Digital claim automation streamlines insurance processes by enabling faster and more accurate data extraction compared to traditional fax-based claims processing, which is prone to errors and delays. Automation tools reduce manual workload and improve claim settlement times, leading to enhanced customer satisfaction and operational efficiency. Discover how integrating digital claim automation can transform your insurance operations.

Why it is important

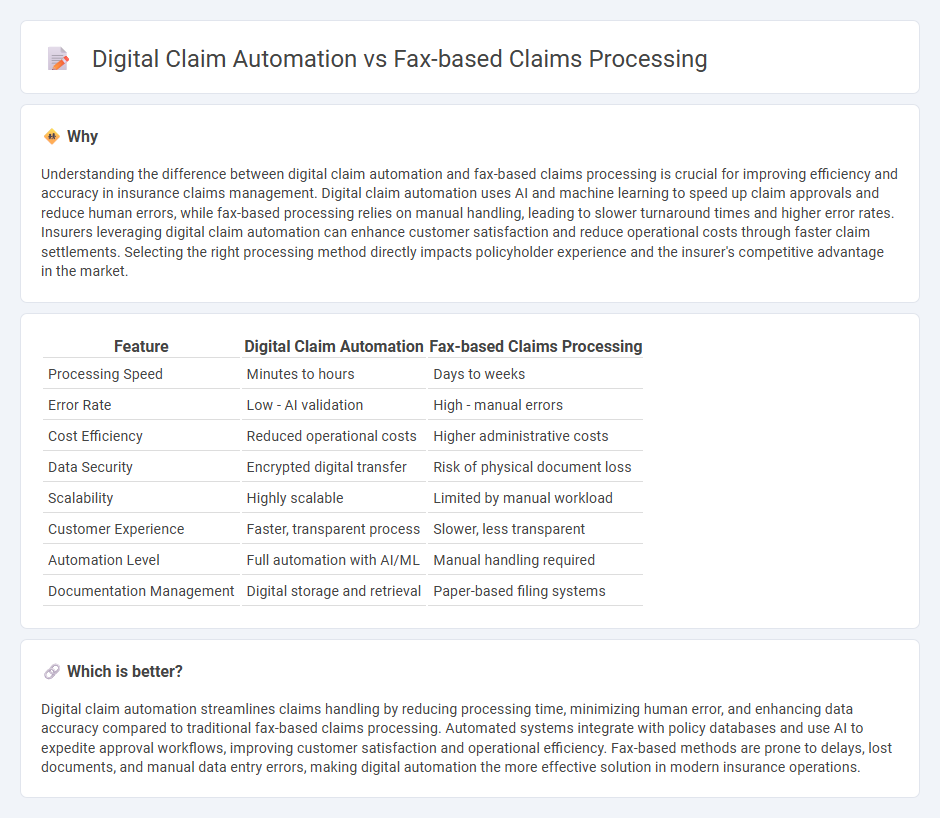

Understanding the difference between digital claim automation and fax-based claims processing is crucial for improving efficiency and accuracy in insurance claims management. Digital claim automation uses AI and machine learning to speed up claim approvals and reduce human errors, while fax-based processing relies on manual handling, leading to slower turnaround times and higher error rates. Insurers leveraging digital claim automation can enhance customer satisfaction and reduce operational costs through faster claim settlements. Selecting the right processing method directly impacts policyholder experience and the insurer's competitive advantage in the market.

Comparison Table

| Feature | Digital Claim Automation | Fax-based Claims Processing |

|---|---|---|

| Processing Speed | Minutes to hours | Days to weeks |

| Error Rate | Low - AI validation | High - manual errors |

| Cost Efficiency | Reduced operational costs | Higher administrative costs |

| Data Security | Encrypted digital transfer | Risk of physical document loss |

| Scalability | Highly scalable | Limited by manual workload |

| Customer Experience | Faster, transparent process | Slower, less transparent |

| Automation Level | Full automation with AI/ML | Manual handling required |

| Documentation Management | Digital storage and retrieval | Paper-based filing systems |

Which is better?

Digital claim automation streamlines claims handling by reducing processing time, minimizing human error, and enhancing data accuracy compared to traditional fax-based claims processing. Automated systems integrate with policy databases and use AI to expedite approval workflows, improving customer satisfaction and operational efficiency. Fax-based methods are prone to delays, lost documents, and manual data entry errors, making digital automation the more effective solution in modern insurance operations.

Connection

Digital claim automation streamlines insurance processes by reducing dependency on outdated fax-based claims processing, which often involves manual data entry and increased error rates. Integration of optical character recognition (OCR) technology enables automated extraction of claim data from fax transmissions, accelerating claim validation and approval timelines. This synergy enhances operational efficiency, reduces processing costs, and improves customer satisfaction within the insurance claims lifecycle.

Key Terms

Manual Data Entry

Fax-based claims processing relies heavily on manual data entry, increasing the risk of errors and delays due to handwritten information and poor image quality. Digital claim automation employs advanced OCR technology and AI-driven data extraction, drastically reducing manual input and enhancing accuracy and processing speed. Discover how transitioning to digital automation can streamline your claims workflow and improve operational efficiency.

Optical Character Recognition (OCR)

Fax-based claims processing relies heavily on manual data entry, leading to increased errors and slower turnaround times. Digital claim automation leverages Optical Character Recognition (OCR) technology to accurately extract data from documents, significantly enhancing processing speed and accuracy. Discover how OCR-driven digital automation transforms claims management for improved efficiency and reduced operational costs.

Application Programming Interface (API)

Fax-based claims processing relies on manual data entry and physical document transmission, resulting in slower turnaround times and higher error rates. Digital claim automation leverages Application Programming Interfaces (APIs) to enable seamless, real-time data exchange between systems, improving accuracy and accelerating claim approvals. Explore how API-driven digital automation transforms claims handling for enhanced efficiency and reduced operational costs.

Source and External Links

Enhancing Healthcare Claims Processing with Cloud Fax - Fax-based claims processing in healthcare can be significantly improved by secure cloud fax systems, which speed up the transfer of claims, reduce errors, ensure HIPAA compliance, and enhance overall efficiency in claims workflows.

Achieving Powerful Post-Service Claims Management - While fax and paper-based claims processing remain common, shifting to electronic processes dramatically reduces manual workload and speeds payment, with healthcare providers seeing up to 75% less staff time spent and 80% fewer paper claims after reducing fax dependence.

Three use cases for cloud fax in financial services - In insurance, cloud fax integrates incoming faxed claim data directly into claims processing systems, automating the handling, status updates, additional information requests, and notifications, thus transforming fax-based claims processing into an efficient, compliant, and customer-friendly workflow.

dowidth.com

dowidth.com