Digital claim automation streamlines the insurance claims process by reducing processing time and minimizing human errors compared to traditional paper-based claim submission. Automated systems leverage advanced algorithms and real-time data integration to enhance accuracy and expedite approvals, resulting in improved customer satisfaction and operational efficiency. Discover how transitioning to digital claim automation can transform your insurance experience.

Why it is important

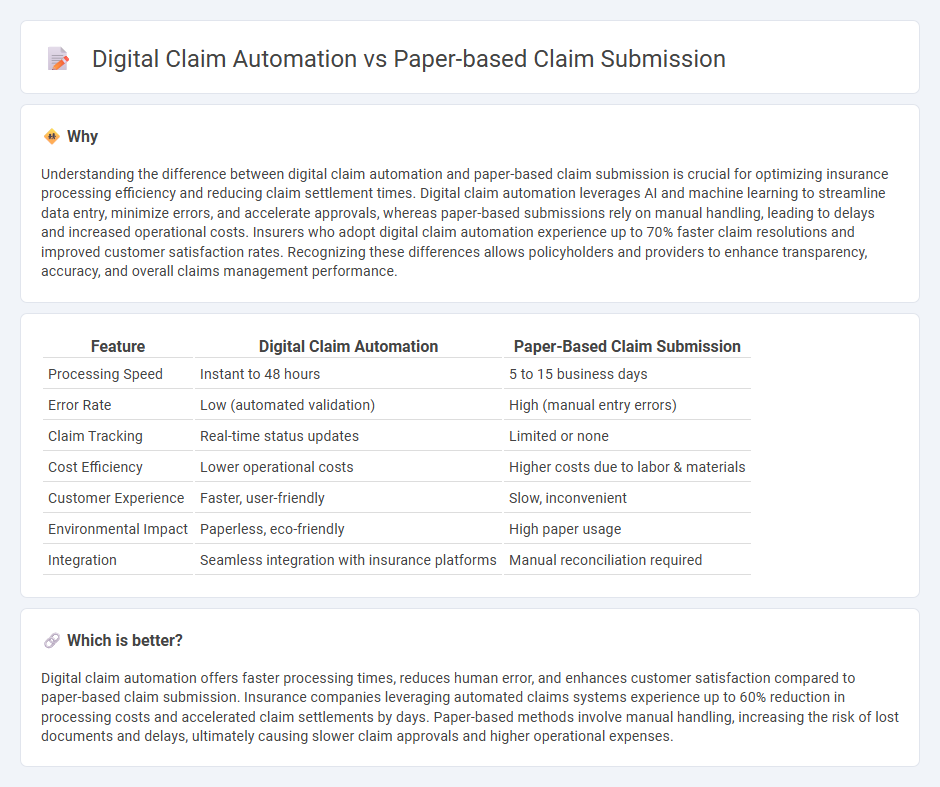

Understanding the difference between digital claim automation and paper-based claim submission is crucial for optimizing insurance processing efficiency and reducing claim settlement times. Digital claim automation leverages AI and machine learning to streamline data entry, minimize errors, and accelerate approvals, whereas paper-based submissions rely on manual handling, leading to delays and increased operational costs. Insurers who adopt digital claim automation experience up to 70% faster claim resolutions and improved customer satisfaction rates. Recognizing these differences allows policyholders and providers to enhance transparency, accuracy, and overall claims management performance.

Comparison Table

| Feature | Digital Claim Automation | Paper-Based Claim Submission |

|---|---|---|

| Processing Speed | Instant to 48 hours | 5 to 15 business days |

| Error Rate | Low (automated validation) | High (manual entry errors) |

| Claim Tracking | Real-time status updates | Limited or none |

| Cost Efficiency | Lower operational costs | Higher costs due to labor & materials |

| Customer Experience | Faster, user-friendly | Slow, inconvenient |

| Environmental Impact | Paperless, eco-friendly | High paper usage |

| Integration | Seamless integration with insurance platforms | Manual reconciliation required |

Which is better?

Digital claim automation offers faster processing times, reduces human error, and enhances customer satisfaction compared to paper-based claim submission. Insurance companies leveraging automated claims systems experience up to 60% reduction in processing costs and accelerated claim settlements by days. Paper-based methods involve manual handling, increasing the risk of lost documents and delays, ultimately causing slower claim approvals and higher operational expenses.

Connection

Digital claim automation transforms the traditional paper-based claim submission process by converting physical forms into electronic data, streamlining verification and approval workflows. This integration reduces manual errors, accelerates claim processing times, and enhances accuracy in insurance settlements. Insurers adopting digital automation achieve improved operational efficiency and customer satisfaction through seamless data exchange between legacy paper submissions and modern digital platforms.

Key Terms

Manual Processing

Manual processing of paper-based claim submissions often leads to increased errors, longer turnaround times, and higher operational costs due to manual data entry and physical document handling. Digital claim automation streamlines workflows by utilizing optical character recognition (OCR) and artificial intelligence (AI) to accurately capture and process data, significantly reducing human intervention and improving efficiency. Explore how transitioning to digital claim automation can transform your claims management process for enhanced accuracy and speed.

Electronic Data Interchange (EDI)

Paper-based claim submission involves manual entry, physical document handling, and longer processing times, often leading to increased errors and higher administrative costs. Digital claim automation leverages Electronic Data Interchange (EDI) to enable real-time, secure transmission of standardized insurance claim data, resulting in faster settlements and improved accuracy. Explore how EDI-driven digital claims can transform your insurance workflow efficiency.

Turnaround Time

Paper-based claim submission processes often result in longer turnaround times due to manual data entry, physical document handling, and increased risk of errors that require rework. Digital claim automation leverages technologies like OCR, AI, and real-time data validation to streamline workflows, reduce processing delays, and improve accuracy, resulting in significantly faster claim settlements. Explore how implementing digital claim automation can transform your operational efficiency and accelerate your claims turnaround time.

Source and External Links

Medicare's Paper Claim Submission - WCH Service Bureau - Paper-based claim submissions remain vital in healthcare, using the CMS-1500 (02/12) form, and must follow specific guidelines to ensure accuracy and effective processing via OCR systems.

Submitting Paper Claims - CGS Medicare - Medicare requires electronic claim submission except limited exceptions, where paper claims using the original CMS-1500 form (version 02/12) must be typed or computer-generated, printed in black ink, with clear legible fonts and no correction fluid or highlighters.

Professional paper claim form (CMS-1500) - CMS - The CMS-1500 form is the standard for paper claim submissions by providers with waiver from electronic requirements; claims must be on official pre-printed forms with OCR-compatible red ink, as photocopies are not accepted due to scanning constraints.

dowidth.com

dowidth.com