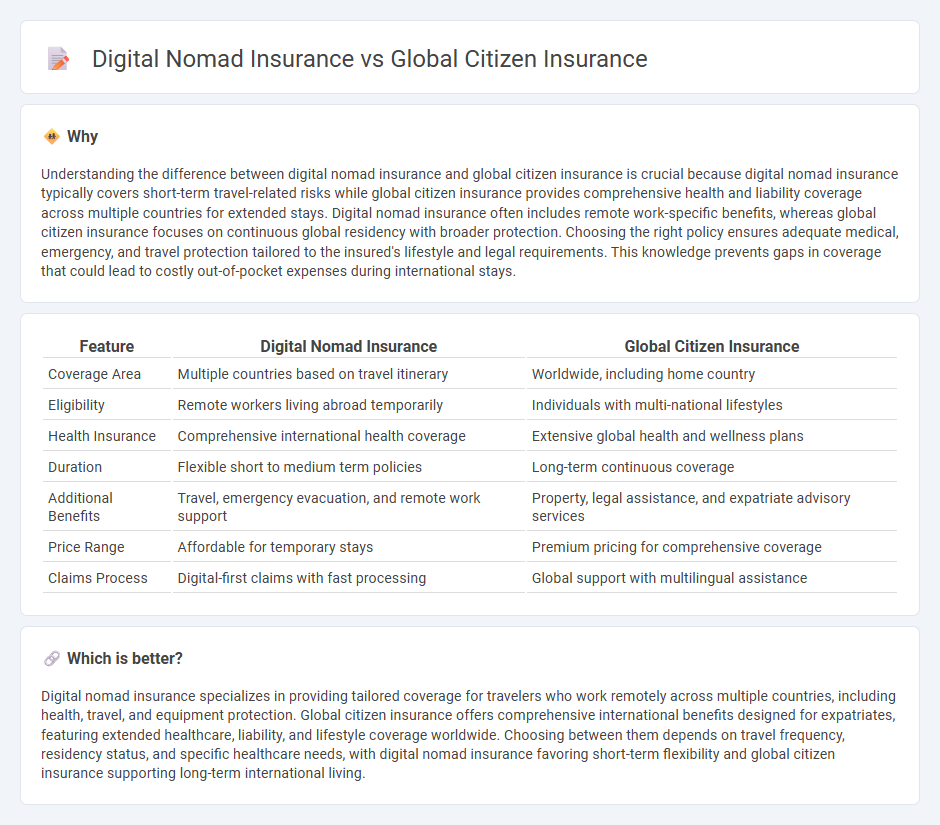

Understanding the difference between digital nomad insurance and global citizen insurance is crucial because digital nomad insurance typically covers short-term travel-related risks while global citizen insurance provides comprehensive health and liability coverage across multiple countries for extended stays. Digital nomad insurance often includes remote work-specific benefits, whereas global citizen insurance focuses on continuous global residency with broader protection. Choosing the right policy ensures adequate medical, emergency, and travel protection tailored to the insured's lifestyle and legal requirements. This knowledge prevents gaps in coverage that could lead to costly out-of-pocket expenses during international stays.

Comparison Table

| Feature | Digital Nomad Insurance | Global Citizen Insurance |

|---|---|---|

| Coverage Area | Multiple countries based on travel itinerary | Worldwide, including home country |

| Eligibility | Remote workers living abroad temporarily | Individuals with multi-national lifestyles |

| Health Insurance | Comprehensive international health coverage | Extensive global health and wellness plans |

| Duration | Flexible short to medium term policies | Long-term continuous coverage |

| Additional Benefits | Travel, emergency evacuation, and remote work support | Property, legal assistance, and expatriate advisory services |

| Price Range | Affordable for temporary stays | Premium pricing for comprehensive coverage |

| Claims Process | Digital-first claims with fast processing | Global support with multilingual assistance |

Which is better?

Digital nomad insurance specializes in providing tailored coverage for travelers who work remotely across multiple countries, including health, travel, and equipment protection. Global citizen insurance offers comprehensive international benefits designed for expatriates, featuring extended healthcare, liability, and lifestyle coverage worldwide. Choosing between them depends on travel frequency, residency status, and specific healthcare needs, with digital nomad insurance favoring short-term flexibility and global citizen insurance supporting long-term international living.

Connection

Digital nomad insurance and global citizen insurance both provide tailored coverage for individuals living and working abroad, addressing risks such as health emergencies, travel disruptions, and liability issues. These policies emphasize flexibility and worldwide protection to accommodate the mobile lifestyles of their insured clients. By focusing on comprehensive international benefits, they ensure seamless insurance coverage regardless of geographic location.

Key Terms

Coverage Scope

Global citizen insurance typically offers extensive coverage, including international health care, emergency evacuation, and repatriation, designed to support expatriates and frequent travelers worldwide. Digital nomad insurance focuses on flexible, short-term health plans that cover remote work risks, travel interruptions, and telemedicine, catering specifically to location-independent professionals. Explore detailed comparisons to find an insurance solution that best fits your lifestyle and work needs.

Portability

Global citizen insurance offers extensive portability by providing worldwide coverage that adapts to frequent international relocations, making it ideal for individuals maintaining multiple residences across countries. Digital nomad insurance emphasizes flexible portability with plans tailored specifically for remote workers constantly on the move, often including coverage for digital devices and co-working spaces. Explore the key differences in portability features and determine which insurance best suits your lifestyle needs.

Policy Duration

Global Citizen Insurance typically offers flexible policy durations designed to accommodate long-term international stays, often ranging from six months to multiple years. Digital Nomad Insurance usually provides shorter, more adaptable policy periods, such as monthly or quarterly plans, catering to the transient lifestyle of remote workers constantly on the move. Explore detailed comparisons to determine the ideal coverage duration for your unique travel pattern.

Source and External Links

Global Citizen Health Insurance - Offers health insurance to U.S. citizens and permanent residents abroad aged 74 or younger.

Global Wealth Financial - Provides innovative life insurance strategies for global citizens with focus on wealth protection and succession planning.

International Citizens Insurance - Offers global health, life, and travel insurance plans for individuals, families, and groups living or traveling abroad.

dowidth.com

dowidth.com