Behavioral policy pricing integrates individual risk behaviors and real-time data to customize insurance premiums, enhancing accuracy in risk assessment. Parametric insurance offers predetermined payouts based on predefined triggers like natural disaster metrics, simplifying claims processing and ensuring swift compensation. Explore the differences and benefits of these innovative insurance models to optimize your coverage.

Why it is important

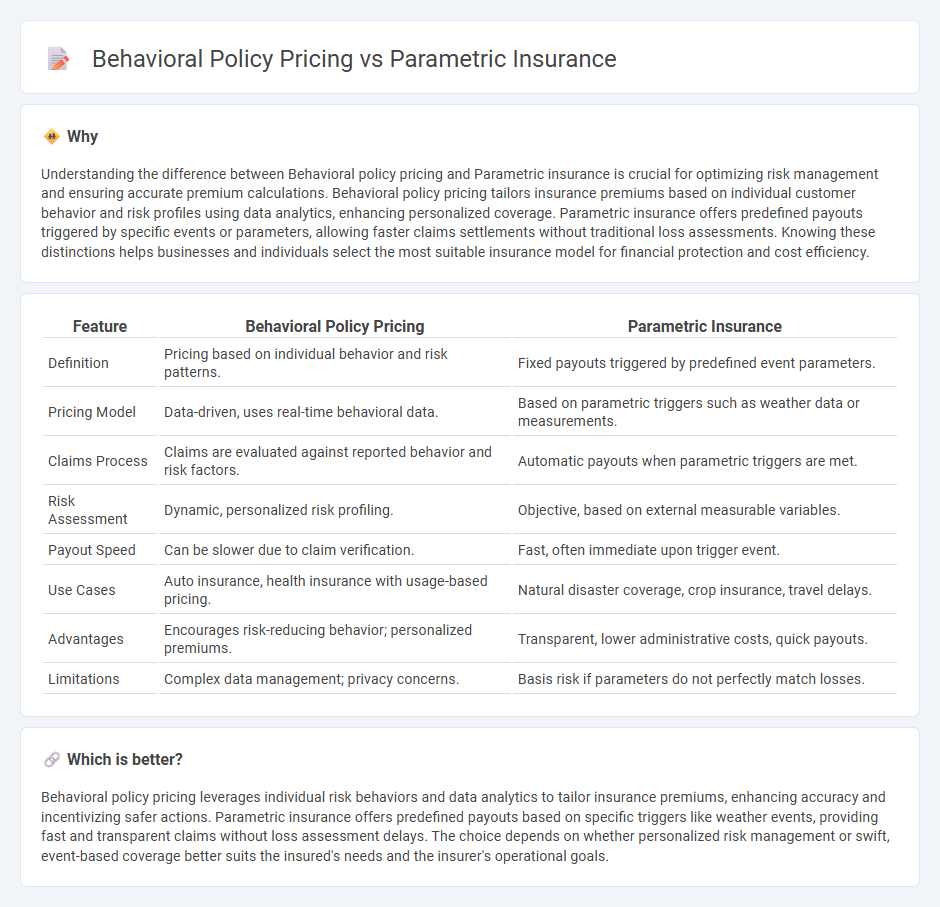

Understanding the difference between Behavioral policy pricing and Parametric insurance is crucial for optimizing risk management and ensuring accurate premium calculations. Behavioral policy pricing tailors insurance premiums based on individual customer behavior and risk profiles using data analytics, enhancing personalized coverage. Parametric insurance offers predefined payouts triggered by specific events or parameters, allowing faster claims settlements without traditional loss assessments. Knowing these distinctions helps businesses and individuals select the most suitable insurance model for financial protection and cost efficiency.

Comparison Table

| Feature | Behavioral Policy Pricing | Parametric Insurance |

|---|---|---|

| Definition | Pricing based on individual behavior and risk patterns. | Fixed payouts triggered by predefined event parameters. |

| Pricing Model | Data-driven, uses real-time behavioral data. | Based on parametric triggers such as weather data or measurements. |

| Claims Process | Claims are evaluated against reported behavior and risk factors. | Automatic payouts when parametric triggers are met. |

| Risk Assessment | Dynamic, personalized risk profiling. | Objective, based on external measurable variables. |

| Payout Speed | Can be slower due to claim verification. | Fast, often immediate upon trigger event. |

| Use Cases | Auto insurance, health insurance with usage-based pricing. | Natural disaster coverage, crop insurance, travel delays. |

| Advantages | Encourages risk-reducing behavior; personalized premiums. | Transparent, lower administrative costs, quick payouts. |

| Limitations | Complex data management; privacy concerns. | Basis risk if parameters do not perfectly match losses. |

Which is better?

Behavioral policy pricing leverages individual risk behaviors and data analytics to tailor insurance premiums, enhancing accuracy and incentivizing safer actions. Parametric insurance offers predefined payouts based on specific triggers like weather events, providing fast and transparent claims without loss assessment delays. The choice depends on whether personalized risk management or swift, event-based coverage better suits the insured's needs and the insurer's operational goals.

Connection

Behavioral policy pricing leverages consumer data and behavioral insights to tailor insurance premiums based on individual risk profiles, enhancing accuracy in coverage costs. Parametric insurance relies on pre-agreed triggers and quantifiable parameters, such as weather data or seismic activity, providing rapid claims settlement without traditional loss assessments. Integrating behavioral policy pricing with parametric insurance can optimize risk evaluation by combining personalized risk behavior analytics with objective, data-driven payout mechanisms.

Key Terms

Trigger Event (Parametric Insurance)

Parametric insurance relies on predefined trigger events such as natural disasters, weather thresholds, or seismic activity to automatically activate payouts without assessing individual loss claims, offering faster and more transparent compensation. Behavioral policy pricing evaluates risk based on individual actions and habits, like driving behavior or health-related activities, adjusting premiums dynamically to incentivize risk reduction. Explore further to understand how these models shape the future of personalized and efficient insurance solutions.

Index Measurement (Parametric Insurance)

Parametric insurance relies on predefined indices such as rainfall levels, wind speed, or earthquake magnitude to trigger payouts, enabling swift claims processing without loss assessment. Behavioral policy pricing adjusts premiums based on individual policyholder actions and risk behaviors captured through telematics or other data sources, offering personalized rates. Explore more about how index measurement enhances parametric insurance efficiency and its comparison with behavioral pricing models.

Telematics Data (Behavioral Policy Pricing)

Parametric insurance uses predefined triggers such as weather or seismic events to automate claims payouts, while behavioral policy pricing leverages telematics data to tailor premiums based on individual driving patterns, speed, braking, and location. Telematics sensors collect real-time data, enabling insurers to assess risk dynamically and promote safer driving habits, ultimately optimizing loss ratios and customer engagement. Explore how telematics-driven behavioral policy pricing revolutionizes risk management and insurance personalization.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance is a type of coverage that pays out when a predefined measurable event parameter (like earthquake magnitude or wind speed) meets or exceeds a threshold, focusing on the probability of an event rather than indemnifying actual losses.

Parametric Insurance Solutions - Amwins - Parametric insurance pays based on specific pre-defined triggers such as wind speed or seismic magnitude using near real-time data, enabling fast claim payments and allowing insureds to use proceeds for any losses they incur.

Parametric insurance - Wikipedia - Parametric insurance offers quicker and simplified payout by verifying whether trigger event thresholds occurred using objective data, though it may not cover the full actual loss and is suited for covering hard-to-model catastrophic risks.

dowidth.com

dowidth.com